Value investors may want to consider the following three securities, since their share prices are trading below their respective Peter Lynch earnings lines. This suggests they could be undervalued.

Wall Street sell-side analysts have also issued positive ratings for these companies.

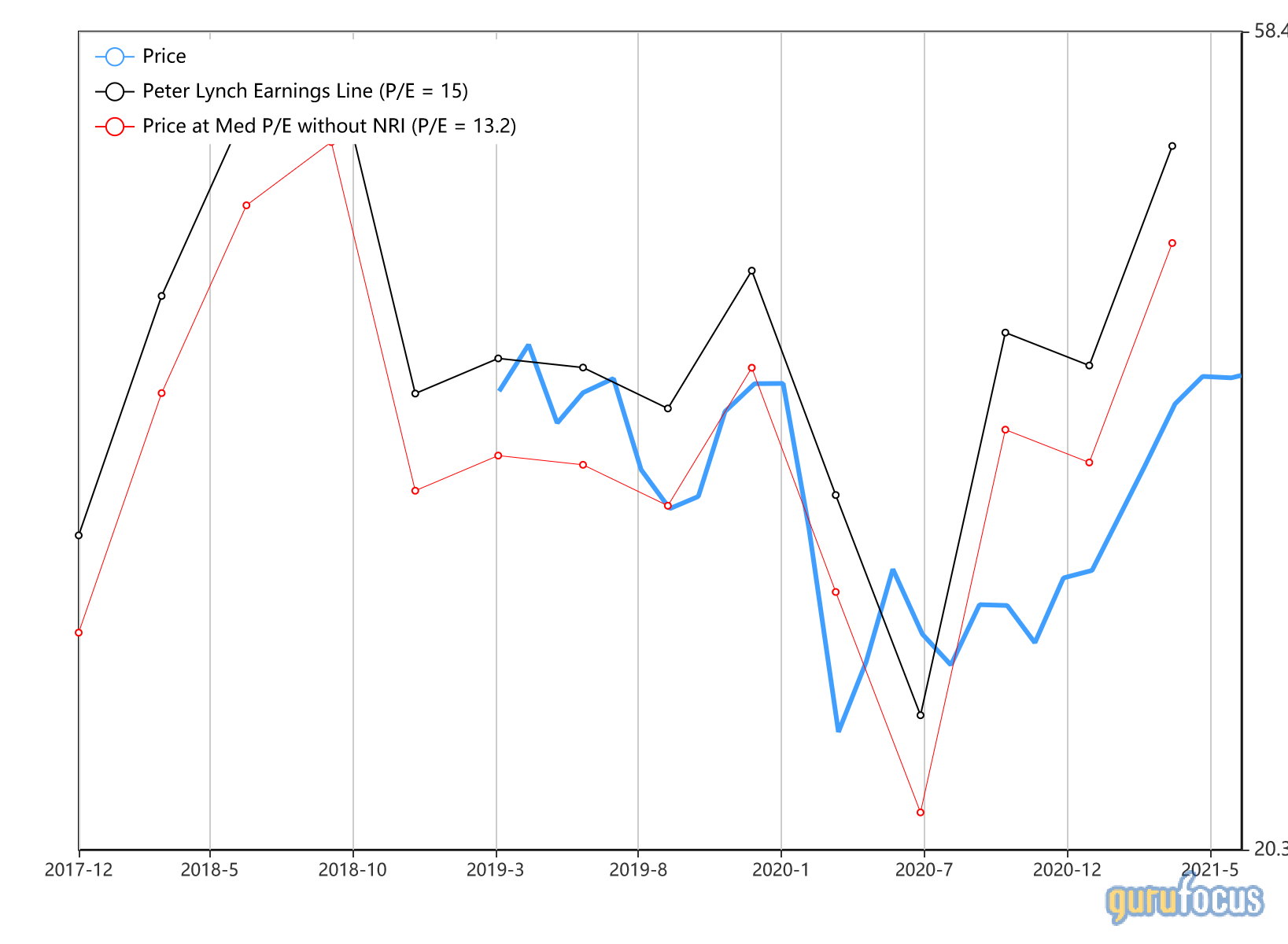

Fox Corp

The first stock investors may want to consider is Fox Corp (FOXA, Financial), a New York-based news, sports and entertainment company.

The chart below illustrates that the share price ($37.47 at close on June 10) is currently trading below the Peter Lynch earnings line ($50.04).

The stock has risen 32.45% over the past year through Thursday for a market capitalization of $21.33 billion and a 52-week range of $23.93 to $44.80.

The stock has a median recommendation rating of overweight on Wall Street and an average target price of $41.39, which reflects a 10.5% upside from Thursday's closing price. Earnings per share are expected to increase by approximately 8% every year over the next five years.

GuruFocus has assigned a score of 5 out of 10 to the company's financial strength and 6 out of 10 to its profitability.

Dodge & Cox is the leader among top fund holders of the company, holding 7.53% of shares outstanding. The investment firm is followed by BlackRock Inc. with 6.83% and Vanguard Group Inc with 5.87%.

