Microsoft Corp. (MSFT, Financial) released fiscal third-quarter earnings on April 27, beating analysts' expectations for both earnings and revenue.

The software company's revenue increased by 19% on an annualized basis during the quarter ended March 31, and this was the largest revenue growth reported since 2018. This stellar performance goes on to highlight that the company is far from reaching a mature business stage even though it has been around for a while. Intelligent cloud continues to be a key long-term growth driver, with Microsoft Azure being the second-largest cloud computing platform in terms of global cloud market share. In the last couple of weeks, Microsoft stock has come down sharply along with many other tech stocks, which presents an opportunistic entry point for growth investors.

Earnings recap

The company reported earnings per share of $1.95 versus analyst expectations for $1.78 per share in April. The reported revenue was $41.7 billion, which was aided by accelerating digital transformation. The revenue from productivity and business processes was $13.6 billion and was driven by a 22% increase in Office 365 commercial revenue and a 25% increase in LinkedIn revenue. The continued growth of Office 365 was a result of an increase in average revenue per user and installed base expansion across all workloads and customer segments. Total Office 365 subscribers surpassed 50 million in the March quarter for the first time in the company's history.

LinkedIn continues to lead the global business-to-business digital advertising market, which is growing in leaps and bounds thanks to favorable industry conditions. The conversations rate on LinkedIn increased by 43% in the March quarter, while content sharing increased by 29%. The number of hours spent on LinkedIn increased by 80% with the introduction of new features such as creator mode and skills assessments. On the other hand, the intelligent cloud segment's revenue came in at $15.1 billion for the quarter with Azure generating 50% of sales.

Commenting on the strong financial performance from the cloud segment, CEO Satya Nadella said:

"We are building Azure to address organizations' needs in a multi-cloud, multi-edge world. We have more data center regions than any other provider, including new regions in China, Indonesia, Malaysia, as well as the United States. Azure has always been hybrid by design, and we are accelerating our innovation to meet customers where they are."

Xbox and gaming consoles are continuously gaining higher engagement rates as well. Xbox gaming revenue increased 232% in the March quarter, which was supported by the majority of the global population seeking home entertainment solutions. With the acquisition of ZeniMax Media, Microsoft made 20 of the world's iconic games accessible via Game Pass in the last quarter. The company also announced it had secured a 10-year deal from the U.S. Army for augmented reality headsets based on its new HoloLens platform, which is a contract worth up to $21.9 billion.

In addition to these core business segments, the company is seeing strong momentum for its other apps and services. For instance, Microsoft Teams now has over 145 million daily active users, and the number of business applications using Teams has nearly tripled year over year. Microsoft Teams, which is the flagship video communication platform owned and operated by the company, is gradually taking market share from other communication platforms by allowing users to take advantage of Microsoft Power Apps within the Teams ecosystem, helping clients in building custom apps, bots and workflows.

Microsoft introduced Viva, an employee experience platform that enables companies to design virtual workspaces for their employees. The company is aggressively pursuing growth opportunities that are opening up as a result of the continued growth of the work-from-home movement. As a leader in many business verticals, including video communication and business apps, Microsoft seems well positioned to report strong earnings growth by making itself a key facilitator of the remote working economy.

The outlook is promising

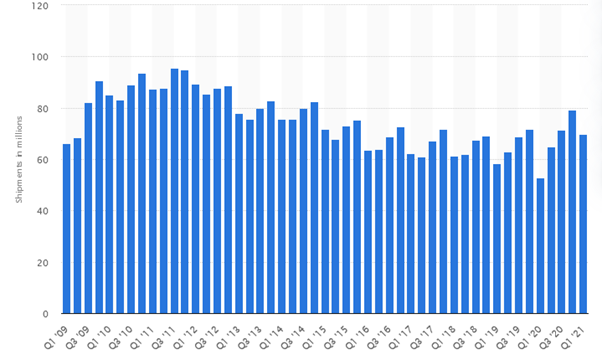

According to the Business Research Company, the global computer hardware market is projected to reach $944 billion in 2021, which would be a notable improvement from $862.93 billion in 2020, and is expected to reach a value of $1,178 billion by 2025, growing at a compounded annual rate of 6%. According to this recent study, North America dominated the global computer hardware industry in 2020, accounting for 43% of the market, whereas Asia-Pacific was the second-largest region, accounting for 29% of the global computer hardware market share. As illustrated below, PC shipments have rebounded sharply in 2020, bucking the negative trend that prevailed for many years.

