The increased digitalization among companies has resulted in a strong need for cybersecurity. The market size of enterprise-level cybersecurity has already increased significantly after the SolarWinds cyberattack that took place at the end of 2020, and corporate spending on improved cybersecurity solutions is expected to increase with every passing year.

This has led to an exceptional runup of renowned cybersecurity players like Palo Alto Networks (PANW, Financial). Palo Alto finished off its previous fiscal year with a bang and is witnessing strong revenue growth on account of both increased software subscription and support sales as well as pertinent bolt-on acquisitions. Let's take a look at this company to see if it could still be a compelling investment opportunity at current levels.

Recent financial performance

Palo Alto Networks reported quarterly results recently with a top-line of $1.22 billion for the three months ended July 31, representing 28.29% growth as compared to the $950.40 million in revenue reported in the corresponding quarter of the previous year. The company was comfortably ahead of the analyst consensus estimate of $1.17 billion.

These revenues translated into a gross margin of 70.57% and an operating margin of -4.95%, which were lower than in the same quarter of fiscal 2020.

Palo Alto Networks’ net loss was $119.30 million, but its adjusted earnings per share came in at $1.60, which was above the average Wall Street expectation of $1.43.

In terms of cash flows, the company generated $325.80 million in the form of operating cash flows and spent $2.40 million in investing activities during the quarter, resulting in a positive free cash flow.

Successful acquisitions

Palo Alto Networks has been on an acquisition streak since CEO Nikesh Arora took the helm in the middle of 2018. In his regime, the company has acquired many small peers and cyber startups by shelling out at least $3 billion over the last three years.

Most recently, the company was in the news for the acquisition of Bridgecrew, a developer-first cloud security company, for a sum of $156 million. Prior to Bridgecrew, Palo Alto acquired companies like Expanse, Crypsis Group and CloudGenix for considerations of $800 million, $265 million and $420 million, respectively.

These acquisitions were relevant with respect to the cloud computing-based IT infrastructure in order to help Palo Alto create a new breed of cybersecurity. The company has a strong track record of integrating these acquisitions in the past.

Palo Alto Networks consistently generates a free cash flow profit margin above 30%. Even after the shopping spree, they ended their recent quarter with $3.79 billion in cash and investments offset by convertible debt of $3.23 billion. The company's acceleration in revenue and thriving free cash flow is an early indication that its strategy is only just beginning to pay off. I am optimistic about this bolt-on acquisitions strategy over the long term.

New Prisma SASE offering

Because of the Covid-19 pandemic, it has become essential for organizations to actively deploy applications across public clouds, data centers and edge locations for employees at home or remote locations. These widely distributed environments are driving the need for secure connectivity. As a result, most organizations' network priority is to ensure a tightly integrated network and security solution for their employees.

Palo Alto Networks is catering to this need with its latest Prisma SASE (Secure Access Service Edge) offering. The company is offering a unified cloud-delivered service with exceptionally good network security in order to ensure that organizations stay secure and productive while working fluidly from remote locations. Prisma SASE is a widely distributed cloud service that can help companies to easily secure and scale their hybrid workforce while providing an outstanding user experience.

The company also revealed that the Prisma SASE would be rolling out a number of unique capabilities. It looks to unite Cloud Secure Web Gateway, Cloud Access Security Broker, Zero Trust Network Access and Firewall as a Service into a single solution.

This latest product is also offering a new SD-WAN utilization with integrated 5G (ION 1200). It will offer organizations a 5G WAN connectivity as part of the Prisma SASE resolutions, including the proficiency to run active 5G WAN interfaces for carrier redundancy. Lastly, the Prisma SASE looks to provide an integrated Cloud Secure Web Gateway with re-imagined configuration workflows. This web gateway will make the security rules easy to define and simple with pre-defined endorsements and continuous estimations to accommodate the hybrid workforce's requirements. Overall, the new offering could be a strong growth driver for Palo Alto Networks in the coming quarters.

