Founded in 1906, Kellogg is a leading global producer and marketer of cereal, cookies, crackers, and other convenient foods. The firm's offerings are manufactured in 19 countries and marketed in about 180 countries. Its product portfolio includes well-known brands such as Special K, Frosted Flakes, Corn Flakes, Rice Krispies, Pop-Tarts, Eggo, Keebler, and Morningstar Farms. International sales account for about one third of the firm's consolidated total.

From the 4Q 2010 Earnings Call on 2/3/2011:

- Since our third quarter call, our outlook on commodity cost inflation for 2011 has increased. As a result, we expect more net price realization, and we have already announced price increases in many of our businesses.

- Volume is still expected to be flat to down slightly.

- Internal operating profit is still expected to be flat to down 2%.

- We now expect cost pressures as a percentage of cost of goods sold to be approximately 7% and cost savings to be about 4%. We are approximately 80% hedged on commodities for 2011. Our gross margin is expected to be down slightly for the year and we have included $0.12 of upfront costs in our plan.

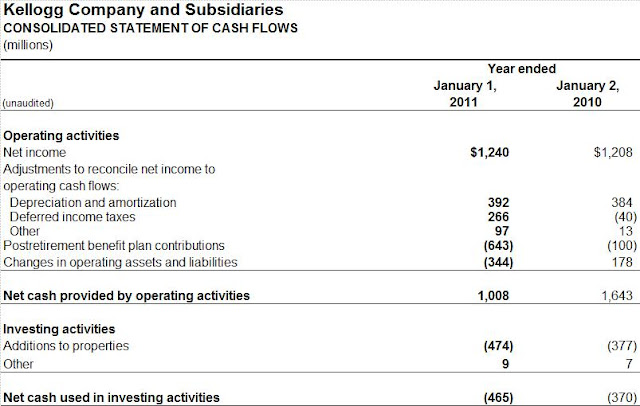

- We expect cash flow to be $1.1 billion to $1.2 billion in 2011, and we expect capital spending to be approximately 4% of net sales.

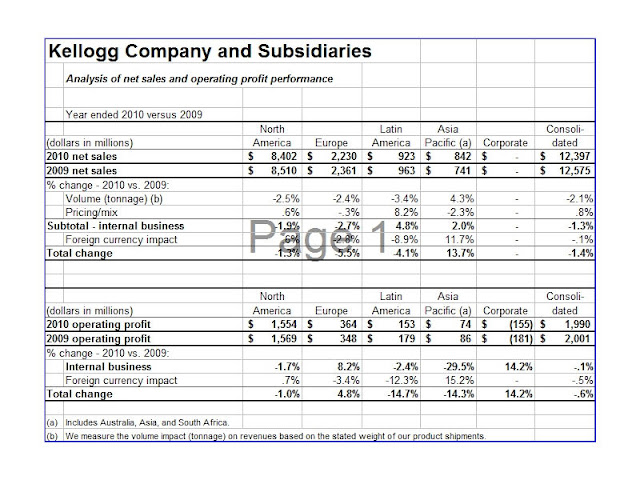

As a consumer, I don't have the stomach for further price increases in the cereal aisle. It's bad enough that a basic box of Rice Krispies sets me back $4.50 or more, so I switched to oatmeal as a breakfast cereal substitute. And I don't like the YOY trend in Sales, COGS, Operating Profit, Operating Cash Flow and Free Cash Flow.

I estimated the firm's WACC at 7.05% using the Capital Asset Pricing Model and the company's recent SEC filings.

Recent free cash flows and noted growth rates:

| Year | FCF $Millions |

| 2000 | 650 |

| 2001 | 856 |

| 2002 | 746 |

| 2003 | 924 |

| 2004 | 950 |

| 2005 | 769 |

| 2006 | 957 |

| 2007 | 1031 |

| 2008 | 806 |

| 2009 | 1266 |

| 2010 | 1001* |

* 2010 adjusted Free Cash Flow

Average Annual Growth: approx. 7%,CAGR: approx. 4%, Consensus Forecast Industry 5-Year Growth: approx. 14% per year, Consensus Forecast Company 5-Year Growth: approx. 9% per year

Assuming the company achieves a 5-year growth rate in FCF of 9% per year, and assuming that after the next five years, the company achieves no growth in FCF or 0% growth per year forever:

Discounted Cash Flow Valuation

| Year | FCF $ Millions |

| 0 | 1001 |

| 1 | 1091 |

| 2 | 1189 |

| 3 | 1296 |

| 4 | 1413 |

| 5 | 1540 |

| Terminal Value | 23797 |

The firm's future cash flows, discounted at a WACC of 7.05%, give a present value for the entire firm (Debt + Equity) of $22,209 million. If the firm's fair value of debt is estimated at $7127 million, then the fair value of the firm's equity could be $15,082 million. $15,082 million / 366 million outstanding shares is approximately $41 per share and a 20% margin of safety is $33. I believe Kellogg Company, at $53/share is priced beyond its fair value on a cash flow valuation basis.