Berkshire Hathaway reported strong resultsfor the first quarter of 2010 with book value per share rising 5.8 percent to $89,374 per Class A share which represents a record high (all per share figures in this article will refer to Class A shares). Operating earnings, which excludes the impact of volatile investment and derivatives gains or losses, rose to $1,390 per share from $1,100 for the first quarter of 2009 representing a 26.4 percent increase.

Overview

Quarterly results at Berkshire Hathaway are subject to significant volatility due to the timing of realized investment gains or losses as well as the impact of the derivatives portfolio which is marked to market each quarter even though most contracts will not expire for several years. Net earnings per share for the first quarter of 2010 were $2,272 compared to a loss of $990 per share in the first quarter of 2009 due to an improved market environment this year compared to last year.

The main event for the first quarter was the completion of the Burlington Northern Santa Fe acquisition on February 12. Berkshire paid aggregate consideration of $26.5 billion for the BNSF common stock that the company did not already own. This consisted of $15.9 billion in cash, of which approximately 50 percent was financed with new debt, with the remainder financed by cash on hand. The remaining $10.6 billion of consideration was paid for using newly issued Berkshire shares.

In this article, we will take a brief look at each of the major areas of Berkshire Hathaway with a special focus on the consolidation of BNSF and the implications of the consolidation on users of Berkshire’s financial statements.

Insurance

Berkshire once again posted underwriting profits for the insurance businesses as a whole resulting in a negative cost of float for the quarter.

GEICO

GEICO turned in a typically strong performance with a 91.3 percent combined ratio and pre-tax underwriting profits of $299 million compared to underwriting profits of $148 million in the prior year period. GEICO has been able to put in place a slight increase in premiums and policies in force grew by 5.1 percent during the quarter. GEICO was able to reduce the underwriting expense ratio to 18.0 percent of premiums, down from 18.4 percent in the prior year period. Those who are interested in GEICO’s progress relative to competitors should follow Progressive’s monthly and quarterly results. Progressive reported a 90.9 percent combined ratio for the first quarter.

General Re

General Re reported a pre-tax underwriting loss of $39 million for the first quarter of 2010 compared to a $16 million underwriting loss in the prior year period. Price competition in most property and casualty lines led to decreases in premium volume, but this was offset by higher premiums in the life/health segment. The quarter included $278 million of catastrophe losses from the Chilean earthquake and storm related losses in Europe, Australia, and New England. Management cautions that premium volumes may drop for 2010 as a whole due to the need to maintain underwriting discipline in a continued soft pricing market. During the quarter, General Re reached a $92 millionsettlement with the Federal Government allowing the company to avoid prosecution for alleged misconduct related to a transaction with AIG.

Berkshire Hathaway Reinsurance Group

Berkshire Hathaway Reinsurance Group posted a $52 underwriting gain for the first quarter of 2010 compared to a $177 million underwriting gain in the prior year period. Beginning in 2010, BHRG’s underwriting activities include a life reinsurance and annuity business that was previously consolidated in Berkshire’s Finance and Financial Products segment. As with General Re, BHRG noted that the insurance market remains soft and this led management to reduce premium volumes during the quarter. Management estimated losses related to the Chilean earthquake at $82 million for the catastrophe and individual risk business and $140 million for the multi-line property/casualty business.

Berkshire Hathaway Primary Group

Berkshire’s primary insurers produced underwriting gains of $33 million for the first quarter compared to $4 million in the prior year period. Premiums earned declined to $425 million from $456 million in the first quarter of 2009 due to a soft market that caused management to constrain business. The improvement in underwriting results was attributed primarily to lower losses in the medical malpractice business.

Investments

Berkshire posted insurance investment income of $988 million for the first quarter of 2010 compared to $1,069 million for the first quarter of 2009. Increases due to the investments in Swiss Re and Dow Preferred stock were more than offset by reductions in dividends from Wells Fargo and the impact of a onetime gain in 2009 associated with a short term currency transaction made in connection to the Swiss Re investment.

