Jeffries analysts are encouraging shareholders of Oak Street Health, Inc. (OSH, Financial) to be patient. They think the value-based primary care network for seniors will become profitable by 2025, according to an article in Healthcare Dive.

Oak Street’s march toward profitability has been hampered by a costly roll-out of its services where the greatest need exists and where it doesn’t have a foothold, Executive Medical Director Marisa Rogers told Healthcare Dive.

Last week, the company added to its portfolio with the $130 million acquisition of privately held virtual specialty provider RubiconMD. The deal gives Oak Street additional firepower as it battles other major U.S. clinical networks for a favored place among employer and payer clients looking to cut costs with no loss in quality.

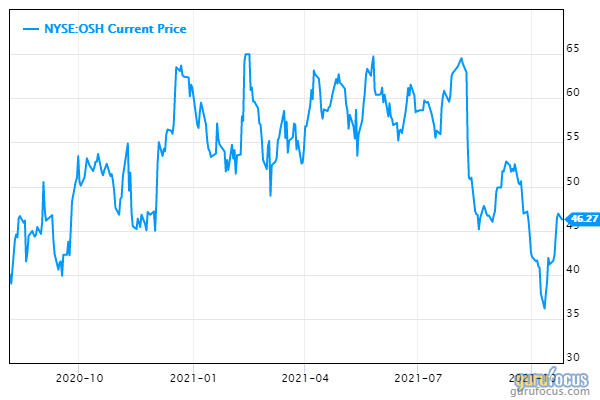

Oak Street went public in August 2020 to a market thirsty for its shares, as the IPO price of $21 more than doubled on its first day of trading. The stock traded as high as $63 in July but has since retreated to just more than $46.

At its current price, Wall Street thinks the stock is a bargain, rating it a buy with a low target price of $50, a median of $61 and a high of $76. In another bullish sign, Oak Street is a darling of the most sophisticated money managers. Insider Monkey reports that the company was in 33 hedge funds' portfolios at the end of the second quarter of 2021, just one below the company’s all-time high and up three since the end of March.

Oak Street and other primary care operators are riding the wave of the shift to a value-based system, especially in the profitable Medicare Advantage population, which is expanding rapidly as the population gets older. It also serves patients with other insurance choices.

Oak Street has cut a wide swath, It will have 120 clinics in 19 states by the time the calendar turns and has plans to enter Arizona and Kansas next year. The decade-old company offers virtual and in-home care options focused on primary care, behavioral health and social worker support, while offering less ancillary and specialist services in-clinic than its peers, Jefferies says.

Oak Street is facing competition in the Medicare space from Iora Health, which was acquired last year by 1Life Healthcare, Inc. (ONEM, Financial) for $2.1 billion. 1Life operates a membership-based primary care platform under the One Medical brand. The company went public in January 2020 at $14 a share and now trades just over $22, well off its year-to-date high of nearly $60.

UnitedHealth Group Incorporated (UNH, Financial) is also getting in on the action. The broad-based health care giant just announced that it’s going to introduce a virtual-first primary care product by the end of the year. And the ubiquitous Amazon.com Inc. (AMZN, Financial) said it planned to expand its virtual-first Amazon Care offering to at least five more U.S. cities this year.