Solitron Devices Inc. (SODI, Financial) manufactures semiconductor components that are used primarily for military and aerospace applications. Its customers include Raytheon Technologies (RTX, Financial), Lockheed Martin (LMT, Financial), L3Harris Technologies (LHX, Financial), General Electric Aviation (GE, Financial) and Northrup Grumman Corp. (NOC, Financial). Solitron's products are used in hundreds of major government military programs, including rockets, aircraft, satellites, fighter jets, missiles and radar shields.

An attractive business

Solitron has a number of attributes that make it an attractive business.

First, it is completely mission-critical to its customers. Solitron supplies components that cost, on average, $122. This is immaterial in comparison to the overall cost of producing the equipment they are supplying to such as an advanced fighter jet, which costs over $100 million. Solitron's components are mission-critical, yet the products have very low unit costs. They compete on quality and reliability rather than price.

In addition, Solitron's products are custom designed into specific programs. Once the components are created for that program, they become a sole source supplier and are locked in for the entire life of that program. The switching costs are insurmountable for its customers. In the defense industry, programs last an incredibly long time. This creates a highly recurring, long lasting and non-cyclical revenue base.

The company supplies to a diversified group of programs, so the risk of losing a contract when the U.S. military replaces a program is not an issue as long as Solitron continues to win more business over time, which it has been successful in doing in recent years.

Solitron's contracts are also cost plus, which leads to consistent and predictable margins.

All of the dynamics mentioned above make for both a low-risk and highly predictable business. This is not your typical semiconductor business, which is generally extremely cyclical. Solitron's revenue and margins are consistent and predictable.

A talented and well-aligned management team

A group of activist fund managers, led by Tim Eriksen (who is now Solitron's CEO), successfully took control of the company in 2015.

Erikson is the head of a successful hedge fund called Cedar Creek Partners. He owns over 13% of Solitron's outstanding shares, both directly and through his fund. These shares were acquired primarily in the open market, not through stock grants. Furthermore, his compensation is modest at just $77,000 per year. He is not milking the company for his own benefit.

The rest of the management team, including Chairman Dave Pointer and Chief Operating Officer Mark Matson, also own a significant amount of shares. As such, there is strong alignment between management and outside shareholders.

The company was mismanaged under the previous management team

Eriksen and Matson have completely revamped Solitron's operations in order to position the company for future growth. The company had long been mismanaged under the previous team and was destined to decline had the activist investors not taken over and restructured the business.

Turning around a complex business like Solitron is not easy, so the process took years. The company invested a significant amount of money to fix its operations and make improvements. The expenses and investments associated with the turnaround resulted in negative net income in recent years. These expenses were transitory and are now completely behind the company.

A turnaround that has already turned

Solitron is not a turnaround investment. The turnaround has already happened and was successful. While tough and time-consuming, it also distracted management from focusing on sales growth initiatives. Now that the turnaround has occurred, management is now able to focus on business development activities. This renewed focus on sales growth is already bearing fruit. Since the present management team took over in 2015, revenue has grown by 57%, from $7 million annually to an estimated $11 million for fiscal 2021, which ended Feb. 28. Most of this growth has taken place over the last 12 months.

Revenue growth has been driven by an improved customer focus, which has resulted in winning new contracts with existing customers. For example, Solitron's largest customer, Raytheon, recently named the company as one of its preferred suppliers. This is yet another positive sign.

Solitron's new management team has completely overhauled its operations and positioned the company for future growth. The transitory costs and one-time expenses it incurred over the past several years in connection with the turnaround efforts are now behind it. The company has introduced new products, grown sales, upgraded the quality of its workforce and improved operations. Most importantly, Solitron is now demonstrating consistent profitability and cash flow.

As such, Solitron is a rare example of a successful turnaround.

Improving financial trajectory

As shown in the chart below, Solitron is demonstrating significantly improved financial performance now that the transitory costs associated with the turnaround have fallen away.

The year ahead will be a strong year of growth for Solitron. In its 8-K filing for 2020, the company noted the following about bookings:

"So far in the month of December we have received bookings in excess of $6.6 million and expect to receive approximately another $1.0 to $1.5 million of additional bookings before the end of the fiscal year in February 2021."

When including the estimated bookings noted above, total bookings in fiscal 2021 will likely exceed $12 million. Bookings convert to sales over the subsequent 12 months, which indicates sales will be growing materially in fiscal 2022. Given the increased level of bookings, sales are likely to exceed $12 million next year.

At this level of sales, Solitron is likely to produce gross margins in the mid-30% range and Ebit margins in the high teens. For instance, in the second quarter of 2021, Solitron produced $3.1 million in sales (which is $12.4 million annualized). For the same period, the company produced a gross margin of 36% and an Ebit margin of 19.3%.

It's important to note that Solitron's quarterly sales and profits can be volatile based on when it ships orders. It's best to focus on annual results so the quarterly volatility is smoothed out. During periods of slow sales growth, Solitron will likely generate gross margins in the high 20% range. Similarly, in quarters with high sales growth, gross margins will likely be in the mid-to-high 30% range. There is a high degree of operating leverage in this business, so any incremental sales carry a 40% to 50% contribution margin.

Despite the run up in price, the stock remains significantly undervalued

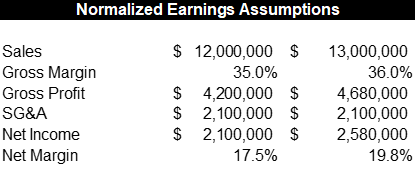

Given the current level of bookings, Solitron is likely to produce annual sales of $12 million to $13 million in each of the next several years. The table below demonstrates assumptions of normalized profitability at this level of sales:

Solitron pays no taxes due to significant net operating losses and has no interest expenses. At the same time, the business has minimal capital expenditure needs, resulting in net income converting entirely to cash. Based on statements from management, the company plans to return excess cash to shareholders via buybacks and dividends.

At the current share price of $7.95, Solitron has a market cap of $16.4 million. After netting out cash of $3.7 million, Solitron has an enterprise value of $12.7 million.At the current share price, Solitron is trading for just 4.9 to 6.0 times normalized earnings (net of cash). This is astoundingly cheap for a business of this quality.

At a valuation of 13 to 15 times net income plus net cash of $3.7 million, Solitron is worth $31 million to $42.4 million, or $14.88 to $20.36 per share.At the current share price of $7.95, Solitron's shares have 87% to 156% upside.

Disclosure: I am long Solitron. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.