Shares of McCormick & Company, Inc. (MKC, Financial) are down nearly 17% for the year while the S&P 500 index has enjoyed a double-digit gain. Looking at the 52-week high is even worse as the stock sits 22% below this mark.

Like many packaged food companies, McCormick saw business pick up during the worst of the pandemic. Unlike many peers, however, that strength has continued into 2021, with the company expecting business results to easily top that of the prior year.

With business performing at a high level, it appears that the market has mispriced shares of the company, in my view. Let’s look deeper into why I think McCormick is an undervalued Dividend Aristocrat that can be bought at the current price.

Earnings highlights

McCormick reported earnings results for its fiscal third quarter on Sept. 30 (the company’s fiscal year ends Nov. 30). Revenue grew 8.3% to $1.55 billion, topping Wall Street analysts’ estimates by $10 million. Adjusted earnings per share of 80 cents compared to adjusted earnings per share of 77 cents in the prior-year quarter and came in 10 cents above expectations.

Currency exchange was a favorable 3% tailwind during the quarter. Acquisitions added 4.5%, volume and mix added 0.7% and pricing gained 0.1%, all of which contributed to results.

In the Consumer segment, net sales grew 1.2%, but fell 1.2% in constant currency. A 3.3% decrease in volume and mix more than offset a 2.5% tailwind from acquisitions. Currency exchange aided results by 2.4%.

The Americas region was up 0.2%, mostly due to acquisitions as volumes were down slightly. McCormick’s purchase of hot sauce Cholula helped results and the branded portfolio remains in high demand.

The Europe/Middle East Africa (EMEA) region was lower by 6% as volumes were down 11%. Much of this was due to a difficult comparable period in the prior year. Eastern Europe returned to growth.

Asia/Pacific grew more than 20%. Currency exchange was a favorable 9.6% during the quarter, but volumes were up almost 10%. A recovery in the branded foodservice business was the main driver of gains. The recovery in India has been slower than other areas within the region.

The Consumer segment performed very well last year as more consumers ate more meals at home. Volumes were up almost 14% during that quarter, so a small decline year-over-year shows that many of those new customers were converted into repeat customers.

On the other hand, Flavor Solutions felt the brunt of the pandemic last year, so its year-over-year comparisons were more favorable, though this business had shown signs of recovery last year.

Flavor Solutions grew 20.8% overall and 16.6% without the benefit of a weaker U.S. dollar. Acquisitions added 8%, but volume and mix grew 7.5% and pricing added 1.1%.

In the Americas, Flavor Solutions grew 20.8% and 18.6% in constant currency. Acquisitions added 11.8% to results, but volume and mix improved 5.4%. Again, Cholula played an important role, but so did higher sales to branded foodservice clients. Demand for snack seasonings was especially high.

The EMEA region surged 28.1%. Currency was again a major tailwind, but constant currency growth was still 19.4%, with volume and mix growing 18.5%. The packaged food and beverage business did well and sales to quick service restaurants and branded foodservice returned to more normalized levels.

Asia/Pacific was up 8.4%, almost entirely due to currency exchange, but volume and mix did grow 1.6%. As with the other regions, an improvement in quick service restaurant business was the primary driver.

Importantly, every region in both businesses saw growth from 2019 levels, with many areas seeing a double-digit increase.

The company did revise its guidance for the year. Revenue is now projected to be higher by 12% to 13% from the prior year, compared to second quarter guidance of 11% to 13% growth and first-quarter guidance of 8% to 10%. On the other hand, leadership expects that adjusted earnings per share will now be in a range of $2.97 to $3.02, down from $3.00 to $3.05 previously. Reaching the new adjusted earnings per share midpoint would be a 6% improvement from last year.

Takeaways and valuation analysis

Top- and bottom-line results were very good this quarter, and this was coming off the gains that were made in the prior year. Revenue for the third quarter of last year was up 7.6%. McCormick has made a habit of posting strong results on top of what were pretty good numbers in the prior year.