Exhibit 1: Personal computer shipments worldwide from 2009 to 2021, by quarter

Source: Statista

The growing sales of personal computers will result in an increase in the sales of Windows licenses, and Microsoft is in a good position to convert this favorable industry outlook into higher earnings. According to the company guidance for the next quarter, revenue from personal computing, which includes Windows, gaming, devices and search, is expected to be between $13.6 billion and $14 billion.

Microsoft is well positioned to benefit from the increasing interest of consumers in virtual reality as well. VR is a technology that allows a person to interact with a three-dimensional computer-based environment with the help of VR devices, such as headsets or glasses, gloves and bodysuits. Mordor Intelligence projects the global virtual reality market to be valued at $184.66 billion by 2026, which would be a notable improvement from just $17 billion in 2020. Over the last several years, virtual reality has gained widespread acceptance because of its many use cases, including gaming, education, health care, media and entertainment.

Microsoft is one of the leading designers of VR headsets, and the company projects sales to exceed 6 million units in 2021. Commenting on the opportunity available for Microsoft in the VR industry, Nadella said:

"As the virtual and physical worlds converge, the metaverse comprised of digital twins, simulated environments and mixed reality is emerging as a first-class platform. We are leading and seeing traction across the public and private sectors. Bentley Systems is building a digital twin of the city of Dublin to reimagine urban planning used our Azure Digital Twins as well as Azure IoT. PepsiCo is simulating its manufacturing processes to improve product consistency using our autonomous systems platform. And from Airbus and Toyota to L'Oreal and Intel, customers in every industry are transcending space and addressing complex challenges using mixed reality."

The global lockdown has helped businesses understand the need to continue their operations in a virtual environment, and VR technology has seen an increase in demand as a result of this macroeconomic development. From attending meetings to formulating various policies and strategies for their ongoing businesses, companies have moved to virtual platforms. Microsoft Teams, HoloLens and Power BI are playing a significant role in helping businesses to adapt and grow in a changing technological environment by driving productivity gains, improving the virtual office experience, providing the highest level of cybersecurity and addressing other complex challenges. Overall, the expected growth in the VR industry will present Microsoft with many opportunities to grow, and the company has already laid out a strong foundation to increase its market share in this industry.

Additionally, growth in cloud computing will be a game-changer for Microsoft Azure, resulting in higher revenue in the coming years. The global lockdown last year accelerated the adoption of cloud computing technologies, and the industry is set to carry this momentum into the future. Technavio projects the global cloud computing market to reach $287 billion by 2025, dominated by the North American region.

Microsoft Azure offers more than 600 services, including computer services, data management, developer services, Azure AI and onternet of things-related services. The company extended the Azure control plane to Azure Arc, allowing users to build cloud-native apps, codes and deploy applications to any Kubernetes distribution and build and train machine learning models anywhere. Arc is being used by companies, including Fujitsu and KPMG, to simplify hybrid management and run Azure data services from anywhere. Azure allows building advanced machine learning models as well.

Commenting on the outlook for the cloud industry, Gartner Research vice president Sid Nag said:

"The ability to use on-demand, scalable cloud models to achieve cost efficiency and business continuity is providing the impetus for organizations to rapidly accelerate their digital business transformation plans. The increased use of public cloud services has reinforced cloud adoption to be the 'new normal,' now more than ever."

Microsoft Azure will be key to the company's growth in the coming years, so the favorable outlook for the cloud computing industry suggests Microsoft is well positioned to report strong earnings growth.

Takeaway

Microsoft's March quarter performance confirms the company is well and truly growing despite its massive size and scale. The company has diversified into many fast-growing, young industries such as cloud computing, artificial intelligence and virtual reality, and is well positioned to convert the favorable industry outlook for these industries into higher earnings in the future.

At a forward earnings multiple of 31, Microsoft is one of the most cheaply valued tech giants, so the recent pullback in the stock price presents a good opportunity to invest in the company.

Disclosure: The author owns shares in Microsoft.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.