Philippe Laffont (Trades, Portfolio)’s Coatue Management LLC recently disclosed a new stake in Blend Labs Inc. (BLND, Financial), a fintech software company offering a cloud-based platform for a variety of banking products.

According to GuruFocus Real-Time Picks, a Premium feature, the firm acquired 11,286,100 shares of Blend Labs’ stock on July 17, giving the holding a 1.28% weight in the equity portfolio. On the day of the trade, shares traded for an average price of $20.90.

About Coatue Management

Founded in 1999 and headquartered in New York, Coatue Management is an employee-owned private hedge fund sponsor. It launches and manages various hedge funds for clients and is perhaps best known for its tech-focused hedge fund. The firm mainly invests in U.S. and non-U.S. publicly traded equity securities, but it also has short positions and investments in private equity and hedging markets.

Chief Investment Officer Philippe Laffont (Trades, Portfolio), who founded the firm after leaving Tiger Management, takes a top-down approach to stock picking and focuses on the information technology sector.

More on Blend Labs

Blend Labs was founded in 2012 and has its headquarters in San Francisco. The company’s cloud-based platform powers end-to-end customer journeys for any banking product, and it advertises itself as “leading the change to customer-centric banking.”

In addition to deposit accounts and credit cards, the company’s products also include personal loans, vehicle loans and a mortgage lending platform servicing the home buying process for both buyers and lenders. It enables financial services companies such as Wells Fargo & Co. (WFC, Financial) and Lennar Corp.’s (LEN, Financial) mortgage arm to process an average of more than $5 billion in transactions per day.

In fact, many people have already been interacting with Blend Labs’ products without even realizing it. The company’s focus is on bringing consumer financial products such as mortgages and auto loans into the 21st century, and it is facilitating quicker applications, easier uploads and faster pre-approvals.

The company brings in revenue primarily on a software-as-a-service model, and it has gone public just as its main market, the home loan origination process, is red-hot. This has helped it grow revenue quickly, nearly doubling the top line between 2019 and 2020, though net income is still in the negative range.

Despite the seemingly positive long-term outlook for the company, investors have bid the stock down since its July 16 initial public offering. To date, shares have lost 15% as investors worry about a potential cooldown in the housing market and the fact that Blend Labs has yet to reach the profitability stage.

Portfolio overview

Based on its most recent filings, Coatue Management held shares of 76 common stocks valued at a total of $25.52 billion. The top holdings in its portfolio were DoorDash Inc. (DASH, Financial) with 6.75% of the equity portfolio, Amazon.com Inc. (AMZN, Financial) with 5.86% and Moderna Inc. (MRNA, Financial) with 5.65%.

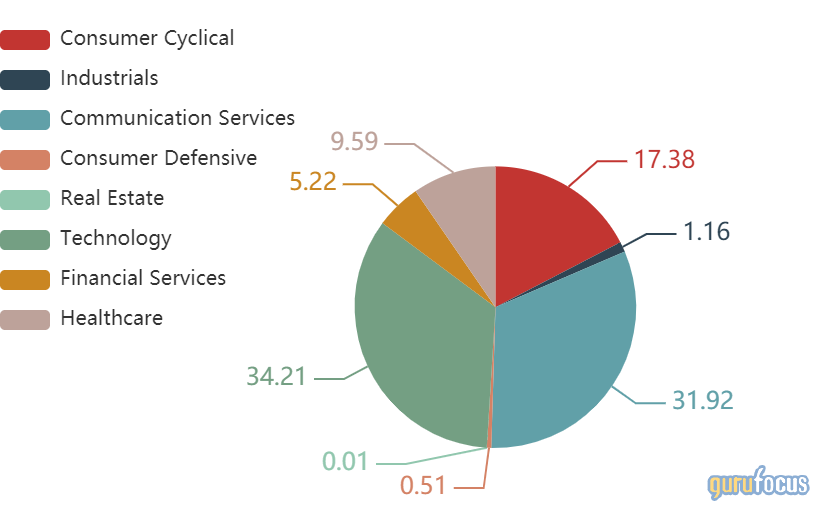

In terms of sector weighting, the firm was most invested in technology, communication services and consumer cyclical.

Laffont’s other fintech software holdings include Brazilian digital payments and business fintech provider StoneCo Ltd. (STNE, Financial), American digital payments and financial services company Square Inc. (SQ, Financial) and Canadian e-commerce platform and retail point-of-sale system Shopify Inc. (SHOP, Financial).