This week we look first at the GDP results and interest rate decision in Malaysia, then take a look at the Russian GDP growth results as well as how the rest of the BRICs are tracking. Then we look at some of the detail in the EU GDP results; tracking how the largest EU economies are growing against trend. Then we review the US trade balance figures for March, and the April employment numbers from Australia. One theme that comes out is the idea of a two-speed recovery.

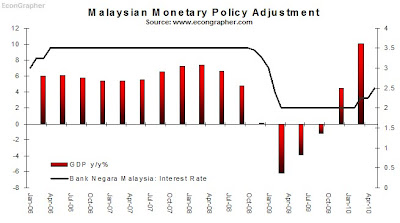

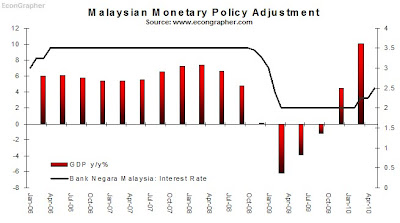

1. Malaysian Monetary Policy Adjustment

The central bank in Malaysia increased the benchmark interest rate to 2.5% from 2.25%, the second tightening this year, in a move that was broadly expected by most analysts. Earlier in the week the Malaysian economy was revealed to have grown 10.1% vs an expected 9% year on year (thus prompting the central bank to lift rates as the Malaysian economic recovery surges on; Euro risks notwithstanding). Another Asian growth powerhouse in a time where developing and emerging markets are almost assured to outperform developed economies on economic growth, but the global risks are still there - we live in an increasingly interlinked global community.

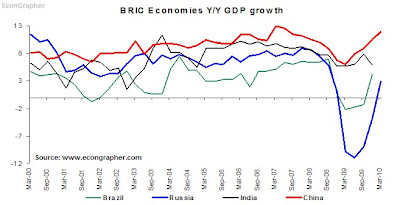

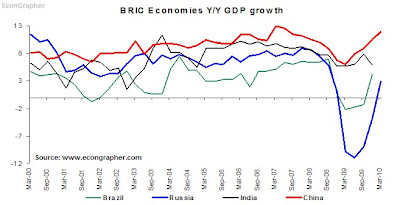

2. Russian Economic Growth

The Russian economy also showed an impressive bounce-back this week for the first quarter of 2010 with 2.9% growth year on year (vs -9.8% in Q1 2009, and -3.8% in Q4 2009). The impressive bounce-back shows how interlinked the Russian economy is with commodity prices, and affirms the view that Russia has good prospects, but with volatility to boot. You may recall recently the Russian central bank dropped interest rates (in contrast to the monetary policy actions of most other emerging markets) in order to secure and sustain the recovery; and it will be interesting how this plays through in the R of the BRIC - major emerging economies.

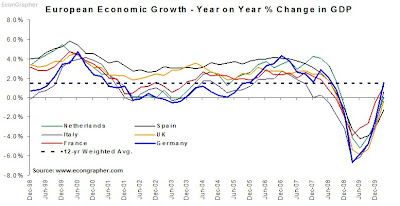

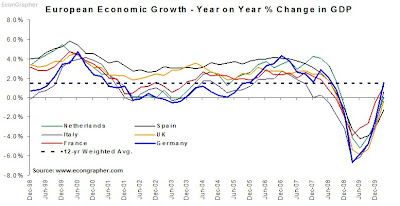

3. European Economic Growth

You probably caught the headlines where the EU beat consensus by 100% with 0.2% vs an expected 0.1% growth! But it is worth looking through into more of the details. The larger EU economies like Germany, Italy, Spain, France, are experiencing the similar global pattern of a sharp v shaped recovery in GDP growth. However with the exception of Germany the large EU economies are still below their average year on year growth rate of about 1.5%. Granted, some of the "rebound" is due to a low comparator period, but this "V" shaped recovery in the EU is probably the most likely spot for a "W" shaped recovery to eventually unfold given the weight of the problems and risks there.

