The stock of PPL (NYSE:PPL, 30-year Financials) gives every indication of being modestly overvalued, according to GuruFocus Value calculation. GuruFocus Value is GuruFocus' estimate of the fair value at which the stock should be traded. It is calculated based on the historical multiples that the stock has traded at, the past business growth and analyst estimates of future business performance. If the price of a stock is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. On the other hand, if it is significantly below the GF Value Line, its future return will likely be higher. At its current price of $28.99 per share and the market cap of $22.3 billion, PPL stock is estimated to be modestly overvalued. GF Value for PPL is shown in the chart below.

Because PPL is relatively overvalued, the long-term return of its stock is likely to be lower than its business growth.

Link: These companies may deliever higher future returns at reduced risk.

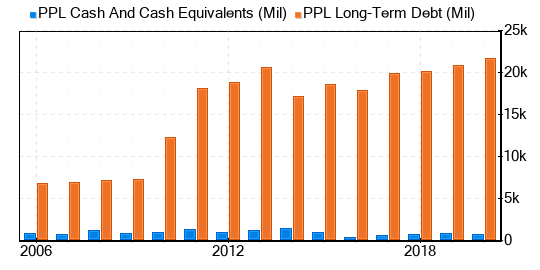

Since investing in companies with low financial strength could result in permanent capital loss, investors must carefully review a company's financial strength before deciding whether to buy shares. Looking at the cash-to-debt ratio and interest coverage can give a good initial perspective on the company's financial strength. PPL has a cash-to-debt ratio of 0.03, which ranks worse than 87% of the companies in the industry of Utilities - Regulated. Based on this, GuruFocus ranks PPL's financial strength as 3 out of 10, suggesting poor balance sheet. This is the debt and cash of PPL over the past years:

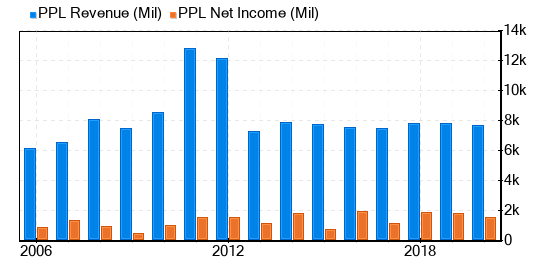

Investing in profitable companies carries less risk, especially in companies that have demonstrated consistent profitability over the long term. Typically, a company with high profit margins offers better performance potential than a company with low profit margins. PPL has been profitable 10 years over the past 10 years. During the past 12 months, the company had revenues of $7.1 billion and loss of $1.19 a share. Its operating margin of 34.05% better than 89% of the companies in the industry of Utilities - Regulated. Overall, GuruFocus ranks PPL's profitability as fair. This is the revenue and net income of PPL over the past years:

One of the most important factors in the valuation of a company is growth. Long-term stock performance is closely correlated with growth according to GuruFocus research. Companies that grow faster create more value for shareholders, especially if that growth is profitable. The average annual revenue growth of PPL is -3%, which ranks worse than 76% of the companies in the industry of Utilities - Regulated. The 3-year average EBITDA growth is -0.4%, which ranks in the middle range of the companies in the industry of Utilities - Regulated.

Another method of determining the profitability of a company is to compare its return on invested capital to the weighted average cost of capital. Return on invested capital (ROIC) measures how well a company generates cash flow relative to the capital it has invested in its business. The weighted average cost of capital (WACC) is the rate that a company is expected to pay on average to all its security holders to finance its assets. When the ROIC is higher than the WACC, it implies the company is creating value for shareholders. For the past 12 months, PPL's return on invested capital is 3.65, and its cost of capital is 4.58. The historical ROIC vs WACC comparison of PPL is shown below:

To conclude, The stock of PPL (NYSE:PPL, 30-year Financials) appears to be modestly overvalued. The company's financial condition is poor and its profitability is fair. Its growth ranks in the middle range of the companies in the industry of Utilities - Regulated. To learn more about PPL stock, you can check out its 30-year Financials here.

To find out the high quality companies that may deliever above average returns, please check out GuruFocus High Quality Low Capex Screener.