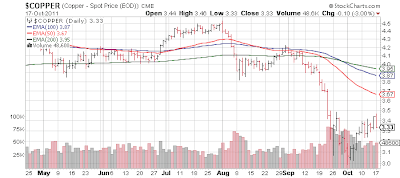

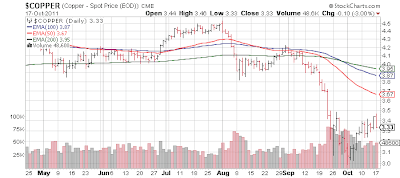

As always take all government data with many grains of salt - especially the Chinese kind. [Aug 5, 2009: China's Provincial Growth Figures Far Overstated versus National Figures] [Dec 7, 2010: WikiLeaks - China's GDP Figures are "Man Made" - or at Least One Province's] but according to 'official' data China GDP fell to 9.1% this past quarter. I'd say copper is telling us is has fallen more than that, but again this is the official line.

Some other metrics:

Meanwhile, the U.K. which has (in my opinion) a far better accurate gauge of inflation (excludes 'rent equivalent' housing) - just saw their inflation figure surge to 5.2, from 4.5%. Keep in mind the central bank just started a new round of QE measure to boot. Stagflation baby. These guys better start doing some of the adjustments we do over here (which if we had not 'adjusted' the way we measure things the past few decades would be reading 8%) so their official statistics don't look so rude. [May 10, 2008: Finally Some Mainstream Reports are Figuring Out the Spin from Government] [May 22, 2008: Bill Gross - Inflation Underplayed by Government] [Dec 16, 2010: Consumer Inflation as Measured in the 1980s Would Be 8%+, as Measured in 1990, 4%]

- China's economic expansion slowed in the third quarter to its weakest pace in more than two years as euro-debt strains and a sluggish U.S. economy took a toll, but healthy domestic drivers suggest little room to relax monetary policy near term.

- GDP grew 9.1 percent from a year earlier, the third consecutive quarterly slowdown in growth after 9.5 percent in the second quarter and 9.7 percent in the first.

- The domestic strength and inflation of more than 6 percent argue for the central bank to keep a tight rein on monetary policy even though overall growth is slowing.

- "GDP growth was surprising for the market on the downside," said Stephen Green, economist at Standard Chartered in Hong Kong. "There is clearer deceleration in the third quarter. No change in policy. Small signs of ad-hoc loosening but no macro change in policy."

- The data was slightly below forecasts of 9.2 percent and the weakest since 8.1 percent in the second quarter of 2009.

- As an indicator of global demand, exports from China actually detracted from the economy's growth in the first three quarters of this year. That was underlined by September data showing exports growth to the euro zone, its biggest market, more than halved from August.

Some other metrics:

- Countering the impact of the global slowdown, fixed-asset investment in the first three quarters of the year chalked up annual growth of 24.9 percent, slightly ahead of forecasts of 24.8 percent.

- Retail sales rose 17.7 percent in September from a year earlier, topping forecasts for a rise of 17.0 percent. Indeed, industrial output in September rose 13.8 percent, above forecasts for an increase of 13.3 percent, suggesting the third quarter ended on a slightly upbeat note.

- However, China's real estate investment, which accounts for a fifth of the country's fixed-asset investment, cooled sharply to 25.0 percent in September from a year earlier, as compared with a rise of 31.6 percent in August, Reuters calculations show, based on the official data.

- Reuters calculations suggest implied oil demand in China rose just 1 percent in September from a year earlier, its slowest rate of growth so far this year.

Meanwhile, the U.K. which has (in my opinion) a far better accurate gauge of inflation (excludes 'rent equivalent' housing) - just saw their inflation figure surge to 5.2, from 4.5%. Keep in mind the central bank just started a new round of QE measure to boot. Stagflation baby. These guys better start doing some of the adjustments we do over here (which if we had not 'adjusted' the way we measure things the past few decades would be reading 8%) so their official statistics don't look so rude. [May 10, 2008: Finally Some Mainstream Reports are Figuring Out the Spin from Government] [May 22, 2008: Bill Gross - Inflation Underplayed by Government] [Dec 16, 2010: Consumer Inflation as Measured in the 1980s Would Be 8%+, as Measured in 1990, 4%]

- The rate of Consumer Prices Index (CPI) inflation in the UK matched its record high in September, rising to 5.2% from 4.5% the month before.An increase in energy costs was behind a large proportion of the rise.

- The 5.2% rate is the highest CPI measure since September 2008, and it has never been higher since the CPI measure was introduced in 1997.

- The Retail Prices Index (RPI) - which includes mortgage interest payments - rose to 5.6% from 5.2%. The latest RPI measure is the highest annual rate since June 1991.

- The Office for National Statistics, which released the data, said in a statement: "By far the largest upward pressure to the change in CPI... came from increases in gas and electricity charges. "There were also large upward pressures from air transport and communication services."

- Bills for gas and electricity have risen 9.9% in the past month, and are up 18.3% on the year. Transport has risen 12.8% on the year, and food was 6% higher than 12 months ago.

- September's CPI measure is way ahead of the Bank of England's target rate of 2%. However, Bank governor Mervyn King still expects inflation to begin falling next year, once factors such as January's VAT rise drop out of the equation.

- Jonathan Loynes, chief European economist at Capital Economics, called the CPI figure a "nasty surprise".But he also agreed that inflation was "either at or close to a peak" and should soon start to fall back.