Since the market buckled under Covid-19 restrictions in March 2020, MKSI Instruments Inc. (MKSI, Financial) has handily outperformed the S&P 500 (SPY, Financial) (this chart uses the index as a proxy).

But since early April, its price has pulled back significantly. Is there something seriously wrong with MKS, or are we seeing Mr. Market taking another of his random walks? We will look for answers by searching the news, reviewing the company’s fundamentals and examining the price charts.

About MKS Instruments

According to its 10-K for 2020, the $8.16 billion company is a global provider of instruments, systems, subsystems and process control solutions.

These tools measure, monitor, deliver, analyze, power and control critical parameters of advanced manufacturing processes. The objective is to improve process performance and productivity for its customers.

It said that its products emerge out its core competencies in pressure measurement and control, flow measurement and control, gas and vapor delivery, gas composition analysis and more.

The markets it serves include semiconductors, industrial technologies, life and health sciences, research and defense.

Recent events

In February, MKS made an unsolicited offer for Coherent (COHR, Financial), a laser developer and manufacturer. The target was already the subject of a takeover bid by Lumentum Holdings Inc. (LITE, Financial). A third company, II-VI Inc. (IIVI, Financial), also made an offer, and a bidding war began.

MKS dropped out of that contest, but was still hungry. In its second-quarter 2021 earnings release, it reported it had subsequently agreed to buy Photon Control (POCEF) in a $309.5 million deal that closed on July 15.

On July 1, it announced a $5.1 billion cash-and-stock transaction agreement to acquire Atotech Ltd. (ATC, Financial). According to MKS President and CEO John T.C. Lee, the company is now “well-positioned to lead the way in addressing the challenges of miniaturization and complexity in semiconductor and advanced electronics manufacturing.”

Recent results

When the first-quarter earnings were announced on April 26, the company boasted of record results on the top and the bottom lines:

- Revenue grew by 30% on a year-over-year basis.

- Non-GAAP net earnings increased 68% to $143 million.

- GAAP net income jumped 99% to $122 million.

- Cash flow was up 69% year over year, while free cash flow jumped 55%.

More of the same appeared in the second-quarter results:

- Record revenue; it was up 38% year over year to $750 million.

- Record non-GAAP net earnings of $168 million, an increase of 88% year over year.

- GAAP net income increased 99% to $147 million.

- Record operating cash flow, which grew 19% to $165 million.

- Record free cash flow of $149 million, up 26% year over year.

Competition

In its 10-K, MKS reported it faces "substantial" competition in most of its product lines, but no single competitor contests with it across all product lines.

For example, named competitors included Advanced Energy Industries Inc. (AEIS, Financial), which sells products that compete with its power delivery and reactive gas generator products. Sigma Koki Co. Ltd. (TYO: 7713) competes with its optics and photonics products. Coherent competes with it for products that involve lasers and photonics instruments.

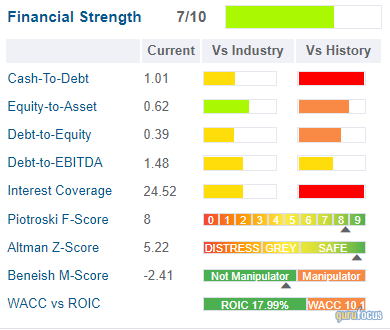

Financial strength

As judged by its balance sheet and debt ratios, MKS is a solid company. It is leveraged to a certain extent, but the cash-to-debt and interest coverage ratios indicate there is little likelihood the company will get into financial trouble. That’s backed up by the high Altman Z-Score.

We can also assume from the Piotroski F-Score that the company is well managed. Similarly, the strong return on invested capital versus the weighted average cost of capital ratio indicates management has invested that capital wisely.

Profitability

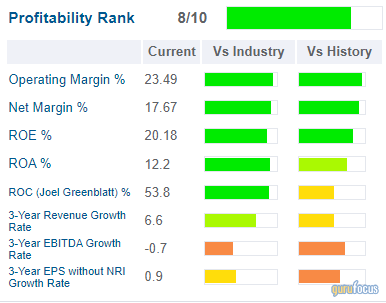

Beginning with the margins, we see its operating margin is better than 91.07% of the 2,328 companies in the hardware industry; the net margin is better than 94.42% of its peers and competitors.

