The Graying of America

It’s no secret that America’s population is aging, and aging fast. As we age our need for healthcare at all levels increases with each passing year. The most frightening aspect of growing old is the prospect of being uprooted from your home and placed into a geriatric institution. Therefore, home healthcare is a very attractive option.

Small Cap Growth

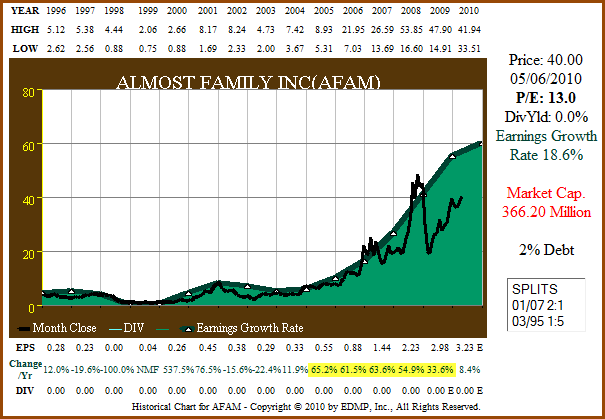

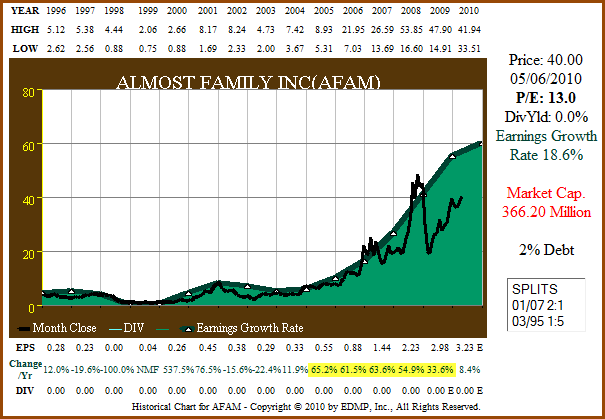

Almost Family, Inc. (AFAM, Financial) is a small-cap company that serves this burgeoning market. Founded in 1976, this Louisville, Kentucky headquartered provider of home healthcare is strategically well-positioned for above-average long-term growth. Figure 1 below looks at Almost Family, Inc. through the lens of our EDMP, Inc. F.A.S.T. Graphs™ (Fundamentals Analyzer Software Tool™) since 1996. Note how stock price (black line) has closely tracked earnings (green line with white triangles), and further note how earnings growth has accelerated since 2004 (yellow shaded area).

Figure 1 AFAM 15yr EPS Growth Correlated to Price

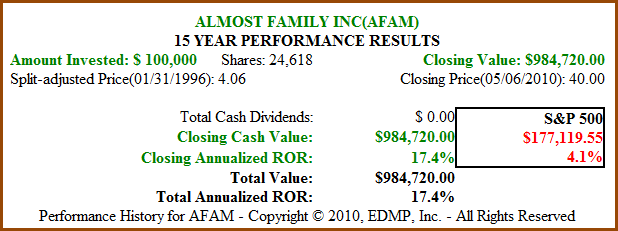

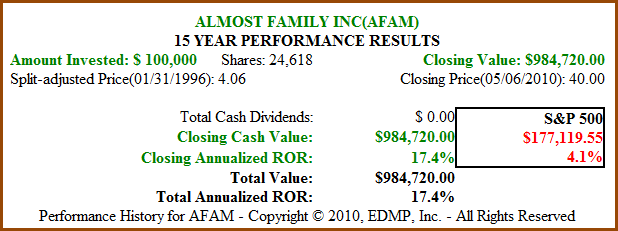

Figure 2 below calculates shareholder’s performance that applies to Figure 1. Long-term shareholders have been well rewarded in close proportion to earnings growth. Furthermore, even though the stock price fell precipitously starting in the fall of 2008 and into March of 2009, earnings held up and therefore price has recovered strongly. Yet even after this recovery, Almost Family, Inc. (AFAM) only traded at a blended PE ratio of 13.0 on Thursday’s 5/06/2010 closing price of $40.00.

