Nicholas Financial (NICK, Financial) ($9.74 on Oct. 17, 2011) is in the business of making subprime auto loans. Owner-operator Peter Vosotas has run the company for over two decades by conservative underwriting and reserving.

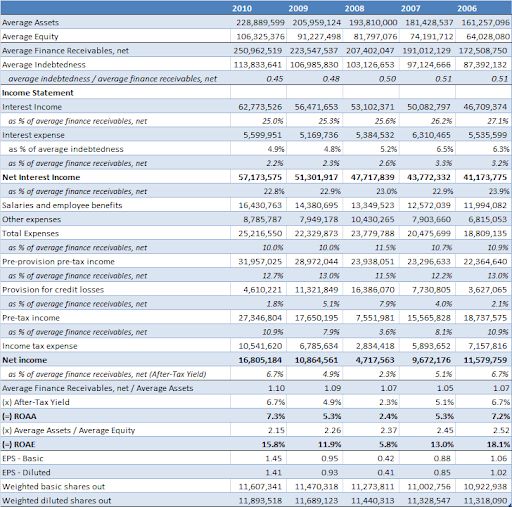

Since 2001, the company has not only grown its loan book organically at a CAGR of 12.6%, but also stayed very profitable through the entire period; for the entire period, ROAE stayed above 10% with the exception of 2008 when ROAE dropped to 6%. It has achieved these admirable results without taking on excessive leverage. NICK has gradually deleveraged itself from a debt/equity of 3 times in 2001 to 0.95 times in June 2011.

It is trading at reported book value, which you will see is grossly understated relative to liquidation value in a run-off scenario, and at 6.3 times trailing P/E. Furthermore, unlike the other financials, you can read its 10-K from front to back without getting confused or feeling queasy. For a highly profitable business that continues to have attractive growth prospects for at least another five years, its current valuation is very cheap. The current valuation ($9.74) provides a very attractive upside of 70% to 150% ($16.5 - $24.5), and a strong downside protection backed by a very conservatively reported book value.

Business Model:

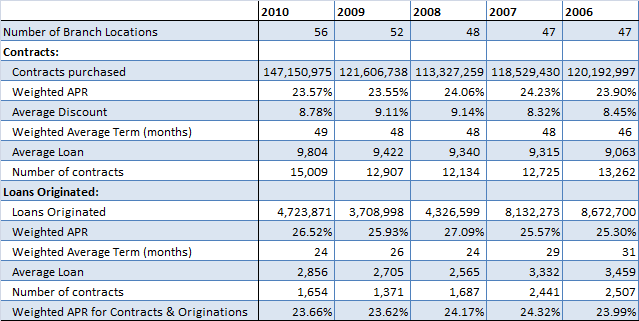

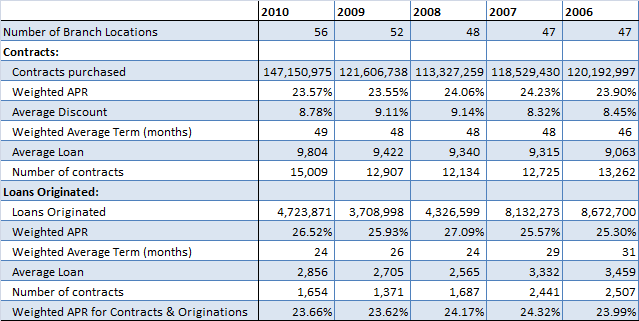

NICK operates its business through a branch network of 56 branches in 15 states. The branches purchase loan contracts from auto dealers in their local markets, and to a very small degree make direct loans.

This business is very competitive, because auto dealers do not care who buys the loans they originate, and they just want the best price for the least stringent lending criteria. NICK’s branch model is the key to their underwriting success; it helps the branch underwriters monitor local employment conditions, the resulting lending standards by the auto dealers and the competition for the loans they make.