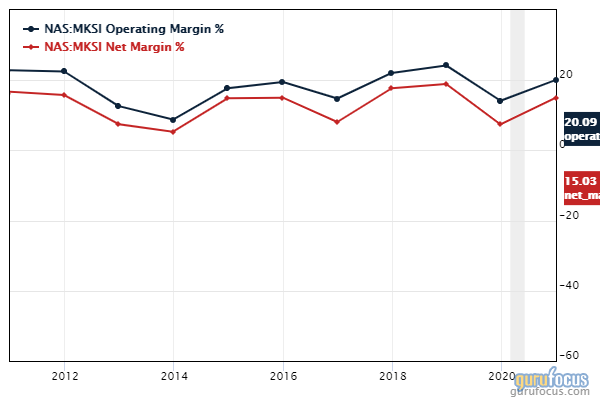

This chart shows the margins recovering in 2020, after a decline in 2019:

Both return on equity and return on assets look robust when compared with industry averages. MKS outperforms 86.42% of its peers and competitors on ROE and 90.32% on ROA.

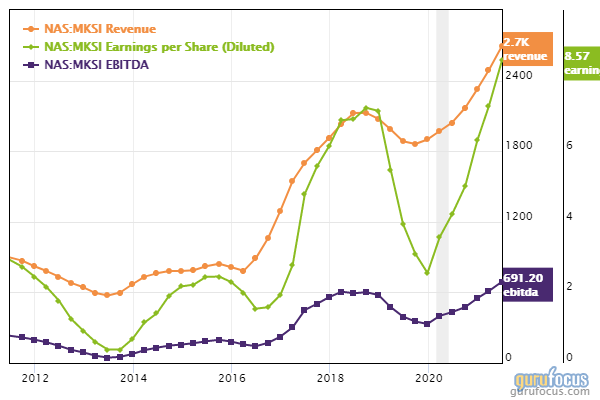

It’s harder to be enthusiastic about its three-year revenue, Ebitda and earnings per share growth, as shown in the table. However, there is reason to be optimistic if we shift to a 10-year chart:

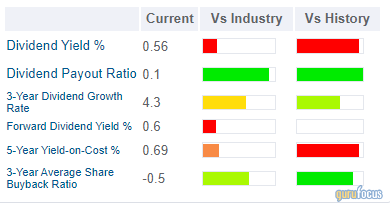

Dividends and share buybacks

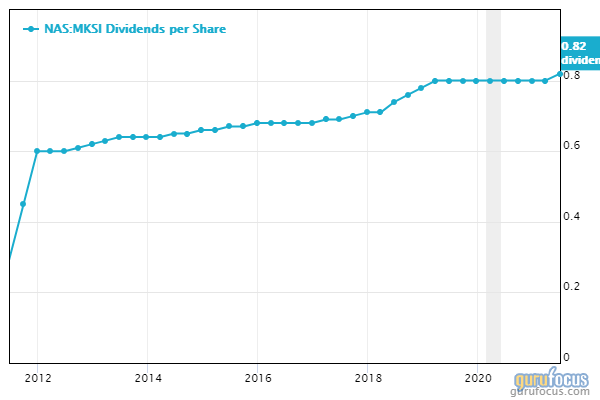

It appears the board was inspired by the first-quarter results to increase the dividend for the first time since the fourth quarter of 2018. On May 12, it announced a 10% increase, from 20 cents to 22 cents:

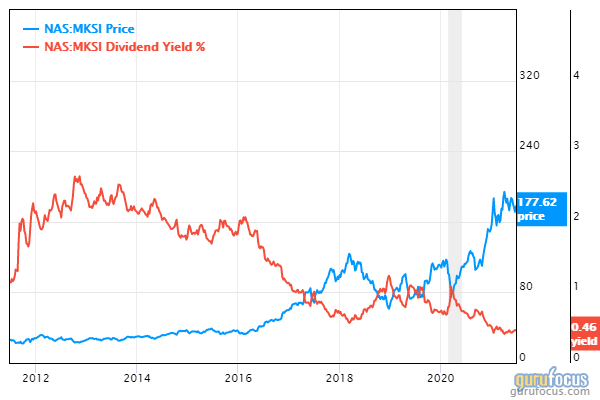

Still, the dividend has not kept up with the rapidly rising share price:

