Daniel Loeb (Trades, Portfolio) has revealed an addition to his SentinelOne Inc. (S, Financial) holding according to GuruFocus’ Real-Time Picks, a Premium feature.

Loeb founded Third Point LLC in 1995 and leads the firm's research activities, portfolio and risk management. Loeb and his firm focus on activist investing and follow an event-driven, value-orientated investment style. He looks for situations in which a catalyst will unlock value and pushes for change with his public letters.

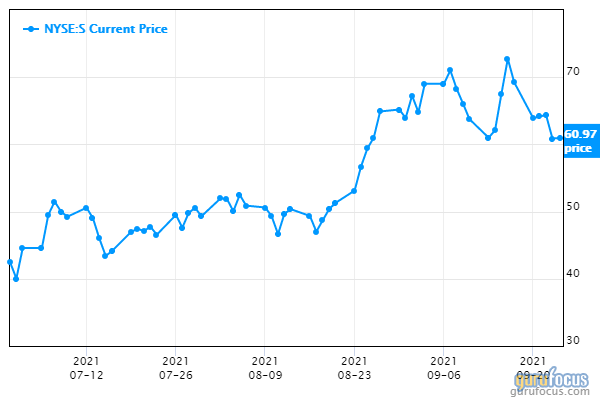

On Sept. 10, the guru boosted the position by 0.75% with the purchase of 200,000 shares. The shares traded at an average price of $63.75 on the day of the purchase. The addition followed closely behind the purchase of 1.15 million shares on July 7. Overall, the purchase had a 0.07% impact on the portfolio and GuruFocus estimates the total gain of the holding at 41.86%.

SentinelOne is an autonomous cybersecurity platform. The company's cybersecurity solutions encompass AI-powered prevention, detection, response and hunting across endpoints, containers, cloud workloads and internet of things devices in a single autonomous XDR platform.

As of Sept. 24, the stock was trading at $61.93 per share with a market cap of $16.38 billion. While share prices have fallen off in the last week, the stock is trading well above its debut price.

GuruFocus gives the company a financial strength rating of 3 out of 10 and there is currently a severe warning sign issued for poor financial strength. While the company’s cash-to-debt ratio of 66.28 ranks better than 78.53% of industry competitors, the company has seen increasingly negative cash flows over the last year. Its return on invested capital has also become increasingly negative, suggesting capital efficiency issues.

Alongside Loeb, guru shareholders in SentinelOne (S, Financial) include Chase Coleman (Trades, Portfolio), Steven Cohen (Trades, Portfolio), Louis Moore Bacon (Trades, Portfolio), Paul Tudor Jones (Trades, Portfolio) and George Soros (Trades, Portfolio).

Portfolio overview

As of the most recent quarter, Loeb’s portfolio contained 125 stocks, with 34 new holdings. It was valued at $17.07 billion and has seen a turnover rate of 23%. Top holdings include Upstart Holdings Inc. (UPST, Financial), SentinelOne, PG&E Corp. (PCG, Financial), Intel Corp. (INTC, Financial) and Danaher Corp. (DHR, Financial).

The top represented sectors are technology (27.52%), financial services (22.21%) and communication services (11.84%).