Hotchkis & Wiley has revealed a significant reduction in its Triple-S Management Corp. (GTS, Financial) holding according to GuruFocus’ Real-Time Picks, a Premium feature.

The Los Angeles-headquartered investment firm focuses exclusively on finding and owning undervalued companies that have a significant potential for appreciation. Its focused, value-orientated approach looks to parameters such as a company's tangible assets, sustainable cash flow and potential for improving business performance to find profitable investments.

On Aug. 31, the firm slashed its Triple-S Management (GTS, Financial) holding by 65.08% with the sale of 1.52 million shares. The shares traded at an average price of $35.50 on the day of the sale and have more than doubled in price since the holding was first established at the beginning of 2020. Overall, the sale had a -0.17% impact on the equity portfolio and GuruFocus estimates the total gain of the holding at 96.18%.

Triple-S Management is a diversified insurance provider that operates in Puerto Rico. The company operates in the managed care, life insurance and property and casualty insurance segments. It generates the vast majority of its revenue through premiums earned from the sale of managed care products to the Commercial, Medicare Advantage and Medicaid sectors. Triple-S generally receives revenue from premiums, administrative service fees and investment income.

As of Sept. 13, the stock was trading at $35.21 per share with a market cap of $839.05 million. According to the GF Value Line, the stock is trading at a significantly overvalued rating.

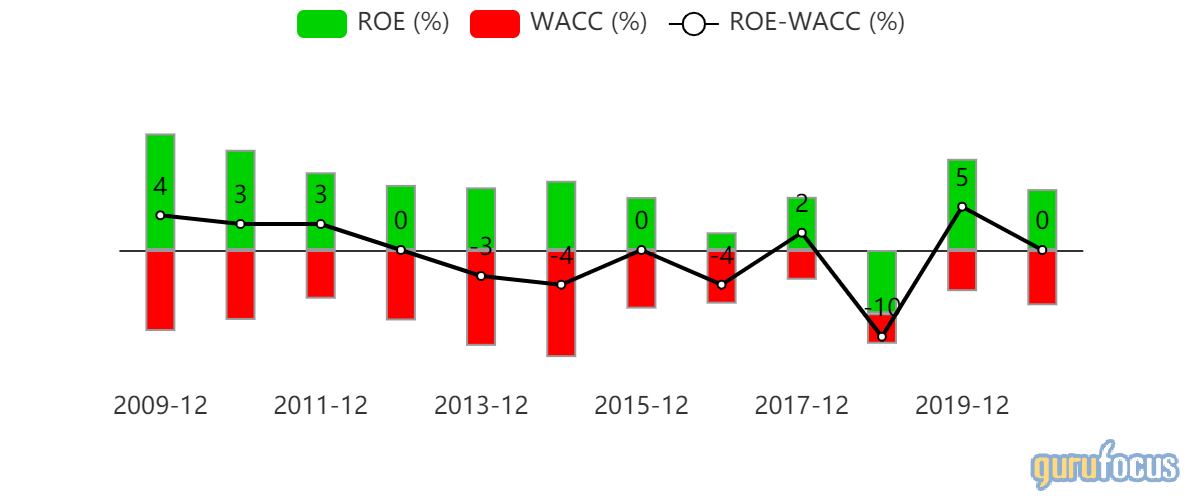

GuruFocus gives the company a financial strength rating of 6 out of 10, a profitability rank of 5 out of 10 and a valuation rank of 8 out of 10. There is currently one severe warning sign issued for assets growing faster than revenue. A medium warning sign is issued for the return on invested capital being lower than the weighted average cost of capital, indicating issues with capital efficiency.

Other top guru shareholders in Triple-S Management include Richard Pzena (Trades, Portfolio), Charles Brandes (Trades, Portfolio), Jim Simons (Trades, Portfolio)' Renaissance Technologies and Jeremy Grantham (Trades, Portfolio).

Portfolio overview

At the end of the second quarter, the firm’s portfolio contained 467 stocks with 10 new holdings. It was valued at $32.79 billion and has seen a turnover rate of 6%. Top holdings include Wells Fargo & Co. (WFC, Financial), American International Group Inc. (AIG, Financial), Citigroup Inc. (C, Financial), General Electric Co. (GE, Financial) and Anthem Inc. (ANTM, Financial).

The top sectors represented are financial services (28.69%), energy (13.37%) and industrials (12.92%).