The company’s typical customer has a credit history that fails to meet the lending standards of most banks and credit unions. Among the credit problems experienced by the company’s customers that resulted in a poor credit history are: unpaid revolving credit card obligations, unpaid medical bills, unpaid student loans, prior bankruptcy, and evictions for nonpayment of rent. Sounds scary! But what makes this “risky” lending process work is NICK’s high-touch process of interviewing candidates on the phone by asking them specific questions that they have learned over time determine the likelihood of non-payment given the customer’s specific situation. In addition, they collect and verify contact information for employers, friends and relatives to help with any necessary collection efforts if the account slips out of status.

Once contracts are purchased from the dealers (or directly originated), NICK retains them until maturity. The company monitors and evaluates the underwriting performance of a branch by segregating loans into static pools where each pool consists of loans underwritten by the branch in the quarter. This fosters a sense of accountability and ownership within each branch, eventually lending to the track record that is evident from its 10-year financials. As of June 2011, the company has 1,176 active static pools. The average pool upon inception consists of 63 contracts with aggregate average finance receivable, net of unearned interest, of approximately $610,000.

In addition to its careful screening process, the company builds another margin of safety in its lending process by negotiating a discount to the original purchase price being financed by the purchaser of the automobile. The discount varies from contract to contract from 1% to 15% based on credit risk of the customer, but historically since 2001, it has been in the 8% to 9% for the aggregate of contracts purchased in a fiscal year.

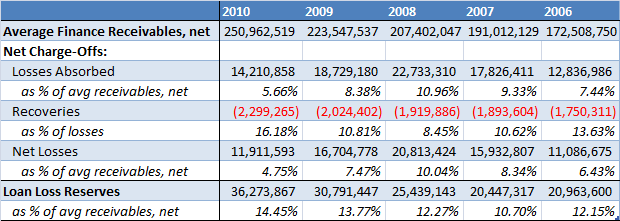

Furthermore, it builds yet another layer of margin of safety, by setting aside future loan loss provision reserves. Historically, since 2001, loan loss reserves have ranged in the 2% to 8% range (as percentage of average finance receivables, net of unearned interest, outstanding in that year).

These three factors have been more than enough to offset net losses charged since 2001. This is what has caused NICK to continue to stay profitable in one of the worst decades for the financial sector since the great depression.

Here are a few quotes about their lending philosophy from their annual reports: “We own everything we underwrite. This is OUR money we are lending.” When competition gets out of whack and pricing becomes irrational, NICK pulls back: “When yields on loans look temporarily high, we always try to remember that the return of your money is more important than the return on your money.”

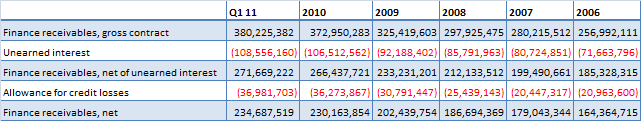

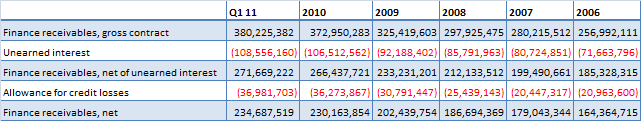

Balance Sheet: Loans are carried on balance sheet as finance receivables, net of interest that is expected to be earned over the remaining life and net of allowance for future credit losses.

Allowance for credit losses are accounted for as explained in the business model section — to the beginning of the year allowance, add discounts acquired on new contracts purchased, add loan loss set aside on the income statement for future losses, subtract losses incurred, add recoveries from selling collateral acquired, and subtracts any discounts accreted at the end of loan life.

I would draw your attention to the deferred tax asset on the balance sheet that has grown from about $4 million in 2006 to $9 million in 2010. IRS does not recognize credit loss provisions until losses actually occur. Thus, NICK’s taxable income is higher than its U.S. GAAP income, leading to higher cash earnings relative to EPS and higher cash taxes relative to accounting tax provision. This leads to a growing deferred tax asset, which theoretically will be reversed in the future when actual credit losses occur. However, as you can see, the credit losses have consistently been lower than provisions, leading to an ever-growing tax-deferred asset base. In fact, you will see this trend, even if you go back to 10-year data (not shown). This shows in yet another way that NICK's reserving is very conservative.