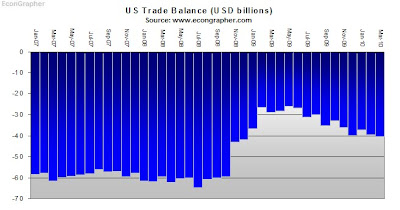

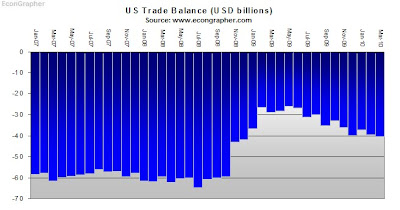

4. US Trade Balance

The US recorded a slightly worse trade balance in March with a deficit of -$40.4 billion, vs -$39.7 billion in February. The slightly worse result is mostly driven by oil imports, which has a distorting impact on assessing whether or not the US is changing its consuming ways in terms of the export/import mix and global imbalances. Ultimately the US reliance on foreign oil continues to be a key vulnerability for the US and a source of structural trade imbalances. If the yuan were to appreciate then this gap may even widen if the appreciation were small enough not to greatly impact on spending decisions by US importers. But then on that front much of what the US gets from China doesn't carry the same necessity as oil. As always - this is an area of keen interest to me as the US economic recovery unfolds; keep watching this space!

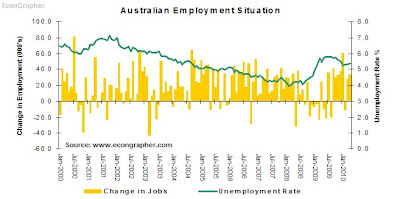

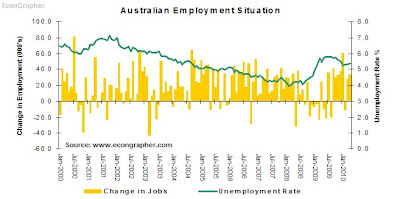

5. Australian Employment

Australia added jobs again in April, recording a total of 33.7k new jobs (27.7k in March), with part-timers declining by -3.9k and all of the growth coming from full-timers 37.5k. The unemployment rate remained stable at 5.4% as the population proved able to supply for the new jobs. As the unemployment rate begins to drop even more, this will probably put the pressure back on the Reserve Bank of Australia to start raising interest rates again; having raised from 3% late last year to 4.5% in May - indicating a pause to be on the cards in its most recent statement. Still a strong economy, but recently brought out some new taxes designed to try remedy the two-speed mining vs non-mining economy (this could have the unintended effect of changing it to a one-speed (slow), economy).

Summary

So Malaysia is showing a pretty strong rebound from the crisis, even being spurred to ratchet up interest rates for fears of overheating (as has some of its emerging market ilk). Indeed the BRICs have also shown a pattern of a sharp recovery; with Russia - the one that took the biggest hit - showing a drastic turnaround, reflecting the volatility inherent in emerging markets.

Meanwhile developed markets are showing the same pattern but don't at this stage give any monetary policy setters any jitters whatsoever just yet - indeed the developed markets probably need a lot more water to go under the bridge before they can declare it all over.

And as for the US trade balance and Aussie employment, it just plays into the two-speed idea... The recovery is going to carry on at a two-speed pace with emerging markets leading the charge and developed economies falling behind, and global risks will be waiting at every corner!

Sources

1. Bank Negara Malaysia www.bnm.gov.my

2. Trading Economics www.tradingeconomics.com Bloomberg www.bloomberg.com

3. OECD Statistics database www.oecd.org

4. Trading Economics www.tradingeconomics.com

5. Australian Bureau of Statistics www.abs.gov.au

Article Source: http://www.econgrapher.com/top5graphs15may.html

1. Malaysian Monetary Policy Adjustment

The central bank in Malaysia increased the benchmark interest rate to 2.5% from 2.25%, the second tightening this year, in a move that was broadly expected by most analysts. Earlier in the week the Malaysian economy was revealed to have grown 10.1% vs an expected 9% year on year (thus prompting the central bank to lift rates as the Malaysian economic recovery surges on; Euro risks notwithstanding). Another Asian growth powerhouse in a time where developing and emerging markets are almost assured to outperform developed economies on economic growth, but the global risks are still there - we live in an increasingly interlinked global community.