Investment and derivatives gains were $1.4 billion which consists of $165 million related to the sale of investments, $267 million related to derivatives being marked to market, and a onetime gain of $979 related to the Burlington Northern Santa Fe acquisition. When Berkshire closed the transaction, it was required to recognize the excess of fair value of the 76.8 million shares of Burlington Northern that were already owned prior to the acquisition.

Manufacturing, Service, and Retail

The manufacturing, service, and retailing segment covers a wide variety of businesses and, in aggregate, has recovered nicely from the depths of the recession. First quarter net earnings for the group was $477 million compared to $258 million for the first quarter of 2009.

Marmon’s pre-tax earnings increased to $190 million from $162 million in the prior year period on a 11 percent increase in revenues. Six of the eleven business sectors within Marmon generated increased revenues while all but two sectors produced increased earnings compared to 2009. The improvements are a result of recovery in many of Marmon’s end markets along with ongoing efforts to control costs.

McLane reported pre-tax earnings of $80 million compared to $143 million in the first quarter of 2009. The bulk of the decrease is due to the fact that earnings in 2009 were boosted by the impact of a substantial inventory price change gain due to increases in federal excise taxes for cigarettes. McLane’s revenues were up six percent over 2009 levels reflecting strength in the grocery and food service businesses.

Other manufacturing posted pre-tax earnings of $332 million compared to $176 million in the prior year period primarily due to strength at Forest River, Iscar, and the apparel group. The building products businesses continue to be adversely affected by low residential and commercial construction activity.

Other service posted $219 million for the first quarter of 2010, far surpassing the profit of $14 million in the first quarter of 2009. NetJets posted a 18 percent increase in revenue compared to last year and generated $57 million in pre-tax earnings compared to a pre-tax loss of $96 million in the first quarter of 2009. NetJets continues to own more aircraft than required for present operations but management is taking steps to ensure that the company will operate profitably in the future.

The retailing businesses posted pre-tax profits of $32 million in the first quarter which is double the $16 million profit generated in 2009. The retailing segment had improved operating results in furniture and jewelry in addition to improved results at See’s candies which was partially driven by the timing of Easter.

Finance and Financial Products

The finance and financial products segment posted net earnings of $69 million during the quarter which is relatively flat compared to earnings of $68 million in the first quarter of 2009. Manufactured housing revenues were 5 percent higher than 2009 levels. Home sales increased compared to 2009 levels driven by a 20 percent increase in unit sales partially offset by a 10 percent decline in the average sales price per unit due to changing product mix. Clayton’s quarterly pre-tax earnings declined to $32 million compared to $42 million in 2009 due to lower interest income and a slight increase in loan loss provisions, partially offset by improved profits in manufacturing.

Clayton continues to be negatively affected by the economic recession as well as the fact that many housing programs sponsored by the Federal government specifically exclude factory built homes from participating. Despite this negative impact, management believes that Clayton will continue to operate profitably going forward.

Railroad, Utilities, and Energy

Following the acquisition of Burlington Northern Santa Fe on February 12, Berkshire consolidated the railroad operations into the “Railroad, Utilities, and Energy” reporting segment. Warren Buffett has stated that railroads are similar in many ways to utilities due to the manner in which they are regulated by government authorities and the requirement for ongoing capital expenditures in both businesses. BNSF is consolidated into Berkshire starting on February 12, 2010, the effective date of the acquisition. Therefore, only a partial quarter of results are reflected in the first quarter’s financial statements.

Many observers, including Buffett biographer Alice Schroeder, have expressed disappointment regarding the fact that BNSF is not receiving its own segment. In the context of a broader question at the annual meeting regarding the amount of information in the annual report, Mr. Buffett was reported to make the case that too many additional pages could serve to confuse matters rather than create more enlightenment.

While it is true that Berkshire’s current arrangement does not disclose many details regarding the railroad or the utility business, it should be pointed out that any shareholder seeking additional information may examine the separate SEC Filings of MidAmerican and BNSF. Click on this link for Burlington Northern’s 10-Q covering the first quarter and click on this link for MidAmerican’s 10-Q covering the first quarter.