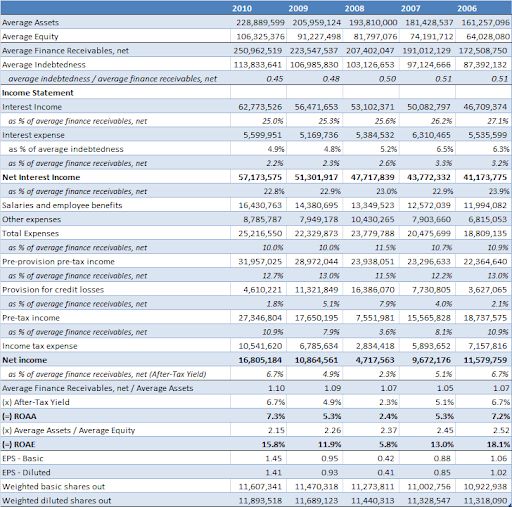

Income statement: Revenue is largely comprised of interest income, expenses consists of interest expense on debt, salaries and benefits, provision for future credit losses (that were transferred to balance sheet in calculating net loss allowance), and other minor expenses.

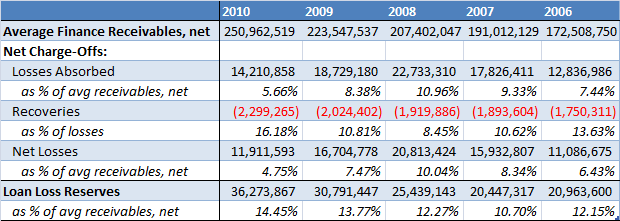

Credit Quality: The table below shows that net losses charged off has consistently been below loan loss reserves on balance sheet

Valuation:

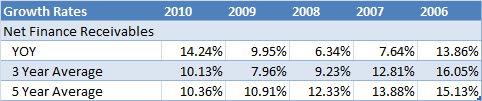

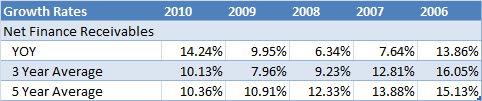

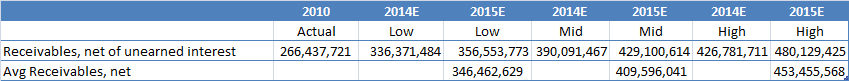

Let’s first look at past growth rate for average finance receivables, net of unearned interest (but before loss allowance).

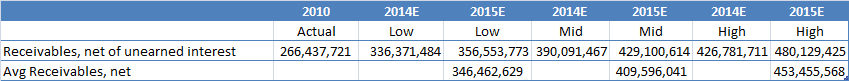

Based on growth rates for last five years, a full cycle, we can use 10% CAGR growth rate for net receivable growth from here out to 2015 as the mid case. For low case, we will use CAGR 6% and for high case, we will use CAGR of 12.5%. Relative to its market size, NICK is still quite small, and it can grow its branch network to achieve these rates for the next five years, without compromising on loan quality.

Besides, when the economy is weak, the one thing that Americans still need is a car to get to a job. One can downsize to living with parents or roommates, but since public transportation is very weak in most U.S. cities, getting to a job (90% of employed Americans) requires one to have a car.

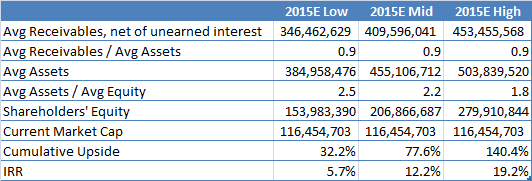

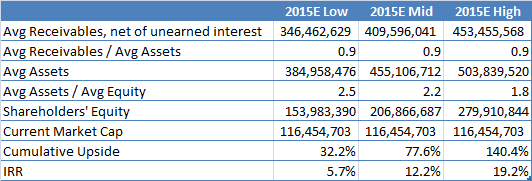

Next, we estimate 2015E shareholders’ equity:

As a sanity check, we estimate 2015E EPS using estimated average net receivables from above and income statement ratios as percentage of net receivables based on historical data

Either way, we get a downside that is well protected and an upside of 70% - 150%.

