Shares of Canadian National Railway Co. (CNI, Financial)(TSX:CNR, Financial), a Montreal-based transportation company, slightly increased in aftermarket trading on Monday following the release of its first-quarter results.

For the quarter ending March 31, Canadian National reported operating income of 1.327 billion Canadian dollars ($1.07 billion), up 9% from the prior-year quarter. Despite this, diluted earnings of CA$1.37 declined 4% from first-quarter 2020 diluted earnings per share.

Company reports strong growth in traffic volume, yet currency translation impacts revenue

The company reported revenue of CA$3.535 billion, in line with prior-year quarter revenue as negative translation impacts of a stronger Canadian dollar and fuel surcharge rates offset strong traffic volumes.

While revenue ton miles increased 5% year over year, Canadian National's freight revenues per revenue ton mile declined 5% from the prior-year period on the heels of the stronger Canadian dollar and lower applicable fuel surcharge rates, offset by higher freight rate costs.

Company reiterates merger with Kansas City Southern

Canadian National President and CEO JJ Ruest said that despite the flat growth in revenue, the company's gains in several areas, including safety, labor productivity and fuel efficiency, demonstrate its "strong operational performance." Ruest also added that the company's proposal to merge with Kansas City Southern (KSU, Financial) expects to "enhance customer choice and competition" while reducing greenhouse gas emissions.

On Saturday, the Kansas City-based railroad company's board of directors unanimously determined that Canadian National's stock-and-cash offer of $325 per share could reasonably lead to a "company superior proposal" as defined by the company's merger agreement with Calgary, Alberta-based Canadian Pacific Railway Ltd. (CP, Financial)(TSX:CP, Financial). Canadian Pacific and Kansas City Southern announced in March an agreement in which Canadian Pacific will acquire Kansas City Southern for $275 per share in stock and cash.

Ruest welcomed the Kansas City-based decision, saying that he is "pleased" that the combination would drive safe and clean railroad services across North America.

Stock trades slightly higher as company upgrades full-year outlook

Shares of Canadian National traded around $109.46, up approximately 0.55% from last Friday's close of $108.85. The stock is modestly overvalued based on Monday's price-to-GF Value ratio of 1.13.

The company upgraded its full-year 2021 outlook, targeting double-digit adjusted earnings growth from 2020 earnings of CA$5.31, up from the prior outlook of growth in the high single digits.

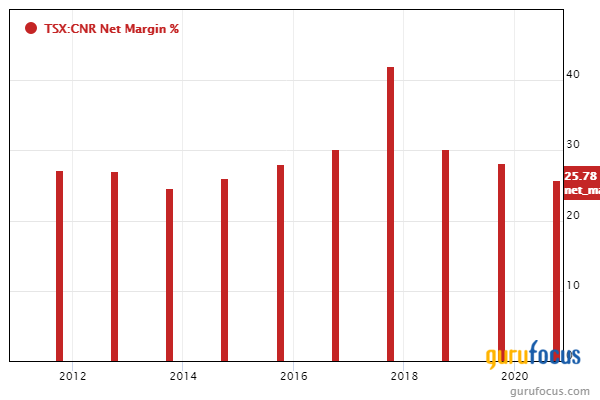

GuruFocus ranks Canadian National's profitability 8 out of 10 on several positive investing signs, which include a 3.5-star business predictability rank, a net profit margin that outperforms over 94% of global competitors and a return on assets that outperforms over 88% of global transportation companies.

Gurus with holdings in Canadian National's U.S.-based shares include Bill Gates (Trades, Portfolio)' Bill and Melinda Gates Foundation Trust and Pioneer Investments (Trades, Portfolio). Likewise, gurus with holdings in the company's Canadian shares include Leith Wheeler Canadian Equity (Trades, Portfolio) and Mawer Canadian Equity Fund (Trades, Portfolio).

Disclosure: Long Canadian Pacific.

Read more here:

- Kimberly-Clark Falters on 1st-Quarter Sales Decline

- Honeywell Slips Despite 1st-Quarter Earnings Beat

- Steven Romick Drives Out Porsche Holding in 1st Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.