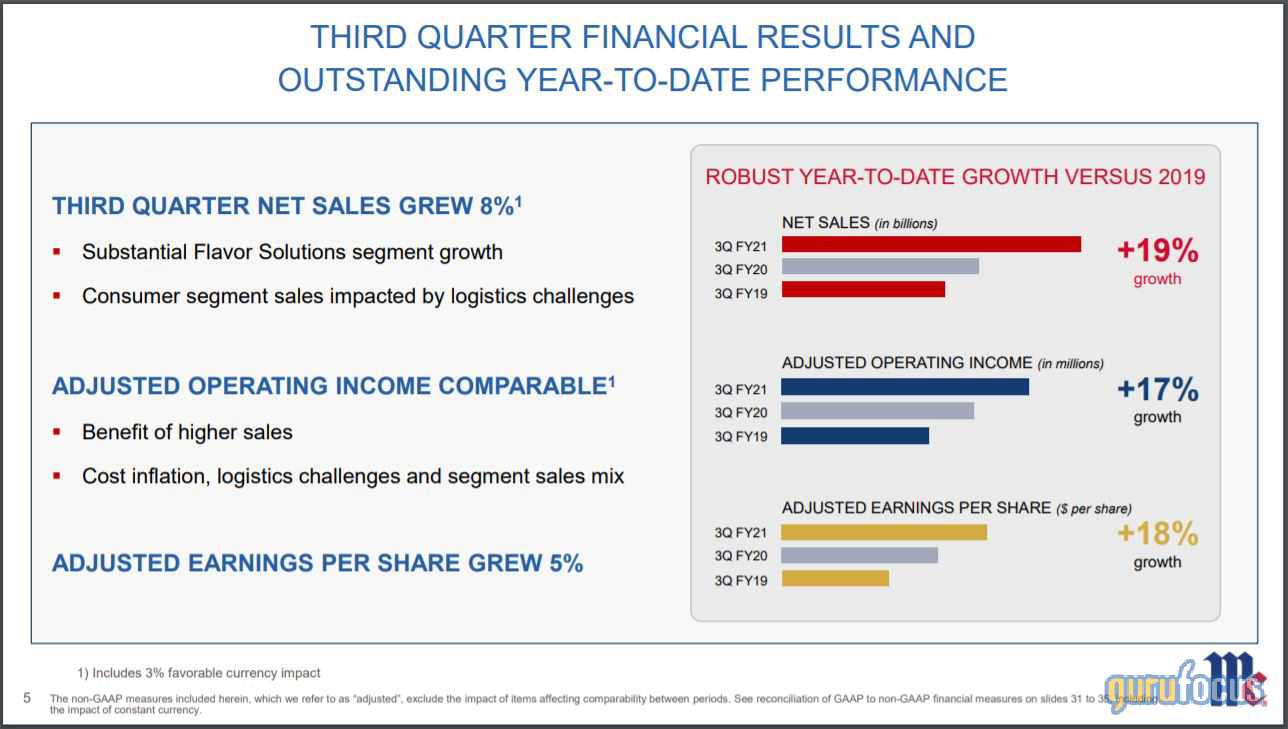

Source: Investor Presentation

As we can see in the image above, not only is the company producing growth on a year-over-year basis, but also against the 2019 period. Year-to-date revenue, adjusted operating income and adjusted earnings per share are all up at least 17% relative to the same period of 2019.

McCormick’s biggest hurdle remains accelerating inflation. Leadership stated that transportation and packaging costs will result in prolonged higher prices, which could impact demand somewhat. Gross margins fell 260 basis points in the most recent quarter as price increases lagged. Those increases should be in place during the fourth quarter or early next fiscal year.

That said, McCormick is the largest player by far in the seasoning and spice industry, controlling approximately 20% of this highly fragmented area. The high demand for the company’s products appears sustainable given the quality of growth in year-over-year sales over the past few quarters. Producing growth when demand was high due to more consumers eating at home is one thing. Stacking another near 8% gain on top of that speaks to the brand power McCormick has and the company’s ability to provide the products that customers want.

The market isn’t ignoring these positives that McCormick possess, which is why the stock trades at more than 26 times its expected earnings, but the stock has long had a premium valuation. Shares have an average price-earnings ratio of more than 23 since 2011. Knowing this, the stock isn’t overly expensive compared to its historical multiple, in my opinion.

It can be argued that McCormick is a better positioned company today than it was over the last decade. The demand seen in the worst portions of the pandemic was incredibly high and that has carried over to as recently as the third quarter even as social distancing and stay-at-home directives have largely been eased in many areas that the company operates. McCormick’s strategic acquisitions, such as Cholula as well as Frank’s Red Hot and French’s Mustard several years ago, have given the company a foothold in some of the fastest growing condiments categories. This has allowed the company to expand its footprint and its potential customer pool.

This is why the stock looks very cheap according to the GuruFocus Value chart:

McCormick has a GF Value of $93.52. Using Friday’s closing price of $79.31, the stock has a price-to-GF-Value ratio of 0.85. Reaching the GF Value would mean a nearly 18% return based on the most recent closing price.

The stock’s dividend will also play a role in total returns. McCormick has raised its dividend for 34 years, qualifying the company as a Dividend Aristocrat. There are less than 70 names in the S&P 500 index that have earned that status. The dividend has a compound annual growth rate of 8.5% over the last decade and shares yield 1.7%.

Combine the potential gain in share price with the stock’s dividend yield and total returns could reach nearly 20%, an excellent upside offering for a consumer staple company. Therefore, I find McCormick to be a buy due to possible total returns at this level.