Wells Fargo (WFC, Financial), a large U.S. bank with headquarters in San Francisco, plans to double its quarterly dividend to 20 cents a share from 10 cents. Last year, it was one of the few large banks to cut its dividend during the pandemic, reducing the payment from 51 cents a share per quarter all the way down to 10 cents.

Wells Fargo's stock has bounced back since the beginning of the pandemic, returning about 55% year to date. This company also released a good earnings report last month for the second quarter of 2021, recording earnings per share of $1.38 vs. analyst consensus estimates of $0.91. This compares favorably with EPS of $1.05 in Q1 and a loss per share of $1.01 in Q2 2020. The company also reported that it bought back 35 million shares of its stock over the last quarter.

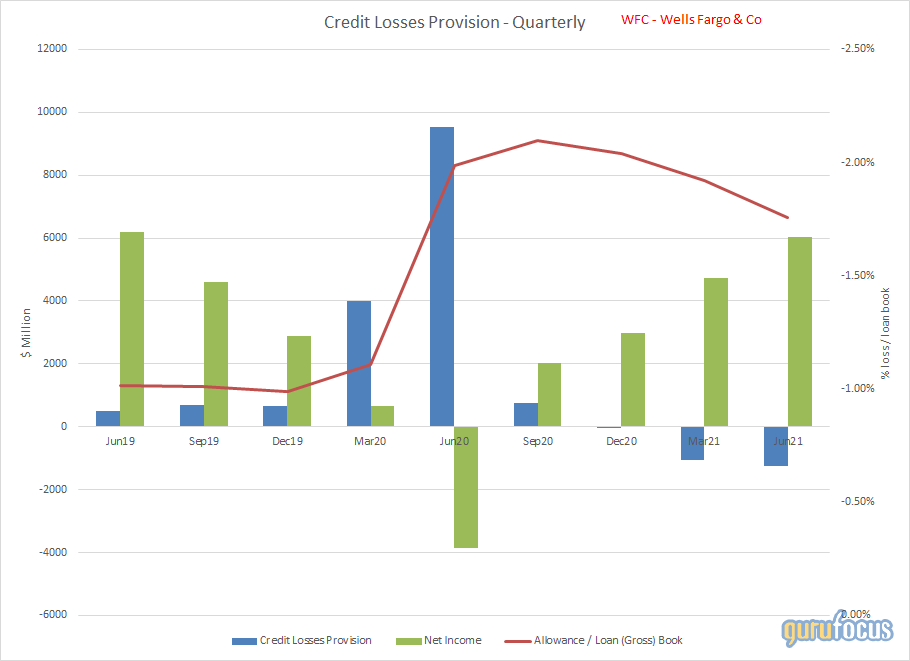

Like most other U.S. bank majors, Wells Fargo has been reversing credit loss provisions taken during the pandemic, and this is adding tremedously to earnings. These reversals are obviously temporary (and might even backfire given that more credit losses are expected once interest rates are raised again thanks to historically high levels of unsustainalbe corporate debt). The Q2 credit loss reversal was $1.26 billion following a reversal of $1.05 billion in Q1. In Q2 of 2020, the provisions for credit loss stood at $9.53 billion.

Results were robust across the following key metrics:

- The efficiency ratio was 66% vs. 77% in Q1.

- The net interest margin was 2.02% vs. 2.05% in Q1 and 2.25% in the year-ago quarter.

- The Q2 net loan charge-off rate was 0.18% (annualized) vs. 0.24% in Q1.

- The CET1 Ratio was 12.1%.

Stock price is nearly back to its 10-year trend line and is trading well above book value:

I believe the new management is making good progress in executing the turnaround plan, and Wells Fargo stock remains cheap, as it is still about 20% below its pre-pandemic stock price. However, the bank remains subject to the $1.95 trillion asset cap the Fed imposed on it following the fake accounts scandal back in 2016. The asset cap prevents Wells Fargo from growing its balance sheet.

As a brief recap, the fake accounts scandal was a result of a toxic sales culture in which Wells Fargo's management pressured employees to meet impossible goals, which resulted in employees opening millions of fake accounts using customer information in order to meet the goals. Costs remain high as compared to other banks as Wells Fargo struggles to comply with regulatory orders. Net interest income also remains under pressure because of sustained historical low interest rates.

Before the scandal was uncovered, Wells Fargo was the most valuable bank in the country. As can be seen below, its market cap growth has been on a steady downward trend to below its rivals, which have surged ahead.

If the asset cap is ever lifted, Wells Fargo's stock should poise a huge comeback, not only because of growth potential but also simply due to investor optimism. The basics of the company's former success are still there. However, this may take multiple years. My medium-term target for the stock is $60, which is in line with a price-book ratio of 1.4. This should translate into a mid to high single-digit annual total return over the next five years.