Carl Icahn (Trades, Portfolio) has revealed a reduction in his Herc Holdings Inc. (HRI, Financial) position according to GuruFocus’ Real-Time Picks, a Premium feature.

Icahn is known for taking activist positions in undervalued, struggling companies and working with management in order to improve profitability as well as unlock value for shareholders. He seeks to avoid consensus thinking and believes the momentum with trends will always fall apart.

On Oct. 27, Icahn cut the holding by 4.54% with the sale of 204,234 shares, the first change to the holding in the last four years. The guru had previously made a 4.22% addition to the holding with the purchase of 181,929 shares in the the third quarter of 2017. On the day of the most recent transaction, the shares traded at an average price of $178.74, well above Icahn’s average price paid per share of $33.94. Overall, the sale had a -0.15% impact on the equity portfolio and GuruFocus estimates Icahn has a staggering total estimated gain of 434.10% on the holding.

Herc Holdings is an equipment rental company that was spun out of Hertz Global in 2016. It serves construction customers, the environmental sector, industrial entities and entertainment production companies. During much of its 50-plus-year history, the company has rented equipment to its customers for intermittent use. Herc Holdings' strategy now offers to industrial customers long-term rental schemes, where Herc maintains its own staff at the customer site. In 2019, Herc Holdings' fleet included $3.8 billion of equipment at original cost.

As of Oct. 28, the stock was trading at $180.96 per share with a market cap of $5.34 billion. According to the GF Value Line, the stock is trading at a significantly overvalued rating.

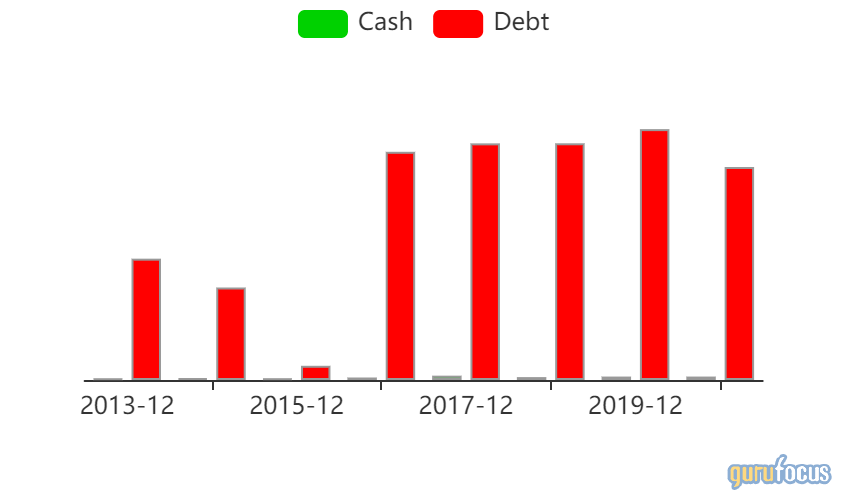

GuruFocus gives the company a financial strength rating of 3 out of 10 and a profitability rank of 6 out of 10. There are currently two severe warning signs issued for poor financial strength and an Altman Z-Score placing the company in the distress column. A cash-to-debt ratio of 0.02 ranks the company worse than 96.36% of industry competitors and takes its toll on the company’s financial strength rating.

Icahn is the largest shareholder with 14.47% of shares outstanding. Other top guru shareholders in Herc Holdings (HRI, Financial) include Mario Gabelli (Trades, Portfolio), Chuck Royce (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio), Barrow, Hanley, Mewhinney & Strauss and First Eagle Investment (Trades, Portfolio).

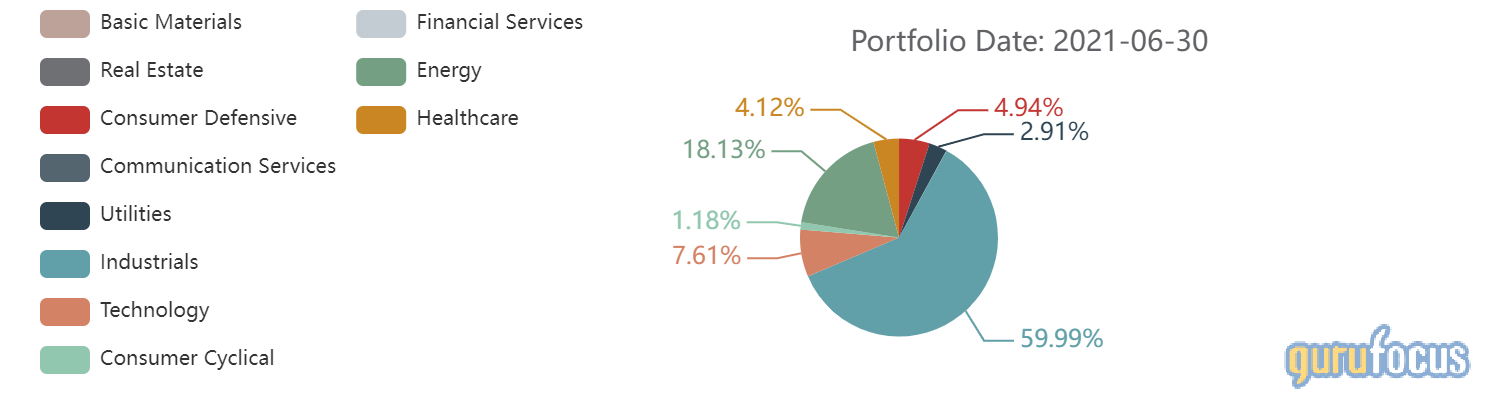

Portfolio overview

Icahn’s portfolio contains 17 stocks with no new holdings. It was valued at $24.29 billion and has seen a turnover rate of 4%. Top holdings include Icahn Enterprises LP (IEP, Financial), Occidental Petroleum Corp. (OXY, Financial), Cheniere Energy Inc. (LNG, Financial), CVR Energy Inc. (CVI, Financial) and Newell Brands Inc. (NWL, Financial).

The top represented sectors in his portfolio are industrials (59.99%), energy (18.13%) and technology (7.61%).