FactSet Research Systems Inc. (FDS, Financial) is an established platform and analytics solutions provider catering to institutional investors, banks and various types of financial consultancies. The company has adapted to changing customer needs for the past two decades and provides a healthy mix of offerings for its core base of buy-side clients that account for nearly 84% of its revenue.

The stock has endured multiple financial crises without much fluctuation, making it a highly resilient investment. However, the company is trading at an exceptionally high valuation today and is also facing more and more competition. Is the stock a worthwhile investment? Let us find out.

Recent financial performance

In June, FactSet reported third-quarter results. It managed to outperform Wall Street's expectations on the revenue front, but delivered an earnings miss. The company’s top line of $399.56 million for the three months ended May 31 grew 6.81% from $374.08 million in the prior-year quarter. It beat the analyst consensus estimate of $397.73 million. Revenue translated into a gross margin of 48.63% and an operating margin of 29.46%, which were lower than in the same quarter of last year.

The company reported net income of $100.68 million. The adjusted earnings per share of $2.72 fell below the analyst consensus estimate of $2.75. In terms of cash flow, FactSet reported $140.31 million in operating cash flow and spent $18.66 million on investing activities. The company produced lower cash flows as compared to the same period last year.

Defensive business model

FactSet has witnessed strong organic growth in revenue over the past several years. It is one of the few companies that showed positive growth in the financial crisis of 2008 despite being directly linked to the financial markets. Its relative robustness in the Covid-19 crisis is further proof that the business model is relatively immune to market fluctuations. This makes the stock a defensive investment.

The company also sells its analysis tools and advanced services to customers outside the financial industry in order to diversify its client base and expand the areas of application of its platform. For example, it has a customer base of corporate research houses that use its tools and data to analyze various companies.

Within FactSet’s Analytics and Trading business, it provides several products for portfolio analysis as well as risk management for institutional investors. The company offers its own FactSet Workstation as a stand-alone module so that customers can assemble it fit their needs. The integration of its tools into third-party products is also a powerful offering. The company's tools in combination with Microsoft (MSFT, Financial) Office allows asset managers and analysts to quickly incorporate data and reports into Excel calculations and transform them into PowerPoint presentations.

BTU Analytics acquisition

FactSet’s management recently announced it completed the acquisition of BTU Analytics, a Lakewood, Colorado-based provider of data and analytics in the North American renewables, oil, power and natural gas sectors. Founded in 2014, BTU specializes in gathering raw information in these markets and converting it into cross-commodity analytics, thereby helping investors in the energy as well as the renewable energy sector.

This acquisition brings wide-ranging sector data into FactSet’s content portfolio. Management believes this should help the company expand its industry-specific or deep-sector content for shareholders. Furthermore, the collaboration between FactSet’s vast global network and solid clientele and BTU Analytics’ data and analytic capabilities may help investment professionals choose wisely in the energy marketplace.

The combination is expected to strengthen the company’s position in the energy space as BTU Analytics has a significant foothold across all fuel types, including the increasingly relevant power and renewables markets. Moreover, management expects the integration of this data will offer clients the content they need to make good investment and environmental, social and corporate governance decisions throughout the energy landscape.

Final thoughts

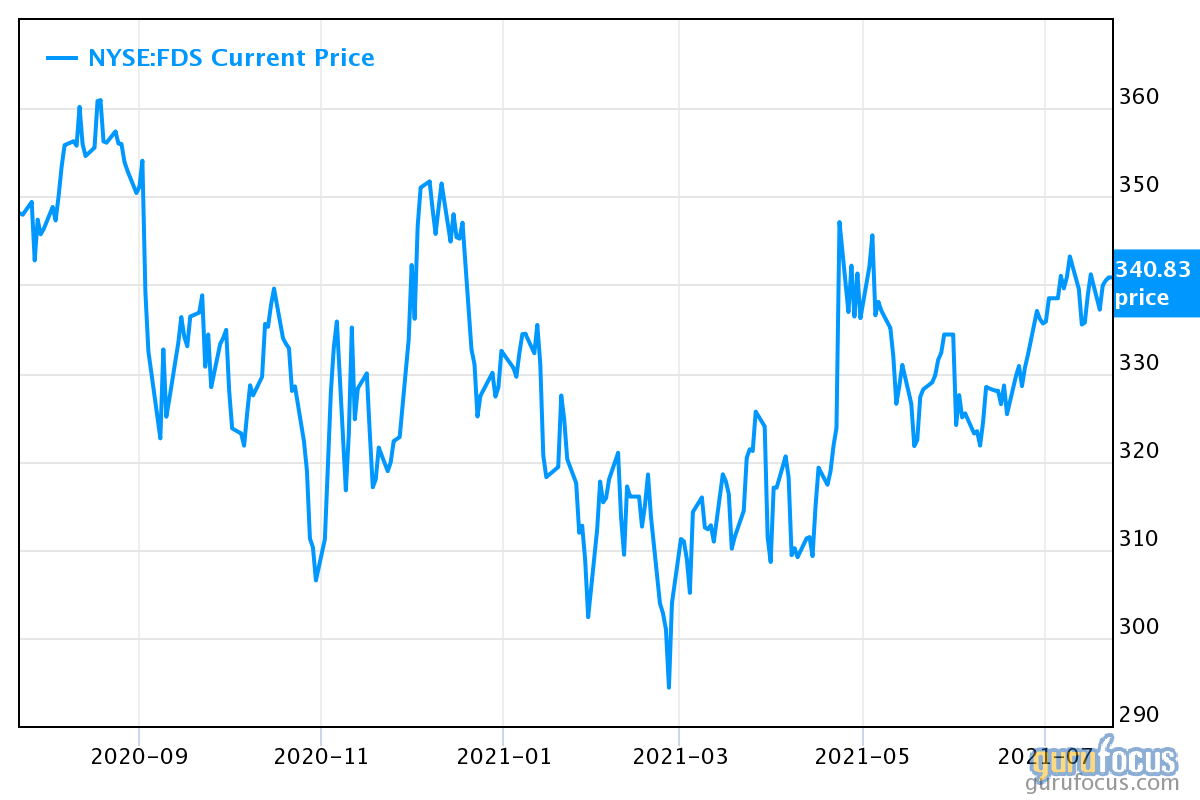

It is evident from the price chart that FactSet has stayed more or less flat over the past year. The reason for the lack of appreciation is the phenomenal valuation. The stock is trading at an enterprise value-to-revenue ratio of 8.37 and a price-book ratio of 12.51, which are both above the median for the capital markets industry.

FactSet operates in a highly competitive environment, with players like Bloomberg, Refinitiv (Thomson Eikon), S&P (SPGI, Financial) (Capital IQ) and Visible Alpha rapidly acquiring customers and growing their market share. Many smaller research distribution platforms have emerged after the approval of MiFID II regulations in Europe, posing a threat to the company with offerings that are significantly cheaper. Overall, I believe that while the company has a resilient business model, it is best avoided at current levels.