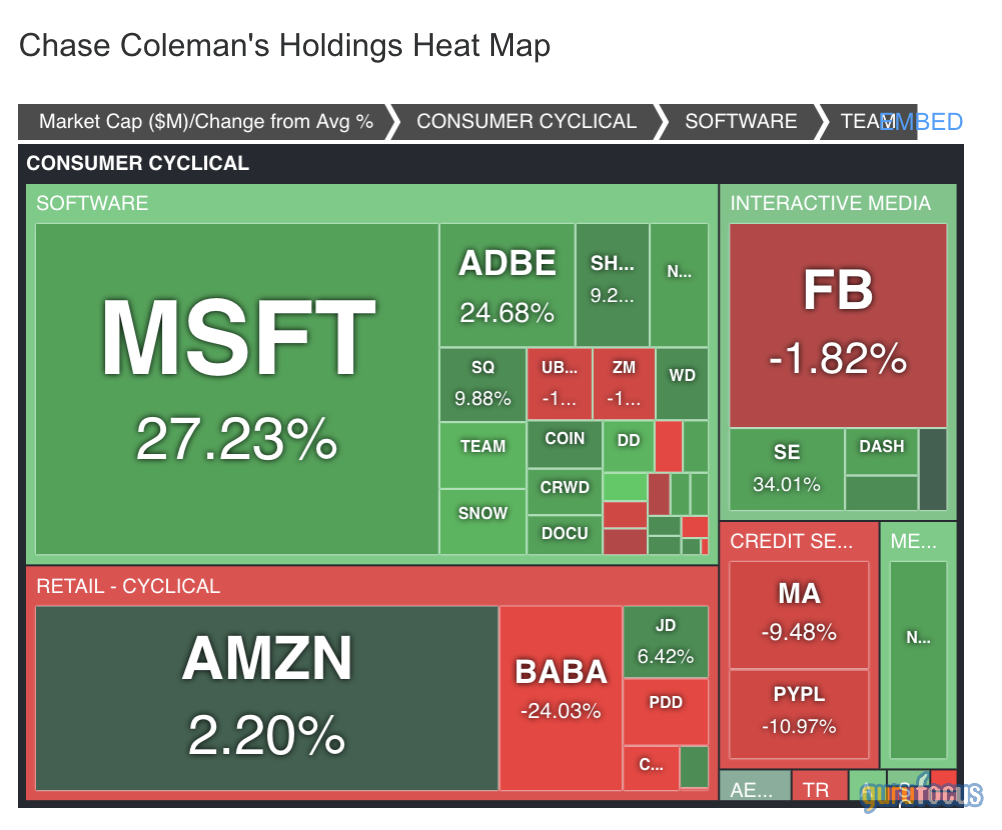

Chase Coleman (Trades, Portfolio)'s Microsoft (MSFT, Financial) holding now makes up 6.62% of his portfolio after the guru added 27.23% to the position in the previous quarter. While some analysts may be saying that Microsoft is overvalued right now, I am inclined to agree with Coleman's bullish stance on the stock. Here's why I think Microsoft could be a good bet right now.

Big tech narrative and earnings

There's been much talk about big tech being overbought and that it will sell off with a rising 10-year yield, which could see strength in the bond market and financial sector stocks.

Although I agree with the latter, I don't agree with the bearish outlook for big tech at all. Microsoft has a strong foothold in both the hardware and the software departments. The products and services it sells have become a need more than a want in the developed world, while this maybe wasn't the case in the 90s when the tech bubble burst.

Microsoft flew past earnings estimates with its fiscal first-quarter earnings release this week. The firm beat revenue estimates by $1.3 billion and GAAP EPS estimates by $0.64, clinching pro-forma estimates.

The company has a bullish outlook, and the CEO explained a bullish case for Microsoft's future rather well in my view. According to Microsoft's CEO Satya Nadella, “Digital technology is a deflationary force in an inflationary economy. Businesses – small and large – can improve productivity and the affordability of their products and services by building tech intensity."

I don't see a slowdown in the business trajectory for the company at all. It's experiencing strong growth via its cloud services segment (+29% year-over-year), teams user growth is skyrocketing amid a flexible/work-from-home- environment, advertising revenue (+39% YoY) is looking strong and a solid uptake in Xbox sales is helping its gaming department.

Valuation

You can't value this stock based on simple price multiples given that it's still in hypergrowth mode and has a capex-to-sales ratio increasing by 12.21% (YoY). I think the best would be to look at Ebitda and cash flow fowth while considering shares outstanding.

Microsoft's free cash flow to equity margin is 33.85% higher than its five-year average, and its three-year Ebitda compound annual growth rate of 21.72% demonstrates the consistency of this company's growth.

Finally, Microsoft's board has approved a $60 billion stock buyback program and an 11% hike in its quarterly dividend, which suggests that an increase in intrinsic value is on its way and management anticipates free cash flow growth ahead.

Final word

Microsoft is in a good space, and the naysayers don't have much substance. There's a reason Chase Coleman (Trades, Portfolio) owns a significant stake in the company and is adding more, and I assure you it's not based on pure speculation.