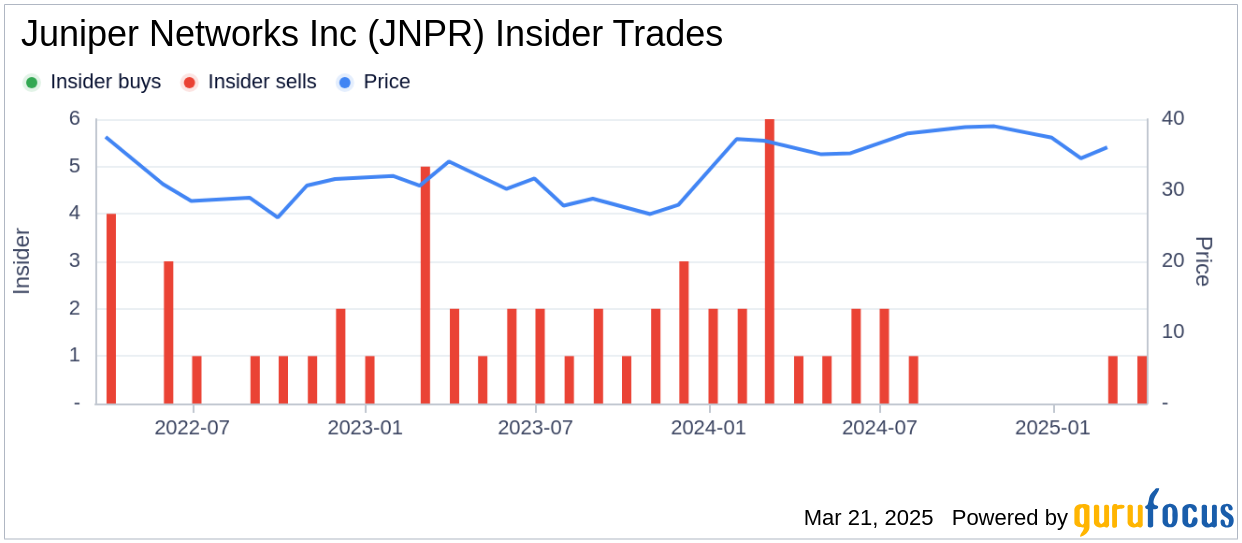

On March 14, 2025, Kaddaras Christopher Nicholas Jr, Executive Vice President and Chief Revenue Officer at Juniper Networks Inc, sold 90,000 shares of the company, according to a SEC Filing. Following this transaction, the insider now owns 57,682 shares of the company. Juniper Networks Inc (JNPR, Financial) is a company that designs, develops, and sells products and services that provide high-performance network infrastructure. The company offers routing, switching, and security solutions that are designed to meet the demands of global service providers, enterprises, and public sector organizations.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.