When screening the market for bargain opportunities. value investors may want to consider the following securities, as their share prices are trading near or below the intrinsic value estimated by the GuruFocus Value Line. The GF Value is a unique intrinsic value calculation from GuruFocus that utilizes the three components listed below:

- The stock's historical multiples, such as the price-earnings ratio, the price-sales ratio, the price-book ratio and the price-to-free cash flow ratio.

- A GuruFocus adjustment factor based on the past returns and growth of the company's business.

- Estimations of future business performance.

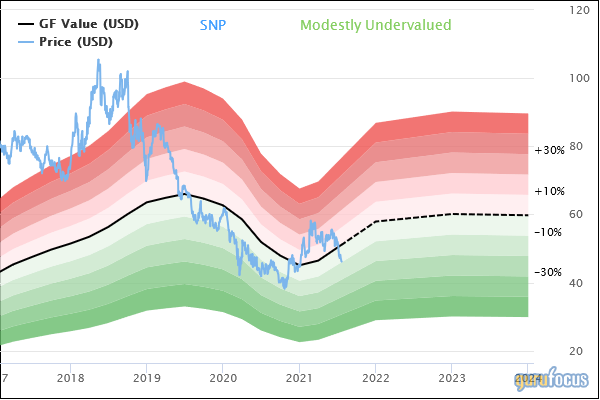

China Petroleum & Chemical Corp

The first stock that holds the criteria is China Petroleum & Chemical Corp (SNP, Financial), a Chinese producer of crude oil and natural gas.

China Petroleum & Chemical Corp's share price was $46.17 at close on Tuesday, while its GF Value stands at $52.15, resulting in a price-to-GF Value ratio of 0.89 and a rating of modestly undervalued.

The stock price is currently up 2.5% year-over-year, determining a market capitalization of $55.90 billion and a 52-week range of $38.18 to $58.40.

The price-earnings ratio is 5.17 (versus the industry median of 14.16) and the price-book ratio is 0.47 (versus the industry median of 1.19). Also, the price-sales ratio is 0.17 (versus the industry median of 1.3) and the price-to-free-cash-flow ratio is 3.85 (versus the industry median of 9.06).

The stock has a GuruFocus profitability rating of 6 out of 10.

Concerning the future business performance, sell-side analysts on Wall Street estimate that earnings per share will increase by approximately 116.4% year-over-year in 2021. As of July, the stock has two strong buy recommendation ratings with an average target price of $68.13 per share.

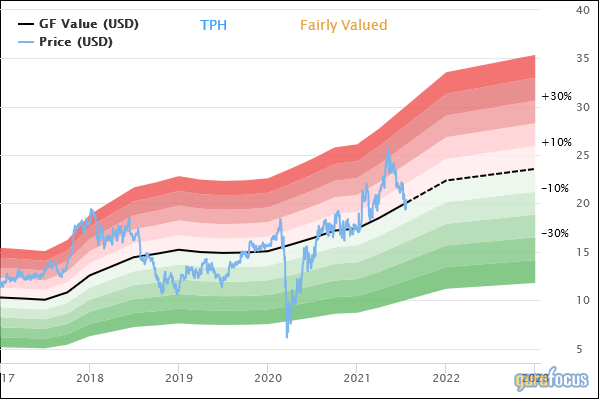

Tri Pointe Homes Inc

The second stock that meets the requirements is Tri Pointe Homes Inc (TPH, Financial), an Incline Village, Nevada-based single-family attached and detached homes builder in the United States.

Tri Pointe Homes Inc’s shares closed at $25.95 per unit on Tuesday while its GF Value is $26.72, resulting in a price-to-GF Value ratio of 0.97 and a rating of fairly valued.

Currently, the stock price is up 18.72% year-over-year for a market capitalization of $2.41 billion and a 52-week range of $15.66 to $26.35.

The price-earnings ratio is 7.99 (versus the industry median of 13.64) and the price-book ratio is 1.07 (versus the industry median of 1.4). The price-sales ratio is 0.74 (versus the industry median of 1.07) and the price-to-free-cash-flow ratio is 3.79 (versus the industry median of 8.70).

The GuruFocus profitability rating is 7 out of 10.

Regarding future business performance, sell-side analysts on Wall Street forecast that the earnings per share increase by 52.1% this year and by 9.7% next year.

As of July, sell-side analysts on Wall Street have issued three strong buy recommendation ratings, five buy recommendation ratings and five hold recommendation ratings for the stock with an average target price of $27.57 per share.

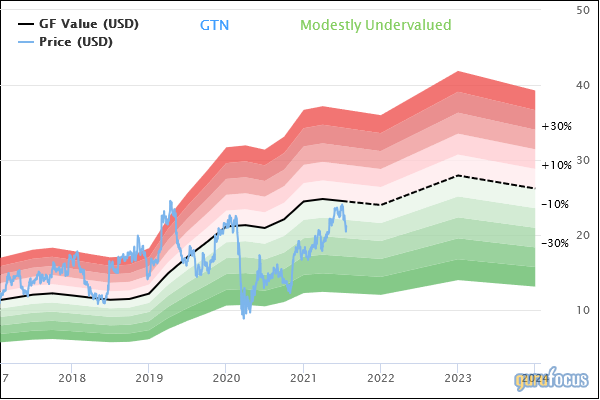

Gray Television Inc

The third stock that holds the criteria is Gray Television Inc. (GTN, Financial), an Atlanta-based television broadcasting company.

Gray Television Inc was trading at $21.15 per share at close on Tuesday while its GF Value was $26.64, resulting in a price-to-GF Value ratio of 0.79 and a rating of modestly undervalued.

The stock has risen by nearly 49% over the past year, determining a market capitalization of $2.01 billion and a 52-week range of $11.95 to $24.43.

The price-earnings ratio is 5.09 (compared to the industry median of 21.5) and the price-book ratio is 0.99 (versus the industry median of 1.9). The price-sales ratio is 0.74 (compared to the industry median of 1.83) and the price-to-free-cash-flow ratio is 3.56 (versus the industry median of 15.14).

GuruFocus has assigned the stock a profitability rating of 9 out of 10.

Concerning the future business performance, sell-side analysts on Wall Street predict that the earnings per share will increase 101.7% next year and by 36.9% on average every year over the next five years.

As of July, the stock has five strong buy recommendation ratings and two buy recommendation ratings, with an average target price of $28.71 per share.

Disclosure: I have no positions in any securities mentioned.