Monetary worries are the order of the day. The dollar, the euro, the yen… Where are they all headed?

Eventually, to zero.

But there is a journey of some length between here and there. In the between, you’ll be glad you own real assets like oil, natural gas and gold.

These three are the subject of today’s missive.

We view them through the fog of currencies. You cannot say, for example, that since the price of oil rose in 2010 that means demand is strong and supply is tight. It may also mean the US dollar is weaker.

Nonetheless, on oil, it seems as if the market tightened in the second half of 2010. But the key thing to watch is the marginal cost to produce a barrel of oil. This is an important analysis that many people overlook. What we want to know is how much it costs to produce the most expensive barrel.

If the world’s demand for oil is 85 million barrels a day, then what did it cost to produce the last barrels? This is the marginal cost. The reason it is important is that it gives you insight into how the market ought to behave. If the price of oil is $90 a barrel and the cost to produce is only $40, then that would imply there is a lot of room for the price of oil to fall.

Today, that is not the case. The marginal cost is probably right at $90. I say “probably” because it’s not a figure you can look up so easily. It requires some estimates.

Macquarie Research recently released an estimate of $90 a barrel. At this price, oil sands projects earn after-tax returns in the low teens for big mining projects. By Macquarie’s reckoning, the oil sands projects are the marginal producers. They are the “last barrels.”

Now, this analysis is not perfect. For one thing, supply constraints can drive the price higher. Even though the marginal cost might be $90 today for 85 million barrels, it might be $100 for 90 million barrels. Second, if lower-cost sources of oil expand, you can actually push the marginal cost down.

But even after all this, it’s comforting to know, as an oil investor, that the market price is right where it seemingly ought to be. If global demand sits at 85 million barrels, then $90 is a fair price, given all that we know today.

Conclusion: Oil is not cheap, but neither is it expensive. Stay long oil and oil-related stocks.

Let’s turn to natural gas.

I got natural gas wrong two years ago. I couldn’t see it going below $5/mcf. When I saw the rig count drop off severely, I thought for sure the production of natural gas would also topple over. Then, the price of natural gas would have to rise. But I was wrong. The natural gas price easily broke below $5/mcf and then languished below that level.

I thought the natural gas industry could operate profitably at sub-$5 natural gas. But I got wrong. For one thing, the productivity of rigs has climbed. We produce a lot more gas with a lot fewer rigs. Secondly, the drilling technologies that have “unlocked” shale gas deposits have lowered the marginal cost of natural gas production. But even so, very few natural gas projects are economic below $5/mcf…and many projects require even higher gas prices to operate profitably.

So I think the pressure on natural gas prices going forward will be to the upside. But since natural gas is very difficult to transport around the globe, gas prices vary dramatically from place to place. So here is how I would play it. Invest in gas plays that are overseas, where you get paid more than twice what you do in the US for the same resource.

To bridge these markets, there is the LNG trade. This is the trade for liquefied natural gas, which is put on tankers. There is plenty of money going toward LNG terminals. Longer term, I think the US emerges as a big exporter of natural gas.

Conclusion: Eventually, natural gas prices will turn up. In the meantime, in North America, I’d own producers with proven low costs, such as Contango Oil & Gas (MCF, Financial).

Finally, let’s turn to gold.

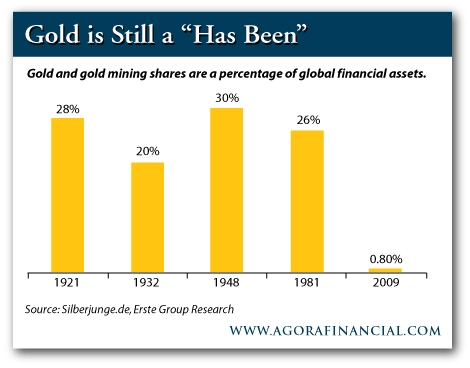

Over the weekend, Barron’s had its first installment of its annual round table. Two panelists made intriguing points on gold. Fred Hickey pointed out that “institutional ownership of gold is ridiculously low. It is less than 1%.” And Felix Zulauf said that at its last peak in 1980, gold was 3% of the market capitalization of global stocks, bonds and money market assets. Today it is 0.6%.

Here is a chart I found on gold and gold mining shares as a percentage of global assets:

Despite a big run-up in the price of gold, it is still vastly under-owned. As inflation starts to get more and more headlines, I think more and more attention will focus on to gold. We still have a long way to go. In inflation-adjusted terms, gold doesn’t hit a new high until it breaks $2,000 an ounce.

On the way, gold stocks look attractive. In particular, I’d stay with the juniors and mid-tier producers. With them, you have the added prospect of getting a buyout. I think we’ll see consolidation among the gold producers.

In the end, it’s simply easier to buy a gold mining company with proven reserves than to build a new mine. You get a 100,000-ounce producer in a safe jurisdiction and it trades for only 5 times cash flow. Either the market will take the price of that stock higher or somebody is going to take them out.

