When a company's return on equity (ROE) ratio beats most of its competitors, it suggests that the company has been very efficient in generating profits. Thus, investors may want to consider the following tech favorites, as they are beating most of their peer group companies in terms of a higher ROE ratio.

Apple Inc

The first stock investors may want to consider is Apple Inc (AAPL, Financial), a U.S. electronic devices giant based in Cupertino, California.

Apple Inc has a ROE ratio of 108.57% (versus the industry median of 5.79%), ranking higher than 99.65% of 2,289 companies that are operating in the hardware industry.

The share price was $127.13 at close on Wednesday, increasing 51.39% over the past year, for a market capitalization of $2.12 trillion and a 52-week range of $83.14 to $145.09.

The stock has a price-book ratio of 30.66 and a price-earnings ratio of 28.54.

GuruFocus has assigned a score of 6 out of 10 for the company's financial strength rating and 8 out of 10 for its profitability rating.

On Wall Street, the stock has a median recommendation rating of overweight and an average target price of $157.10 per share.

Microsoft Corp

The second stock investors may want to consider is Microsoft Corp (MSFT, Financial), a Redmond, Washington-based developer, manufacturer, licensor and seller of computer software, personal computers and consumer electronics.

Microsoft Corp has a ROE ratio of 45.11% (versus the industry median of 4.66%), which ranks higher than 96.30% of the 2,219 companies that are operating in the software industry.

The share price has increased by 36.14% over the past year to trade at $253.59 at close on Wednesday for a market capitalization of $1.91 trillion and a 52-week range of $184.01 to $263.19.

The stock has a price-book ratio of 14.2 and a price-earnings ratio of 34.55.

GuruFocus has assigned a score of 6 out of 10 to the company's financial strength rating and 8 out of 10 to its profitability rating.

On Wall Street, the stock has a median recommendation rating of buy with an average target price of $294.89 per share.

Amazon.com Inc

The third stock investors may want to consider is Amazon.com Inc (AMZN, Financial), a Seattle, Washington-based online retail giant.

Amazon.com Inc has a ROE ratio of 32.14% (versus the industry median of 4.4%), ranking higher than 91.42% of the 1,002 companies that are operating in the retail-cyclical industry.

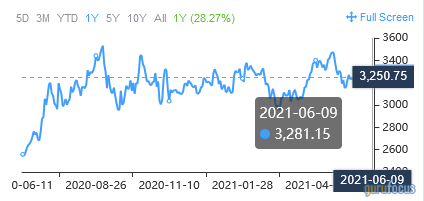

The share price has risen by 28.27% over the past year to trade at $3,281.15 at close on Wednesday, determining a market capitalization of $1.65 trillion and a 52-week range of $2,503.35 to $3,554.

The price-book ratio is 15.99 and the price-earnings ratio is 62.44.

GuruFocus has assigned a score of 6 out of 10 to the company's financial strength rating and 8 out of 10 to its profitability rating.

On Wall Street, the stock has a median recommendation rating of buy with an average target price of $4,274.13 per share.

Disclosure: I have no positions in any securities mentioned in this article.