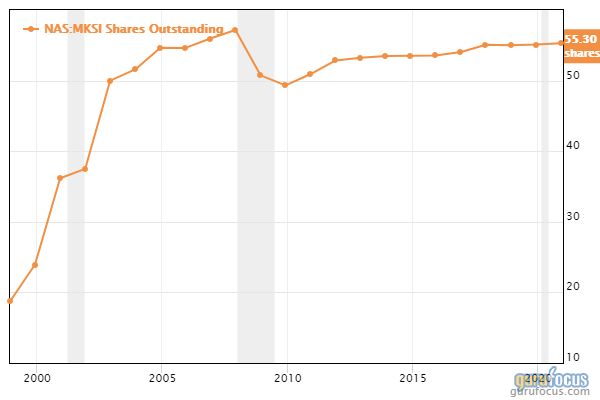

We shouldn’t be surprised about the dividend yield since this company is focused on growth. Confirmation of that comes from the growing number of shares outstanding:

Valuation

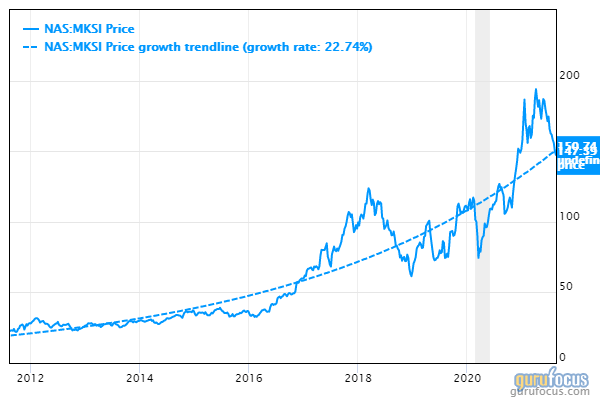

Over the past decade, and especially in recent years, MKS has racked up significant gains in the share price:

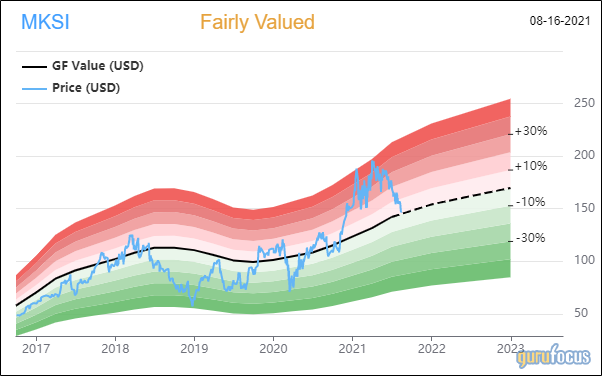

With the pullback that has occurred over the past four months, the GF Value Line finds the company to be fairly valued:

We get confirmation of the valuation from the PEG ratio, which comes in at 0.84, slightly below the fair value mark of 1.00. That’s also below the industry median of 1.76.

MKS’s price-earnings ratio is below the industry average as well, at 17, while the industry’s median ratio is 23. In addition, the company has a strong five-year Ebitda growth rate of 20.50% per year.