Lastly, we can run another sanity check to validate our valuation by checking against liquidation value of the business in an orderly liquidation.

Allowance for credit losses stand at 15.8%, but losses in the last 10 years peaked at 10.5% in 2008. Let’s assume that charge-offs experienced during the liquidation process stay at 10% (which is quite dramatic relative to experience of the last 10 years). So, the remaining 5.8% reserves are released and accrue to the shareholders.

Next, as the receivables are run-off, the unearned interest is earned. Gross unearned interest stands at $108 million, but this will be earned in a period of four years (average life of loans is about 48 months), so we discount at 6% to get present value. Then we add back the principal paid off. We add back current cash, and take off all liabilities to come up with liquidation value before the expenses incurred to liquidate the portfolio (which ought to be quite small). The upside is in the mid range estimated using the other two approaches.

Management:

There is no better way to evaluate a financial's management team other than to look at its historical results over the last 5 to 10 years, given that the past 5 to 10 years have been a good stress scenario for all financials. And NICK passes with flying colors here. It is also evident that we have an owner-manager orientation at the company through share ownership. Mr. Vosotas, the CEO, owns 15% of outstanding shares, and all directors and officers as a group own 18% of the shares.

The management team has de-risked NICK by lowering leverage to a mere factor of two times and recently started a quarterly dividend of 10 cents. At these levels, the current yield is a whopping 4% and it is more than well covered.

I'll take NICK over any other mega financials trading at huge discounts to tangible book, not because they don't represent value, but because of my lack of skills to read and comprehend a 400-page 10-K.

Risks:

Although the combination of discounts of 8% on contracts acquired and a loan loss provision of 2% have been enough to offset net charge offs historically (which peaked at 10.5% in 2008), they may not be enough in case of persistently long unemployment and low-to-no growth of receivables environment. I view this as a highly unlikely event, but it’s a financial — never say never!

NICK is lending at maximum state allowable interest rates and borrowing at interest rates that have continued to stay low, causing net interest margin to expand. It's one of the few financials that is not facing net interest margin compression. Long-term interest rates going up is a risk, but NICK hedges its interest rate exposure. With Mr. Bernanke promising to keep rates low to 2013, NICK has enough time to put on the hedges (if it doesn't already).

It borrows in the short term using a line of credit extended by a group of banks (Wells Fargo, Capital One, First Horizon, Montreal) which doesn't expire until November 2013. Liquidity risk is limited, because it can raise cash simply by running off its portfolio.

Catalyst:

Mr. Vosotas is 69 years old and is looking to exit the business at some point soon. Shareholder value will be realized if NICK is sold at reasonable multiple of book (1.2-1.5x), or if no acquirer is interested given its “unique” high-touch model, the business is liquidated in an orderly fashion.

Disclosure: Long NICK

I appreciate your questions and comments.

Since 2001, the company has not only grown its loan book organically at a CAGR of 12.6%, but also stayed very profitable through the entire period; for the entire period, ROAE stayed above 10% with the exception of 2008 when ROAE dropped to 6%. It has achieved these admirable results without taking on excessive leverage. NICK has gradually deleveraged itself from a debt/equity of 3 times in 2001 to 0.95 times in June 2011.

It is trading at reported book value, which you will see is grossly understated relative to liquidation value in a run-off scenario, and at 6.3 times trailing P/E. Furthermore, unlike the other financials, you can read its 10-K from front to back without getting confused or feeling queasy. For a highly profitable business that continues to have attractive growth prospects for at least another five years, its current valuation is very cheap. The current valuation ($9.74) provides a very attractive upside of 70% to 150% ($16.5 - $24.5), and a strong downside protection backed by a very conservatively reported book value.