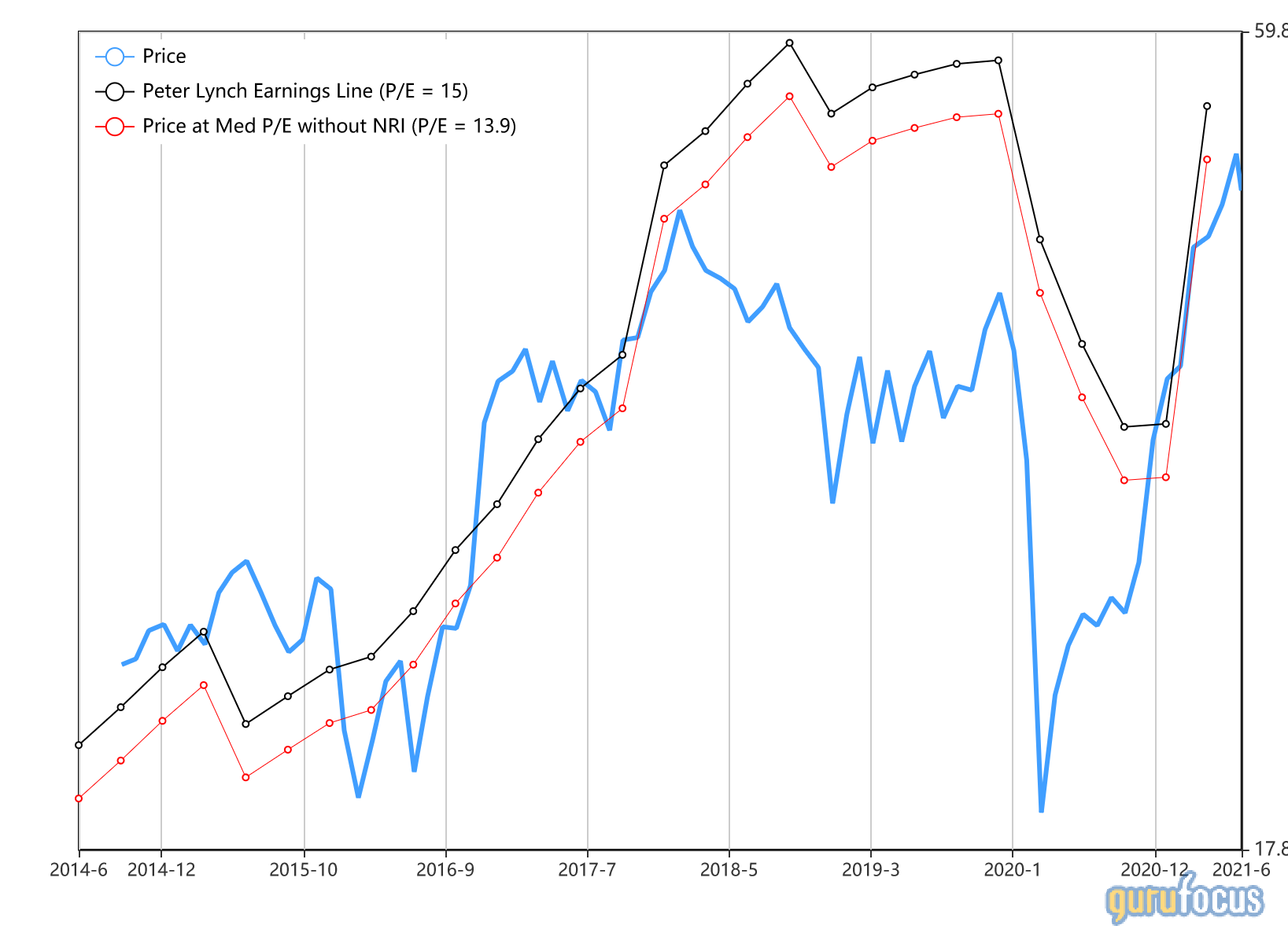

Citizens Financial Group Inc

The second stock to consider is Citizens Financial Group Inc (CFG, Financial), a Providence, Rhode Island-based provider of various banking products to U.S. consumers and businesses through a network of 2,700 ATMs, 1,000 branches and about 130 retail and commercial non-branch offices.

The chart below shows that the share price ($47.25 as of June 10) is currently trading below the Peter Lynch earnings line ($53.55).

The stock has increased by 83% over the past year through Thursday, determining a market capitalization of $20.13 billion and a 52-week range of $22.53 to $51.14.

Wall Street sell-side analysts have recommended a median rating of overweight for this stock with an average target price of $51.56, reflecting a 9.12% upside from Thursday's closing price. Also, analysts forecast that the trailing 12-month earnings per share will increase by nearly 110% this year.

GuruFocus has assigned a score of 3 out of 10 to the company's financial strength and 5 out of 10 to its profitability.

Vanguard Group Inc is the largest top fund holder of the company, as the asset management firm owns 11.43% of total shares outstanding. BlackRock Inc. and State Street Corp are following with 9.24% and 5.67%, respectively.