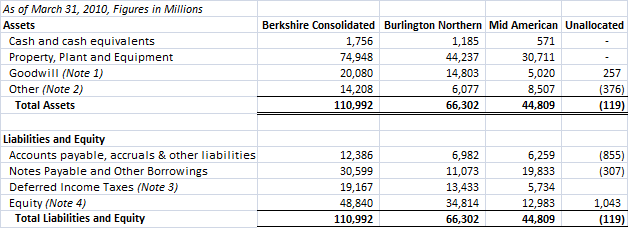

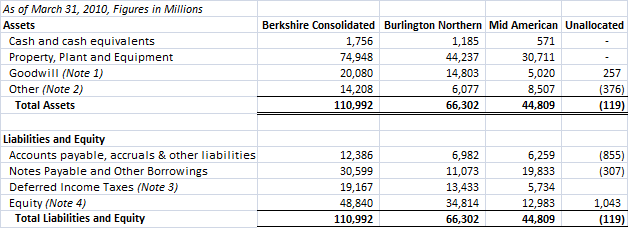

While it is somewhat tricky to fully reconcile Berkshire Hathaway’s consolidated figures for the segment with the 10-Q filings of BNSF and MidAmerican, it is possible to obtain quite a bit of additional detail. As an example, we have prepared the exhibit below which displays a reconciliation of Berkshire’s “Railroad, Energy, and Utilities” balance sheet as of March 31 with Burlington Northern and MidAmerican’s individual 10-Q filings. The “unallocated” column shows the difference between the figures reported in the consolidated financial statements of Berkshire compared to the sum of the same accounts in the subsidiary 10-Q statements. (Click on the image to enlarge the display).

Please click on this link for an Excel spreadsheet with the data along with additional notes regarding thoughts on the reconciliation exercise. While it is interesting to review the information in the subsidiary 10-Q, obviously most Berkshire shareholders will not do so. At a summary level, it seems like Berkshire is attempting to strike the balance between sufficient disclosure and a desire to avoid the production of much longer financial statements that could confuse rather than enlighten shareholders. It is not clear why anyone would object particularly since further details are readily available for those who wish to take a look.

Space and time constraints for this article prevent additional discussion of the Burlington Northern transaction including thoughts on future capital expenditures. Future articles will cover Burlington Northern in more detail. As we speculated earlier this year, it seems likely that capital expenditures are set to rise at BNSF, although any changes may take some time to appear.

Disclosure: The author owns shares of Berkshire Hathaway and is the author of The Rational Walk’s Berkshire Hathaway 2010 Briefing Book which provides a detailed analysis of the company along with estimates of intrinsic value.

Ravi Nagarajan

http://www.rationalwalk.com

Overview

Quarterly results at Berkshire Hathaway are subject to significant volatility due to the timing of realized investment gains or losses as well as the impact of the derivatives portfolio which is marked to market each quarter even though most contracts will not expire for several years. Net earnings per share for the first quarter of 2010 were $2,272 compared to a loss of $990 per share in the first quarter of 2009 due to an improved market environment this year compared to last year.

The main event for the first quarter was the completion of the Burlington Northern Santa Fe acquisition on February 12. Berkshire paid aggregate consideration of $26.5 billion for the BNSF common stock that the company did not already own. This consisted of $15.9 billion in cash, of which approximately 50 percent was financed with new debt, with the remainder financed by cash on hand. The remaining $10.6 billion of consideration was paid for using newly issued Berkshire shares.

In this article, we will take a brief look at each of the major areas of Berkshire Hathaway with a special focus on the consolidation of BNSF and the implications of the consolidation on users of Berkshire’s financial statements.

Insurance

Berkshire once again posted underwriting profits for the insurance businesses as a whole resulting in a negative cost of float for the quarter.

