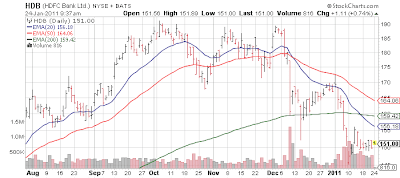

Indian stocks have kicked off 2011 in horrid fashion, with fears of inflation - especially of the food kind - pressuring equities intensely, as a campaign of rate hikes that started in 2010 by the central bank looks to have no end in sight. Due to the dearth of Indian equities that trade in U.S. markets, I've long used the 2 banks HDFC Bank (HDB) and ICICI Bank (IBN, Financial) as my main method to get exposure to the market. As expected both have taken it on the chin of late, but not unexpectedly, as valuations had expanded far too high. Even last September in the mid $170s I wrote this about HDFC

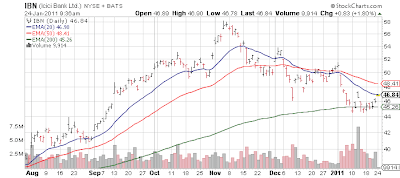

IBN down 22%.

(please note being foreign equities the 'gaps' in these charts are less helpful, as when the U.S. market opens many times these stocks will immediately jump or fall in similar fashion to how the stock acted in its home market)

On a fundamental basis the story continues to be attractive although of course banks prefer their cost of funding to be as low as possible (an ultra easy central bank) - a huge gift given to domestic banking interests day after day.

ICICI Bank reported another solid quarter overnight. Via Reuters:

its valuation has been extreme. It is now at 30x FORWARD PE ... for a bank. Yes a dominant bank in a fast growing country but still...The stock traded up another 15 points, at which point I wrote in November

On year end (which is next March) the stock is already trading at 30x+ forward PE. But in a bubble environment I suppose we need to relax valuation metrics or miss the party.That is more or less where HDFC Bank topped out. So at least this pullback has created somewhat better valuation metrics for both names - HDB down 21% from peak.

IBN down 22%.

(please note being foreign equities the 'gaps' in these charts are less helpful, as when the U.S. market opens many times these stocks will immediately jump or fall in similar fashion to how the stock acted in its home market)

On a fundamental basis the story continues to be attractive although of course banks prefer their cost of funding to be as low as possible (an ultra easy central bank) - a huge gift given to domestic banking interests day after day.

ICICI Bank reported another solid quarter overnight. Via Reuters:

- ICICI Bank Ltd , India's second-largest lender, beat quarterly profit estimates on growing demand for credit in the country and rising fee income, but climbing interest rates are a worry for the sector's growth.

- ICICI Bank and its rivals State Bank of India and HDFC Bank are seeing a surge in loan demand and asset quality improvement in an economy growing at 8.5 percent, the fastest pace among major Asian economies after China.

- "The sector is likely to see some margin pressure going forward as the impact of higher deposit rates in the last quarter start to have an impact," said Binay Chandgothia, chief investment officer at Principal Global Investors in Hong Kong. Principal owns shares of the top three Indian banks including ICICI in its portfolio. "The Reserve Bank of India will keep hiking rates in the short-term and that will slow down the nominal economic growth next year, impacting credit growth," Chandgothia said.

- India's central bank is widely expected to raise key rates by 25 basis points on Tuesday to cool accelerating inflation. It would be the seventh increase in the past 12 months. It had raised its main lending rate by 150 basis points in 2010.

- Net profit at ICICI Bank rose to 14.4 billion rupees ($316 million) in the quarter that ended on Dec. 31, its fiscal third quarter, from 11 billion rupees a year earlier.

- Net interest income rose 12 percent to 23.1 billion rupees. A Reuters poll of analysts had forecast net profit of 13.5 billion rupees on net interest income of 22.9 billion rupees.

- ICICI Bank said on Monday its advances grew 15 percent to 2.07 trillion rupees ($45 billion) as of end-December. The bank's net non performing asset ratio dropped to 1.16 percent as of end-December from 2.19 percent a year ago. The net non performing advances to net advances ratio was 1.4 percent at end-December.