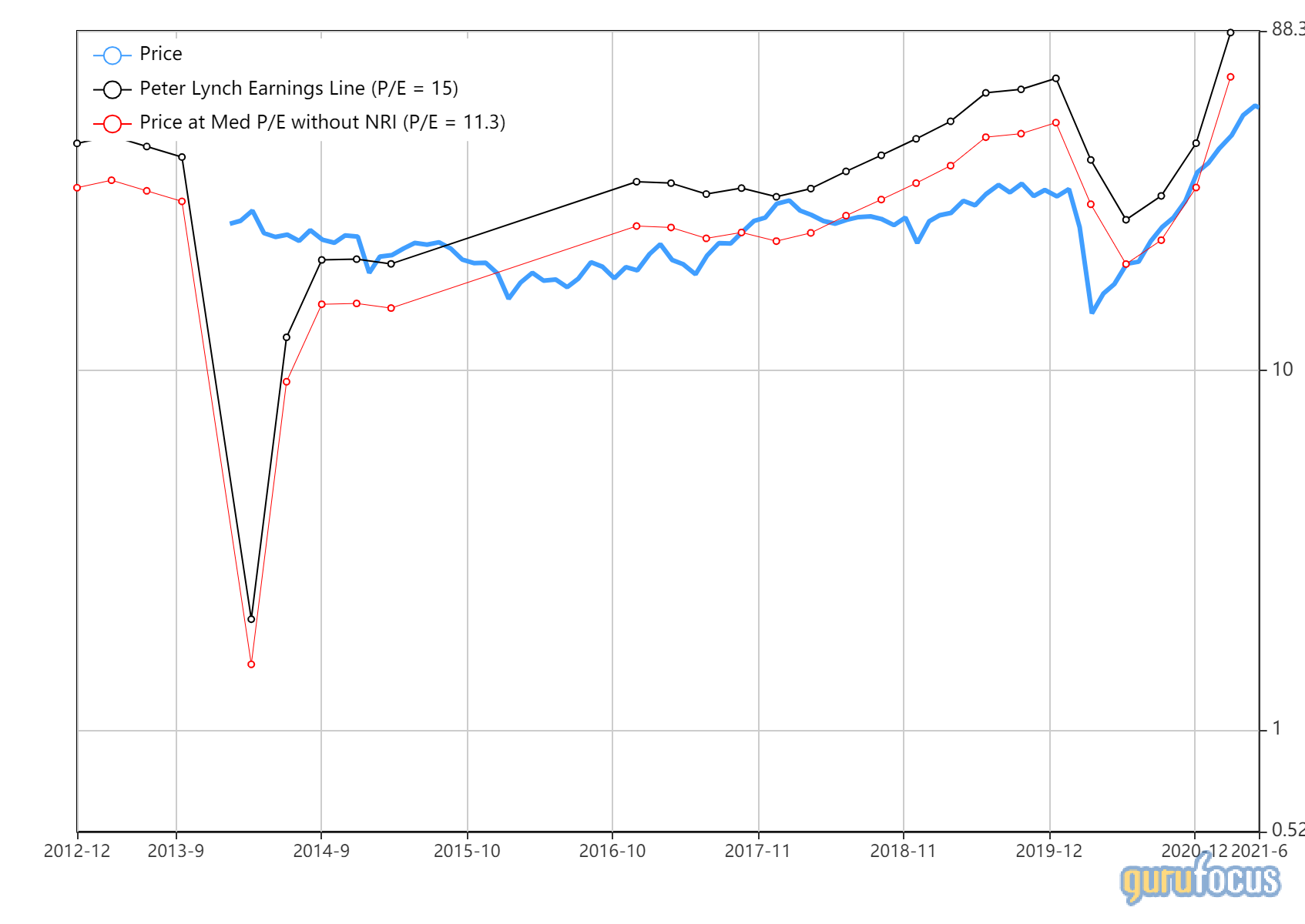

Ally Financial Inc

The third stock to consider is Ally Financial Inc (ALLY, Financial), a Detroit, Michigan-based credit services company focusing on various digital financial products and services for consumers, businesses and corporations in North America.

The chart below exhibits that currently, the share price ($53.97 at close on June 10) is still trading below the Peter Lynch earnings line ($87.38).

The stock has risen by 164.04% over the past year through Thursday for a market capitalization of $20.01 billion and a 52-week range of $18.20 to $56.61.

The stock has a median recommendation rating of buy with an average target price of $60.05 per share, which reflects an 11.3% upside from Thursday’s closing price. The trailing 12-month earnings per share is predicted to rise 7.33% on average every year over the next five years.

GuruFocus has assigned a score of 2 out of 10 to the financial strength and of 5 out of 10 to the profitability of the company.

Vanguard Group is the largest top fund holder with 10.06% of shares outstanding. It is followed by BlackRock with 8.20% and Harris Associates L P with 6.81%.

Disclosure: I have no positions in any securities mentioned.