Business Model:

NICK operates its business through a branch network of 56 branches in 15 states. The branches purchase loan contracts from auto dealers in their local markets, and to a very small degree make direct loans.

This business is very competitive, because auto dealers do not care who buys the loans they originate, and they just want the best price for the least stringent lending criteria. NICK’s branch model is the key to their underwriting success; it helps the branch underwriters monitor local employment conditions, the resulting lending standards by the auto dealers and the competition for the loans they make.

The company’s typical customer has a credit history that fails to meet the lending standards of most banks and credit unions. Among the credit problems experienced by the company’s customers that resulted in a poor credit history are: unpaid revolving credit card obligations, unpaid medical bills, unpaid student loans, prior bankruptcy, and evictions for nonpayment of rent. Sounds scary! But what makes this “risky” lending process work is NICK’s high-touch process of interviewing candidates on the phone by asking them specific questions that they have learned over time determine the likelihood of non-payment given the customer’s specific situation. In addition, they collect and verify contact information for employers, friends and relatives to help with any necessary collection efforts if the account slips out of status.

Once contracts are purchased from the dealers (or directly originated), NICK retains them until maturity. The company monitors and evaluates the underwriting performance of a branch by segregating loans into static pools where each pool consists of loans underwritten by the branch in the quarter. This fosters a sense of accountability and ownership within each branch, eventually lending to the track record that is evident from its 10-year financials. As of June 2011, the company has 1,176 active static pools. The average pool upon inception consists of 63 contracts with aggregate average finance receivable, net of unearned interest, of approximately $610,000.

In addition to its careful screening process, the company builds another margin of safety in its lending process by negotiating a discount to the original purchase price being financed by the purchaser of the automobile. The discount varies from contract to contract from 1% to 15% based on credit risk of the customer, but historically since 2001, it has been in the 8% to 9% for the aggregate of contracts purchased in a fiscal year.

Furthermore, it builds yet another layer of margin of safety, by setting aside future loan loss provision reserves. Historically, since 2001, loan loss reserves have ranged in the 2% to 8% range (as percentage of average finance receivables, net of unearned interest, outstanding in that year).

These three factors have been more than enough to offset net losses charged since 2001. This is what has caused NICK to continue to stay profitable in one of the worst decades for the financial sector since the great depression.

Here are a few quotes about their lending philosophy from their annual reports: “We own everything we underwrite. This is OUR money we are lending.” When competition gets out of whack and pricing becomes irrational, NICK pulls back: “When yields on loans look temporarily high, we always try to remember that the return of your money is more important than the return on your money.”

Balance Sheet: Loans are carried on balance sheet as finance receivables, net of interest that is expected to be earned over the remaining life and net of allowance for future credit losses.

Allowance for credit losses are accounted for as explained in the business model section — to the beginning of the year allowance, add discounts acquired on new contracts purchased, add loan loss set aside on the income statement for future losses, subtract losses incurred, add recoveries from selling collateral acquired, and subtracts any discounts accreted at the end of loan life.

I would draw your attention to the deferred tax asset on the balance sheet that has grown from about $4 million in 2006 to $9 million in 2010. IRS does not recognize credit loss provisions until losses actually occur. Thus, NICK’s taxable income is higher than its U.S. GAAP income, leading to higher cash earnings relative to EPS and higher cash taxes relative to accounting tax provision. This leads to a growing deferred tax asset, which theoretically will be reversed in the future when actual credit losses occur. However, as you can see, the credit losses have consistently been lower than provisions, leading to an ever-growing tax-deferred asset base. In fact, you will see this trend, even if you go back to 10-year data (not shown). This shows in yet another way that NICK's reserving is very conservative.