2. Russian Economic Growth

The Russian economy also showed an impressive bounce-back this week for the first quarter of 2010 with 2.9% growth year on year (vs -9.8% in Q1 2009, and -3.8% in Q4 2009). The impressive bounce-back shows how interlinked the Russian economy is with commodity prices, and affirms the view that Russia has good prospects, but with volatility to boot. You may recall recently the Russian central bank dropped interest rates (in contrast to the monetary policy actions of most other emerging markets) in order to secure and sustain the recovery; and it will be interesting how this plays through in the R of the BRIC - major emerging economies.

3. European Economic Growth

You probably caught the headlines where the EU beat consensus by 100% with 0.2% vs an expected 0.1% growth! But it is worth looking through into more of the details. The larger EU economies like Germany, Italy, Spain, France, are experiencing the similar global pattern of a sharp v shaped recovery in GDP growth. However with the exception of Germany the large EU economies are still below their average year on year growth rate of about 1.5%. Granted, some of the "rebound" is due to a low comparator period, but this "V" shaped recovery in the EU is probably the most likely spot for a "W" shaped recovery to eventually unfold given the weight of the problems and risks there.

4. US Trade Balance

The US recorded a slightly worse trade balance in March with a deficit of -$40.4 billion, vs -$39.7 billion in February. The slightly worse result is mostly driven by oil imports, which has a distorting impact on assessing whether or not the US is changing its consuming ways in terms of the export/import mix and global imbalances. Ultimately the US reliance on foreign oil continues to be a key vulnerability for the US and a source of structural trade imbalances. If the yuan were to appreciate then this gap may even widen if the appreciation were small enough not to greatly impact on spending decisions by US importers. But then on that front much of what the US gets from China doesn't carry the same necessity as oil. As always - this is an area of keen interest to me as the US economic recovery unfolds; keep watching this space!

5. Australian Employment

Australia added jobs again in April, recording a total of 33.7k new jobs (27.7k in March), with part-timers declining by -3.9k and all of the growth coming from full-timers 37.5k. The unemployment rate remained stable at 5.4% as the population proved able to supply for the new jobs. As the unemployment rate begins to drop even more, this will probably put the pressure back on the Reserve Bank of Australia to start raising interest rates again; having raised from 3% late last year to 4.5% in May - indicating a pause to be on the cards in its most recent statement. Still a strong economy, but recently brought out some new taxes designed to try remedy the two-speed mining vs non-mining economy (this could have the unintended effect of changing it to a one-speed (slow), economy).

Summary

So Malaysia is showing a pretty strong rebound from the crisis, even being spurred to ratchet up interest rates for fears of overheating (as has some of its emerging market ilk). Indeed the BRICs have also shown a pattern of a sharp recovery; with Russia - the one that took the biggest hit - showing a drastic turnaround, reflecting the volatility inherent in emerging markets.

Meanwhile developed markets are showing the same pattern but don't at this stage give any monetary policy setters any jitters whatsoever just yet - indeed the developed markets probably need a lot more water to go under the bridge before they can declare it all over.

And as for the US trade balance and Aussie employment, it just plays into the two-speed idea... The recovery is going to carry on at a two-speed pace with emerging markets leading the charge and developed economies falling behind, and global risks will be waiting at every corner!

Sources

1. Bank Negara Malaysia www.bnm.gov.my

2. Trading Economics www.tradingeconomics.com Bloomberg www.bloomberg.com

3. OECD Statistics database www.oecd.org

4. Trading Economics www.tradingeconomics.com

5. Australian Bureau of Statistics www.abs.gov.au

Article Source: http://www.econgrapher.com/top5graphs15may.html