Conclusion: Stay long those junior and mid-tier gold stocks.

Regards,

Chris Mayer

for The Daily Reckoning

Eventually, to zero.

But there is a journey of some length between here and there. In the between, you’ll be glad you own real assets like oil, natural gas and gold.

These three are the subject of today’s missive.

We view them through the fog of currencies. You cannot say, for example, that since the price of oil rose in 2010 that means demand is strong and supply is tight. It may also mean the US dollar is weaker.

Nonetheless, on oil, it seems as if the market tightened in the second half of 2010. But the key thing to watch is the marginal cost to produce a barrel of oil. This is an important analysis that many people overlook. What we want to know is how much it costs to produce the most expensive barrel.

If the world’s demand for oil is 85 million barrels a day, then what did it cost to produce the last barrels? This is the marginal cost. The reason it is important is that it gives you insight into how the market ought to behave. If the price of oil is $90 a barrel and the cost to produce is only $40, then that would imply there is a lot of room for the price of oil to fall.

Today, that is not the case. The marginal cost is probably right at $90. I say “probably” because it’s not a figure you can look up so easily. It requires some estimates.

Macquarie Research recently released an estimate of $90 a barrel. At this price, oil sands projects earn after-tax returns in the low teens for big mining projects. By Macquarie’s reckoning, the oil sands projects are the marginal producers. They are the “last barrels.”

Now, this analysis is not perfect. For one thing, supply constraints can drive the price higher. Even though the marginal cost might be $90 today for 85 million barrels, it might be $100 for 90 million barrels. Second, if lower-cost sources of oil expand, you can actually push the marginal cost down.

But even after all this, it’s comforting to know, as an oil investor, that the market price is right where it seemingly ought to be. If global demand sits at 85 million barrels, then $90 is a fair price, given all that we know today.

Conclusion: Oil is not cheap, but neither is it expensive. Stay long oil and oil-related stocks.

Let’s turn to natural gas.

I got natural gas wrong two years ago. I couldn’t see it going below $5/mcf. When I saw the rig count drop off severely, I thought for sure the production of natural gas would also topple over. Then, the price of natural gas would have to rise. But I was wrong. The natural gas price easily broke below $5/mcf and then languished below that level.

I thought the natural gas industry could operate profitably at sub-$5 natural gas. But I got wrong. For one thing, the productivity of rigs has climbed. We produce a lot more gas with a lot fewer rigs. Secondly, the drilling technologies that have “unlocked” shale gas deposits have lowered the marginal cost of natural gas production. But even so, very few natural gas projects are economic below $5/mcf…and many projects require even higher gas prices to operate profitably.

So I think the pressure on natural gas prices going forward will be to the upside. But since natural gas is very difficult to transport around the globe, gas prices vary dramatically from place to place. So here is how I would play it. Invest in gas plays that are overseas, where you get paid more than twice what you do in the US for the same resource.

To bridge these markets, there is the LNG trade. This is the trade for liquefied natural gas, which is put on tankers. There is plenty of money going toward LNG terminals. Longer term, I think the US emerges as a big exporter of natural gas.

Conclusion: Eventually, natural gas prices will turn up. In the meantime, in North America, I’d own producers with proven low costs, such as Contango Oil & Gas (MCF, Financial).

Finally, let’s turn to gold.

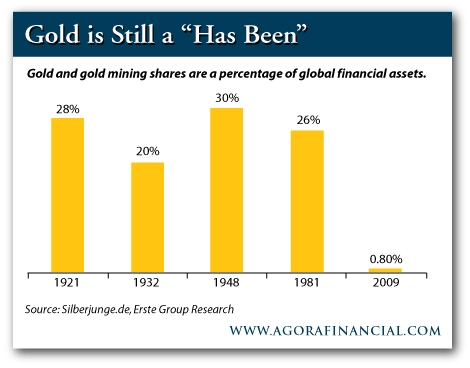

Over the weekend, Barron’s had its first installment of its annual round table. Two panelists made intriguing points on gold. Fred Hickey pointed out that “institutional ownership of gold is ridiculously low. It is less than 1%.” And Felix Zulauf said that at its last peak in 1980, gold was 3% of the market capitalization of global stocks, bonds and money market assets. Today it is 0.6%.

Here is a chart I found on gold and gold mining shares as a percentage of global assets:

On the way, gold stocks look attractive. In particular, I’d stay with the juniors and mid-tier producers. With them, you have the added prospect of getting a buyout. I think we’ll see consolidation among the gold producers.

In the end, it’s simply easier to buy a gold mining company with proven reserves than to build a new mine. You get a 100,000-ounce producer in a safe jurisdiction and it trades for only 5 times cash flow. Either the market will take the price of that stock higher or somebody is going to take them out.

Conclusion: Stay long those junior and mid-tier gold stocks.

Regards,

Chris Mayer

for The Daily Reckoning