Figure 2 AFAM 15yr Price Performance

Thesis for Growth

Almost Family Inc. (AFAM) operates 90 locations in 11 key states. They operate two segments: Visiting nurse providing in-home skilled nursing and personal care services. Florida, Kentucky, Connecticut, Ohio and New Jersey are key markets with a large elderly population. In your own home, services provided by their many subsidiary companies are in high demand. The ability to have your needs cared for in your own home is both comforting and attractive to clients.

Earnings Beat Analysts Expectations

On April 28, 2010, Almost Family reported Q1 earnings that beat analyst expectations by seven cents. Management was upbeat regarding reasonable reimbursement visibility for at least the next three years, thanks to the recent passage of healthcare reform. The stock market reacted favorably pushing Almost Family’s stock price above $40, up approximately 5%.

However, we believe that Almost Family is still very attractively valued at 13 times earnings. They generate very strong free cash flow and have a healthy balance sheet with only 2% debt. Consensus estimates reported to both FirstCall and Zacks look for 20% five-year earnings growth going forward.

Conclusion

We believe Almost Family, Inc. is well-positioned for growth and trades at a very attractive valuation. Therefore, investors looking for above-average growth and willing to assume the risk of owning a small-cap company should consider Almost Family, Inc. (AFAM).

Disclosure: Disclosure: Long AFAM at time of writing.

Disclosure: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.

It’s no secret that America’s population is aging, and aging fast. As we age our need for healthcare at all levels increases with each passing year. The most frightening aspect of growing old is the prospect of being uprooted from your home and placed into a geriatric institution. Therefore, home healthcare is a very attractive option.

Small Cap Growth

Almost Family, Inc. (AFAM, Financial) is a small-cap company that serves this burgeoning market. Founded in 1976, this Louisville, Kentucky headquartered provider of home healthcare is strategically well-positioned for above-average long-term growth. Figure 1 below looks at Almost Family, Inc. through the lens of our EDMP, Inc. F.A.S.T. Graphs™ (Fundamentals Analyzer Software Tool™) since 1996. Note how stock price (black line) has closely tracked earnings (green line with white triangles), and further note how earnings growth has accelerated since 2004 (yellow shaded area).

Figure 1 AFAM 15yr EPS Growth Correlated to Price

Figure 2 below calculates shareholder’s performance that applies to Figure 1. Long-term shareholders have been well rewarded in close proportion to earnings growth. Furthermore, even though the stock price fell precipitously starting in the fall of 2008 and into March of 2009, earnings held up and therefore price has recovered strongly. Yet even after this recovery, Almost Family, Inc. (AFAM) only traded at a blended PE ratio of 13.0 on Thursday’s 5/06/2010 closing price of $40.00.

Figure 2 AFAM 15yr Price Performance

Thesis for Growth

Almost Family Inc. (AFAM) operates 90 locations in 11 key states. They operate two segments: Visiting nurse providing in-home skilled nursing and personal care services. Florida, Kentucky, Connecticut, Ohio and New Jersey are key markets with a large elderly population. In your own home, services provided by their many subsidiary companies are in high demand. The ability to have your needs cared for in your own home is both comforting and attractive to clients.

Earnings Beat Analysts Expectations

On April 28, 2010, Almost Family reported Q1 earnings that beat analyst expectations by seven cents. Management was upbeat regarding reasonable reimbursement visibility for at least the next three years, thanks to the recent passage of healthcare reform. The stock market reacted favorably pushing Almost Family’s stock price above $40, up approximately 5%.

However, we believe that Almost Family is still very attractively valued at 13 times earnings. They generate very strong free cash flow and have a healthy balance sheet with only 2% debt. Consensus estimates reported to both FirstCall and Zacks look for 20% five-year earnings growth going forward.

Conclusion

We believe Almost Family, Inc. is well-positioned for growth and trades at a very attractive valuation. Therefore, investors looking for above-average growth and willing to assume the risk of owning a small-cap company should consider Almost Family, Inc. (AFAM).

Disclosure: Disclosure: Long AFAM at time of writing.

Disclosure: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.