Viemed Healthcare Inc. (VMD, Financial) is an at-home medical service provider using medical devices to increase quality of life in the homes of patients with respiratory diseases.

It provides equipment and home therapy to service patients with various respiratory diseases, including chronic obstructive pulmonary disease, chronic respiratory failure, other neuromuscular diseases and sleep apnea. It provides both equipment and clinical services and works in concert with the patients' physicians. Viemed is one of the largest independent non-invasive ventilator providers in the U.S. with a service coverage area of 39 states and prospects to grow into additional territories.

Originally called Sleep Management, it began offering non-invasive therapy in 2012 and in 2014 rebranded to become Viemed. A spinoff from Patient Home Monitoring in 2016 saw the company listing on the Toronto Venture Exchange in December 2017, before eventually listing on the Toronto Stock Exchange in May 2018. It also trades on the Nasdaq.

Monthly rental revenue from ventilators and the sale of associated supplies represented approximately 88% and 92% of traditional revenue, excluding Covid-19 response sales and services, for 2020 and 2019. Viemed's patients are served by licensed respiratory therapists in each of the 39 states where it provides its services. Most of Viemed's business is derived from Medicare and Medicaid programs, which are administered by The Centers for Medicare and Medicaid Services.

In 2020, approximately 27% of the company's traditional revenue, excluding Covid-19 response sales and services, were derived collectively from managed care plans, commercial health insurers, workers' compensation payers and other private pay revenue sources, while approximately 73% of traditional revenue, excluding Covid-19 response sales and services, were derived from Medicare and Medicaid.

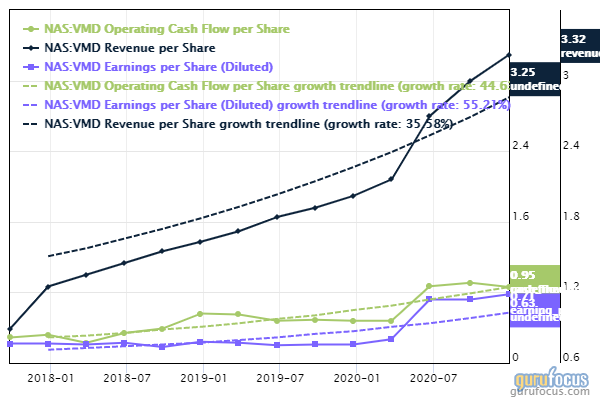

Viemed's financial strength and growth are excellent, as illustrated in the GuruFocus scorecards below.

Free cash flow is also great.

The balance sheet is unlevered.

Conclusion

Revenue and earnings growth over the last three years have been phenomenal, yet the stock is only selling at a trailing price-earnings rato of 11. The forward price-earnings ratio is around 40.

The market is expecting a sharp slowdown in 2021 and 2022 as Covid-19 has indirectly increased Viemed's business. This has put the stock under pressure. The company expects to keep growing organically and via acquisitions. The aging demographics are positive over the near and medium term, though it does have regulatory risk in 2024 when CMS is expected to open up non-invasive respirators for competitive bidding. It produces a lot of cash and the balance sheet is unlevered. It could also be a tasty takeover target.

Disclosure: The author has no position in Viemed Healthcare Inc. but is planning to buy shares.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.