Income statement: Revenue is largely comprised of interest income, expenses consists of interest expense on debt, salaries and benefits, provision for future credit losses (that were transferred to balance sheet in calculating net loss allowance), and other minor expenses.

Credit Quality: The table below shows that net losses charged off has consistently been below loan loss reserves on balance sheet

Valuation:

Let’s first look at past growth rate for average finance receivables, net of unearned interest (but before loss allowance).

Based on growth rates for last five years, a full cycle, we can use 10% CAGR growth rate for net receivable growth from here out to 2015 as the mid case. For low case, we will use CAGR 6% and for high case, we will use CAGR of 12.5%. Relative to its market size, NICK is still quite small, and it can grow its branch network to achieve these rates for the next five years, without compromising on loan quality.

Besides, when the economy is weak, the one thing that Americans still need is a car to get to a job. One can downsize to living with parents or roommates, but since public transportation is very weak in most U.S. cities, getting to a job (90% of employed Americans) requires one to have a car.

Next, we estimate 2015E shareholders’ equity:

As a sanity check, we estimate 2015E EPS using estimated average net receivables from above and income statement ratios as percentage of net receivables based on historical data

Either way, we get a downside that is well protected and an upside of 70% - 150%.

Lastly, we can run another sanity check to validate our valuation by checking against liquidation value of the business in an orderly liquidation.

Allowance for credit losses stand at 15.8%, but losses in the last 10 years peaked at 10.5% in 2008. Let’s assume that charge-offs experienced during the liquidation process stay at 10% (which is quite dramatic relative to experience of the last 10 years). So, the remaining 5.8% reserves are released and accrue to the shareholders.

Next, as the receivables are run-off, the unearned interest is earned. Gross unearned interest stands at $108 million, but this will be earned in a period of four years (average life of loans is about 48 months), so we discount at 6% to get present value. Then we add back the principal paid off. We add back current cash, and take off all liabilities to come up with liquidation value before the expenses incurred to liquidate the portfolio (which ought to be quite small). The upside is in the mid range estimated using the other two approaches.

Management:

There is no better way to evaluate a financial's management team other than to look at its historical results over the last 5 to 10 years, given that the past 5 to 10 years have been a good stress scenario for all financials. And NICK passes with flying colors here. It is also evident that we have an owner-manager orientation at the company through share ownership. Mr. Vosotas, the CEO, owns 15% of outstanding shares, and all directors and officers as a group own 18% of the shares.

The management team has de-risked NICK by lowering leverage to a mere factor of two times and recently started a quarterly dividend of 10 cents. At these levels, the current yield is a whopping 4% and it is more than well covered.

I'll take NICK over any other mega financials trading at huge discounts to tangible book, not because they don't represent value, but because of my lack of skills to read and comprehend a 400-page 10-K.

Risks:

Although the combination of discounts of 8% on contracts acquired and a loan loss provision of 2% have been enough to offset net charge offs historically (which peaked at 10.5% in 2008), they may not be enough in case of persistently long unemployment and low-to-no growth of receivables environment. I view this as a highly unlikely event, but it’s a financial — never say never!

NICK is lending at maximum state allowable interest rates and borrowing at interest rates that have continued to stay low, causing net interest margin to expand. It's one of the few financials that is not facing net interest margin compression. Long-term interest rates going up is a risk, but NICK hedges its interest rate exposure. With Mr. Bernanke promising to keep rates low to 2013, NICK has enough time to put on the hedges (if it doesn't already).

It borrows in the short term using a line of credit extended by a group of banks (Wells Fargo, Capital One, First Horizon, Montreal) which doesn't expire until November 2013. Liquidity risk is limited, because it can raise cash simply by running off its portfolio.

Catalyst:

Mr. Vosotas is 69 years old and is looking to exit the business at some point soon. Shareholder value will be realized if NICK is sold at reasonable multiple of book (1.2-1.5x), or if no acquirer is interested given its “unique” high-touch model, the business is liquidated in an orderly fashion.

Disclosure: Long NICK

I appreciate your questions and comments.