GEICO

GEICO turned in a typically strong performance with a 91.3 percent combined ratio and pre-tax underwriting profits of $299 million compared to underwriting profits of $148 million in the prior year period. GEICO has been able to put in place a slight increase in premiums and policies in force grew by 5.1 percent during the quarter. GEICO was able to reduce the underwriting expense ratio to 18.0 percent of premiums, down from 18.4 percent in the prior year period. Those who are interested in GEICO’s progress relative to competitors should follow Progressive’s monthly and quarterly results. Progressive reported a 90.9 percent combined ratio for the first quarter.

General Re

General Re reported a pre-tax underwriting loss of $39 million for the first quarter of 2010 compared to a $16 million underwriting loss in the prior year period. Price competition in most property and casualty lines led to decreases in premium volume, but this was offset by higher premiums in the life/health segment. The quarter included $278 million of catastrophe losses from the Chilean earthquake and storm related losses in Europe, Australia, and New England. Management cautions that premium volumes may drop for 2010 as a whole due to the need to maintain underwriting discipline in a continued soft pricing market. During the quarter, General Re reached a $92 millionsettlement with the Federal Government allowing the company to avoid prosecution for alleged misconduct related to a transaction with AIG.

Berkshire Hathaway Reinsurance Group

Berkshire Hathaway Reinsurance Group posted a $52 underwriting gain for the first quarter of 2010 compared to a $177 million underwriting gain in the prior year period. Beginning in 2010, BHRG’s underwriting activities include a life reinsurance and annuity business that was previously consolidated in Berkshire’s Finance and Financial Products segment. As with General Re, BHRG noted that the insurance market remains soft and this led management to reduce premium volumes during the quarter. Management estimated losses related to the Chilean earthquake at $82 million for the catastrophe and individual risk business and $140 million for the multi-line property/casualty business.

Berkshire Hathaway Primary Group

Berkshire’s primary insurers produced underwriting gains of $33 million for the first quarter compared to $4 million in the prior year period. Premiums earned declined to $425 million from $456 million in the first quarter of 2009 due to a soft market that caused management to constrain business. The improvement in underwriting results was attributed primarily to lower losses in the medical malpractice business.

Investments

Berkshire posted insurance investment income of $988 million for the first quarter of 2010 compared to $1,069 million for the first quarter of 2009. Increases due to the investments in Swiss Re and Dow Preferred stock were more than offset by reductions in dividends from Wells Fargo and the impact of a onetime gain in 2009 associated with a short term currency transaction made in connection to the Swiss Re investment.

Investment and derivatives gains were $1.4 billion which consists of $165 million related to the sale of investments, $267 million related to derivatives being marked to market, and a onetime gain of $979 related to the Burlington Northern Santa Fe acquisition. When Berkshire closed the transaction, it was required to recognize the excess of fair value of the 76.8 million shares of Burlington Northern that were already owned prior to the acquisition.

Manufacturing, Service, and Retail

The manufacturing, service, and retailing segment covers a wide variety of businesses and, in aggregate, has recovered nicely from the depths of the recession. First quarter net earnings for the group was $477 million compared to $258 million for the first quarter of 2009.

Marmon’s pre-tax earnings increased to $190 million from $162 million in the prior year period on a 11 percent increase in revenues. Six of the eleven business sectors within Marmon generated increased revenues while all but two sectors produced increased earnings compared to 2009. The improvements are a result of recovery in many of Marmon’s end markets along with ongoing efforts to control costs.

McLane reported pre-tax earnings of $80 million compared to $143 million in the first quarter of 2009. The bulk of the decrease is due to the fact that earnings in 2009 were boosted by the impact of a substantial inventory price change gain due to increases in federal excise taxes for cigarettes. McLane’s revenues were up six percent over 2009 levels reflecting strength in the grocery and food service businesses.

Other manufacturing posted pre-tax earnings of $332 million compared to $176 million in the prior year period primarily due to strength at Forest River, Iscar, and the apparel group. The building products businesses continue to be adversely affected by low residential and commercial construction activity.

Other service posted $219 million for the first quarter of 2010, far surpassing the profit of $14 million in the first quarter of 2009. NetJets posted a 18 percent increase in revenue compared to last year and generated $57 million in pre-tax earnings compared to a pre-tax loss of $96 million in the first quarter of 2009. NetJets continues to own more aircraft than required for present operations but management is taking steps to ensure that the company will operate profitably in the future.