Final thoughts

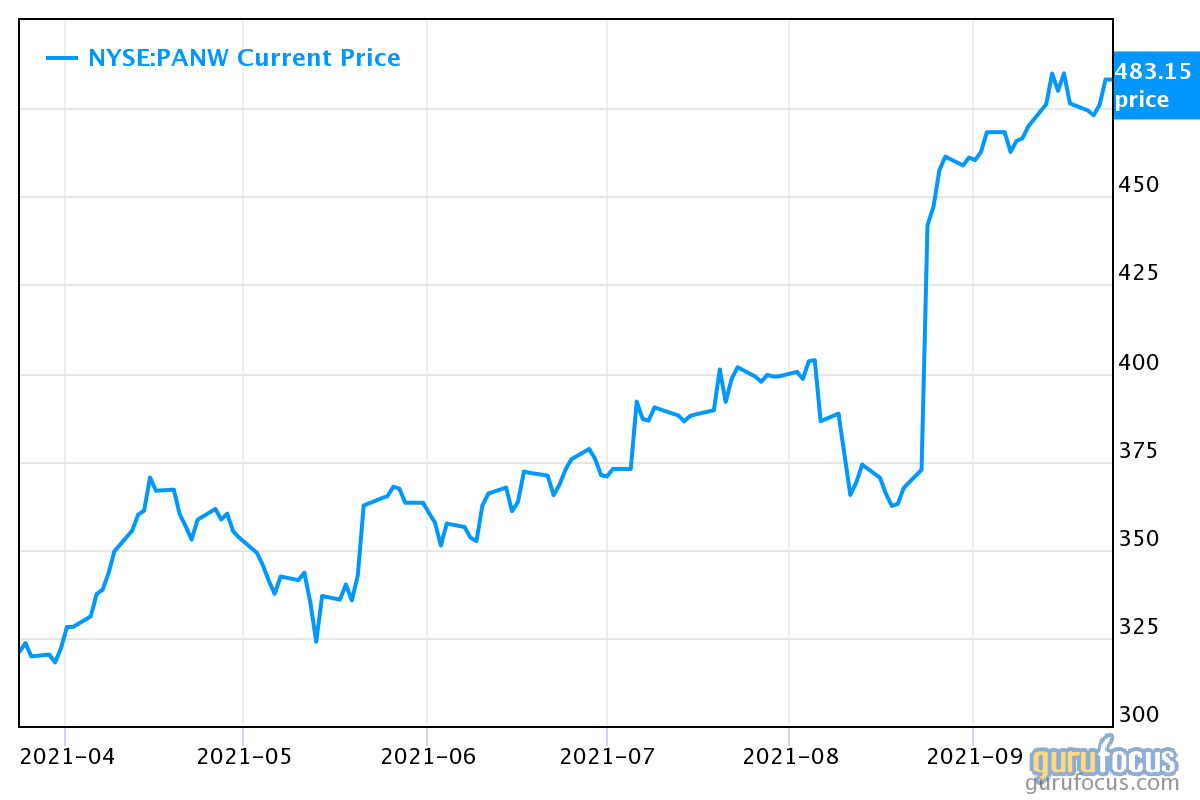

As we can see in the above chart, Palo Alto Networks has had an exceptional runup over the past six months; the stock has gained approximately 50% over this timeframe. There is little doubt that the company has a steep valuation with an enterprise-value-to-revenue multiple of 11.21, but its innovation and its bolt-on acquisition strategy is helping it scale rapidly. Palo Alto Networks is helping companies overcome the new set of security challenges that come with modern technologies, which justifies the premium, in my opinion. Its Prisma SASE and ION 1200 are expected to be launched before the end of October 2021 and should generate a strong revenue stream for the company. Given its steep valuation, I believe that a buy-on-dips approach should be ideal for a stock like Palo Alto Networks, particularly for tech investors who are looking for a quality long-term cybersecurity investment.