Gurus

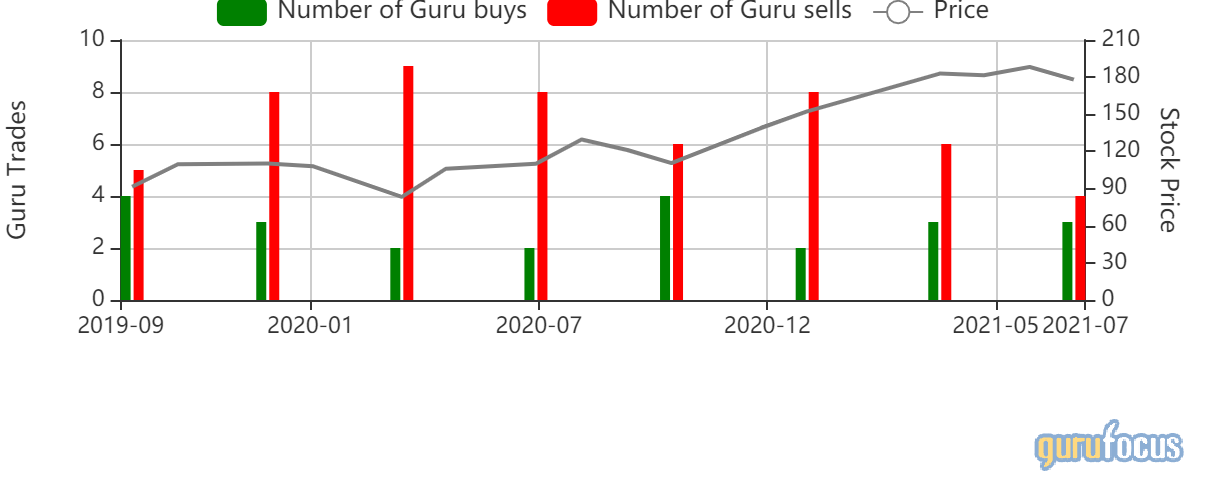

Despite the fundamentals and rising share price, the gurus have done more selling than buying over the past two years:

Six gurus held stakes in MKS at the end of the second quarter. The three biggest positions were those of:

- Chuck Royce (Trades, Portfolio) of Royce Investment Partners cut his holding by 12.43% during the quarter and finished with 779,393 shares. They represented a 1.41% stake in MKS and 0.95% of his fund’s assets under management.

- Ken Fisher (Trades, Portfolio) of Fisher Asset Management added 2.32% to his holding to finish the quarter with 526,199 shares.

- Pioneer Investment made a big addition of 41.49%, finishing the quarter with 261,221 shares.

About that price decline

Obviously, the share price did not drop off in response to either the first or second-quarter earnings reports; indeed, the decline began before the first-quarter results were released.

Perhaps there was some disappointment over its failure to secure Coherent, but to continue bidding might have resulted in it paying too much. In any case, it did end up making two deals for more than $5 billion.

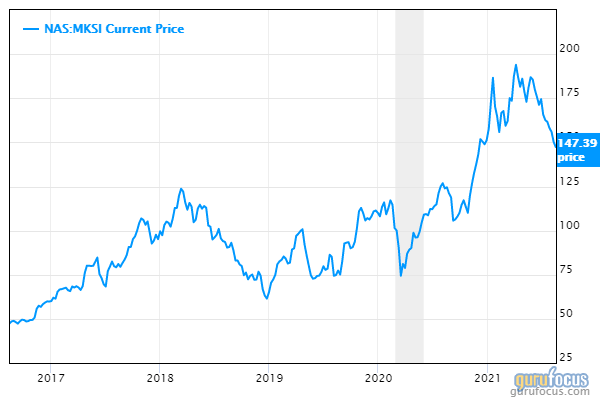

The most likely explanation is that MKS is currently making another round of the sharp dips that it has made in the past. This five-year chart illustrates:

The company noted in its 10-K that its business goes through sharp cycles and added:

“The semiconductor and consumer electronics industries have historically experienced cyclical variations in product supply and demand. For example, our sales to semiconductor capital equipment manufacturers and semiconductor device manufacturers sequentially increased 49% in 2020, sequentially decreased 19% in 2019, and sequentially increased 4% in 2018.”

It attributed these “sometimes sudden and severe cycles” to multiple factors, including consumer and industrial spending and demand for electronic products, manufacturers’ capacity utilization and more.

Conclusion

All this suggests that MKS Instruments is an opportunity and not a value trap. When the share price bottoms and begins rising again, investors may have an opportunity to score capital gains.

Overall, the company generates solid fundamentals, with a solid balance sheet and relatively high profitability.

Because it is not undervalued, it may not be a first choice of value investors. However, growth investors may have an opportunity here, once the price begins rising again. Income investors can pass MKS by because the price they have to pay to collect the dividend is too high.