The retailing businesses posted pre-tax profits of $32 million in the first quarter which is double the $16 million profit generated in 2009. The retailing segment had improved operating results in furniture and jewelry in addition to improved results at See’s candies which was partially driven by the timing of Easter.

Finance and Financial Products

The finance and financial products segment posted net earnings of $69 million during the quarter which is relatively flat compared to earnings of $68 million in the first quarter of 2009. Manufactured housing revenues were 5 percent higher than 2009 levels. Home sales increased compared to 2009 levels driven by a 20 percent increase in unit sales partially offset by a 10 percent decline in the average sales price per unit due to changing product mix. Clayton’s quarterly pre-tax earnings declined to $32 million compared to $42 million in 2009 due to lower interest income and a slight increase in loan loss provisions, partially offset by improved profits in manufacturing.

Clayton continues to be negatively affected by the economic recession as well as the fact that many housing programs sponsored by the Federal government specifically exclude factory built homes from participating. Despite this negative impact, management believes that Clayton will continue to operate profitably going forward.

Railroad, Utilities, and Energy

Following the acquisition of Burlington Northern Santa Fe on February 12, Berkshire consolidated the railroad operations into the “Railroad, Utilities, and Energy” reporting segment. Warren Buffett has stated that railroads are similar in many ways to utilities due to the manner in which they are regulated by government authorities and the requirement for ongoing capital expenditures in both businesses. BNSF is consolidated into Berkshire starting on February 12, 2010, the effective date of the acquisition. Therefore, only a partial quarter of results are reflected in the first quarter’s financial statements.

Many observers, including Buffett biographer Alice Schroeder, have expressed disappointment regarding the fact that BNSF is not receiving its own segment. In the context of a broader question at the annual meeting regarding the amount of information in the annual report, Mr. Buffett was reported to make the case that too many additional pages could serve to confuse matters rather than create more enlightenment.

While it is true that Berkshire’s current arrangement does not disclose many details regarding the railroad or the utility business, it should be pointed out that any shareholder seeking additional information may examine the separate SEC Filings of MidAmerican and BNSF. Click on this link for Burlington Northern’s 10-Q covering the first quarter and click on this link for MidAmerican’s 10-Q covering the first quarter.

While it is somewhat tricky to fully reconcile Berkshire Hathaway’s consolidated figures for the segment with the 10-Q filings of BNSF and MidAmerican, it is possible to obtain quite a bit of additional detail. As an example, we have prepared the exhibit below which displays a reconciliation of Berkshire’s “Railroad, Energy, and Utilities” balance sheet as of March 31 with Burlington Northern and MidAmerican’s individual 10-Q filings. The “unallocated” column shows the difference between the figures reported in the consolidated financial statements of Berkshire compared to the sum of the same accounts in the subsidiary 10-Q statements. (Click on the image to enlarge the display).

Please click on this link for an Excel spreadsheet with the data along with additional notes regarding thoughts on the reconciliation exercise. While it is interesting to review the information in the subsidiary 10-Q, obviously most Berkshire shareholders will not do so. At a summary level, it seems like Berkshire is attempting to strike the balance between sufficient disclosure and a desire to avoid the production of much longer financial statements that could confuse rather than enlighten shareholders. It is not clear why anyone would object particularly since further details are readily available for those who wish to take a look.

Space and time constraints for this article prevent additional discussion of the Burlington Northern transaction including thoughts on future capital expenditures. Future articles will cover Burlington Northern in more detail. As we speculated earlier this year, it seems likely that capital expenditures are set to rise at BNSF, although any changes may take some time to appear.

Disclosure: The author owns shares of Berkshire Hathaway and is the author of The Rational Walk’s Berkshire Hathaway 2010 Briefing Book which provides a detailed analysis of the company along with estimates of intrinsic value.

Ravi Nagarajan

http://www.rationalwalk.com