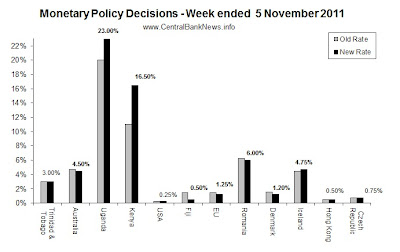

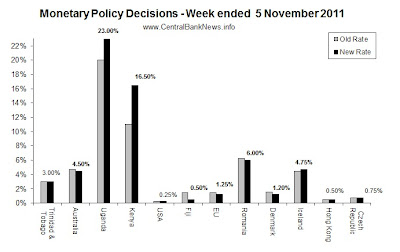

The past week in monetary policy saw 8 interest rate changes announced among the 12 central banks that met to review policy settings. Of those changing interest rates, those that increased rates were: Uganda +300bps to 23.00%, Kenya +550bps to 16.50%, and Iceland +25bps to 4.75%. Meanwhile those that cut rates were: Australia -25bps to 4.50%, Fiji -100bps to 0.50%, Europe -25bps to 1.25%, Romania -25bps to 6.00%, and Denmark -35bps to 1.20%. Those that held rates unchanged were: Trinidad & Tobago 3.00%, USA 0-0.25%, Hong Kong 0.50%, and the Czech Republic 0.75%.

Some of the main themes apparent in the past week included the ongoing uncertainty surrounding the European debt crisis, along with further signs that Europe is largely headed for a period of recession; as reflected in the interest rate cuts by the ECB and other Europe based central banks. The poor global growth outlook also spurred internationally focused economies like Australia to cut rates to be on the safe-side. Meanwhile there were still pockets of tightening going on, driven by economy specific inflation pressures, particularly in emerging and frontier markets.

Some of the key quotes from the central bankers that met last week are included below:

Looking at the central bank calendar, next week several emerging market central banks will be announcing policy decisions; which will provide some insight into how resilient their economies are proving as downside risks to the global growth outlook come to fore. The Bank of England is also scheduled to meet, but consensus says no change to its asset purchase program or interest rate. Elsewhere, the European Central Bank releases its monthly bulletin on Thursday, and the Chicago Fed will be hosting its 14th Annual International Banking Conference.

Source: www.CentralBankNews.info

Article source: http://www.centralbanknews.info/2011/11/monetary-policy-week-in-review-5-nov.html

Some of the main themes apparent in the past week included the ongoing uncertainty surrounding the European debt crisis, along with further signs that Europe is largely headed for a period of recession; as reflected in the interest rate cuts by the ECB and other Europe based central banks. The poor global growth outlook also spurred internationally focused economies like Australia to cut rates to be on the safe-side. Meanwhile there were still pockets of tightening going on, driven by economy specific inflation pressures, particularly in emerging and frontier markets.

Some of the key quotes from the central bankers that met last week are included below:

- US Federal Reserve (Kept policy settings unchanged): "To support a stronger economic recovery and to help ensure that inflation, over time, is at levels consistent with the dual mandate, the Committee decided today to continue its program to extend the average maturity of its holdings of securities as announced in September. The Committee is maintaining its existing policies of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction."

- European Central Bank (Cut rates -25bps to 1.25%): "Owing to their unfavourable effects on financing conditions and confidence, the ongoing tensions in financial markets are likely to dampen the pace of economic growth in the euro area in the second half of this year and beyond. The economic outlook continues to be subject to particularly high uncertainty and intensified downside risks. Some of these risks have been materialising, which makes a significant downward revision to forecasts and projections for average real GDP growth in 2012 very likely. In such an environment, price, cost and wage pressures in the euro area should also moderate; today's decision takes this into account."

- Reserve Bank of Australia (Cut rate -25bps to 4.50%): "Over the past year, the Board has maintained a mildly restrictive stance of monetary policy, in view of its concerns about inflation. With overall growth moderate, inflation now likely to be close to target and confidence subdued outside the resources sector, the Board concluded that a more neutral stance of monetary policy would now be consistent with achieving sustainable growth and 2–3 per cent inflation over time."

- Reserve Bank of Fiji (Cut rate -100bps to 0.50%): "The weaker outlook on global and domestic growth warrants such a move, particularly at this juncture where foreign reserves levels are comfortable and the outlook is stable, while inflation is expected to moderate over the coming months,"

- Central Bank of Iceland (Increased rate +25bps to 4.75%): "Recent data and the Central Bank forecast published today in the Monetary Bulletin confirm that Iceland's economic recovery continues, despite weakening global growth and increased uncertainty. Output is expected to grow slightly faster in 2011 and 2012 than was forecast in August, and inflation is projected to be somewhat lower in coming quarters as a result of a stronger króna and lower imported inflation."

- Central Bank of Kenya (Increased rate +550bps to 16.50%): "Inflation continued to rise while exchange rate volatility persisted in October 2011. Consistent with the monetary policy stance taken by the last MPC meeting, there is therefore a need for further tightening of monetary policy to tame these inflationary pressures and stabilize the exchange rate."

- Bank of Uganda (Increased rate +300bps to 23.00%): "The Bank of Uganda expects that inflation will peak in the coming months and will then decline during 2012, with core inflation reaching single digit levels at about the end of that year. Core inflation is projected to fall further to the Bank of Uganda's policy target of 5 percent in the medium term. However, should upside risks to inflation increase, monetary policy will need to be tightened further."

Looking at the central bank calendar, next week several emerging market central banks will be announcing policy decisions; which will provide some insight into how resilient their economies are proving as downside risks to the global growth outlook come to fore. The Bank of England is also scheduled to meet, but consensus says no change to its asset purchase program or interest rate. Elsewhere, the European Central Bank releases its monthly bulletin on Thursday, and the Chicago Fed will be hosting its 14th Annual International Banking Conference.

- PLN - Poland (National Bank of Poland) expected to hold at 4.50% on the 9th of Nov

- IDR - Indonesia (Bank Indonesia) expected to hold at 6.50% on the 10th of Nov

- GBP - UK (Bank of England) expected to hold at 0.50% on the 10th of Nov

- ZAR - South Africa (South African Reserve Bank) expected to hold at 5.50% on the 10th of Nov

- KRW - South Korea (Bank of Korea) expected to hold at 3.25% on the 11th of Nov

- MYR - Malaysia (Bank Negara Malaysia) expected to hold at 3.00% on the 11th of Nov

Source: www.CentralBankNews.info

Article source: http://www.centralbanknews.info/2011/11/monetary-policy-week-in-review-5-nov.html