Bernard Horn (Trades, Portfolio) , manager of the Polaris Global Value Fund, disclosed last week that his firm’s top five trades during the first quarter included new positions in United Therapeutics Corp. (UTHR, Financial) and Marubeni Corp. (TSE:8002, Financial) and the sale of its holdings in Tapestry Inc. (TPR, Financial), Franklin Resources Inc. (BEN, Financial) and Signature Aviation PLC (LSE:SIG, Financial).

Boston-based Polaris invests in undervalued stocks around the globe according to the belief that country and industry factors are key drivers of stock prices and that global markets fluctuations produce mispriced stocks. While global markets are generally efficient, investor behavior engenders volatility into the stock market and may result in stocks that trade at a discount to long-term fundamental value.

As of March 31, Polaris’ $492 million equity portfolio contains 98 stocks, with four new positions and a turnover ratio of 5%. The top four sectors in terms of weight are financial services, consumer cyclical, basic materials and health care, representing 22.44%, 15.87%, 11.50% and 10.62% of the equity portfolio.

United Therapeutics

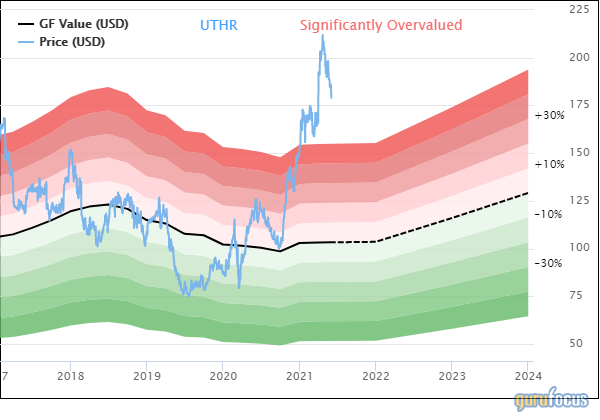

Polaris purchased 41,700 shares of United Therapeutics (UTHR, Financial), giving the position 1.42% weight in the equity portfolio. Shares averaged $166.75 during the first quarter; the stock is significantly overvalued based on Tuesday’s price-to-GF Value ratio of 1.73.

GuruFocus ranks the Silver Spring, Maryland-based biotech company’s financial strength and profitability 7 out of 10 on several positive investing signs, which include a strong Altman Z-score of 6.48 and profit margins outperforming over 80% of global competitors.

Despite high profit margins, United Therapeutics’ three-year average revenue decline rate of 4.7% underperforms 55% of global biotech companies.

Other gurus with holdings in United Therapeutics include Jim Simons (Trades, Portfolio) ’ Renaissance Technologies and Chuck Royce (Trades, Portfolio) ’s Royce Investment Partners.

Marubeni

Polaris purchased 700,200 shares of Marubeni Corp. (TSE:8002, Financial), handing the position 1.18% equity portfolio space. Shares averaged 792.4 yen ($7.24) during the first quarter; the stock is significantly overvalued based on Tuesday’s price-to-GF Value ratio of 1.52.

GuruFocus ranks the Japanese grain-field conglomerate’s financial strength 4 out of 10, driven by a low Altman Z-score of 1.42 and a debt-to-equity ratio that underperforms 77% of global competitors despite interest coverage ratios outperforming more than half of industrial conglomerates.

Tapestry

Polaris sold 168,900 shares of Tapestry (TPR, Financial), shipping out 1.19% of the equity portfolio. Shares averaged $38.53 during the first quarter; the stock is significantly overvalued based on Tuesday’s price-to-GF Value ratio of 1.58.

The fund said in its quarterly letter that it sold the New York-based fashion company at a “profit on valuation.” Based on GuruFocus estimates, Polaris gained approximately 120.77% on the stock since initially purchasing shares during the third quarter of 2020.

GuruFocus ranks Tapestry’s profitability 7 out of 10 on the back of profit margins and returns outperforming over 70% of global competitors.

Gurus with large holdings in Tapestry include Steven Cohen (Trades, Portfolio) ’s Point72 Asset Management and John Rogers (Trades, Portfolio) ’ Ariel Investment.

Franklin Resources

Polaris sold 162,100 shares of Franklin Resources (BEN, Financial), carving out 0.92% of the equity portfolio. Shares averaged $27.32 during the first quarter; the stock is fairly valued based on Tuesday’s price-to-GF Value ratio of 0.99.

GuruFocus ranks the San Mateo, California-based asset management company’s financial strength 5 out of 10: Although the company has a solid Piotroski F-score of 6, interest coverage and debt ratios underperform more than 62% of global competitors.

Signature Aviation

Polaris dissolved its 678,559-share holding in Signature Aviation (LSE:SIG, Financial) during the quarter: The fund said in its letter that shares of the U.K.-based aviation support company increased on the heels of merging with private equity firm Global Infrastructure Partners.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.