I’ve been bullish on Russia long before the market appeared on the radar screens of most investors. I believe that Russia, with its vast treasure trove of resources, is one of the main beneficiaries of Asia’s emergence as an engine of global economic growth.

Heading into 2012, the Russian economy seems well-positioned for growth and its stock market is cheap enough to attract more attention from investors. Most important, the majority of foreign investors are either underweight the market or have no presence at all in Russia.

Historically, these conditions have allowed the Russian market to outperform global indexes, and the same should be true next year, especially if oil prices do not collapse in 2012. Given that the Russian market currently trades at a little over 6 times earnings, I believe that the risk-reward tradeoff is quite appealing.

Given my less-than-sanguine outlook for Europe in 2012, Russian exports should be weak next year. Europe remains Russia’s key trading partner, and I expect a European recession to slow Russian economic growth in 2012. Nevertheless, Russia should be able to match the global economy’s growth of about 3.5 percent. Indeed, Russia’s status as a high-beta market could allow it to grow even faster than the global economy.

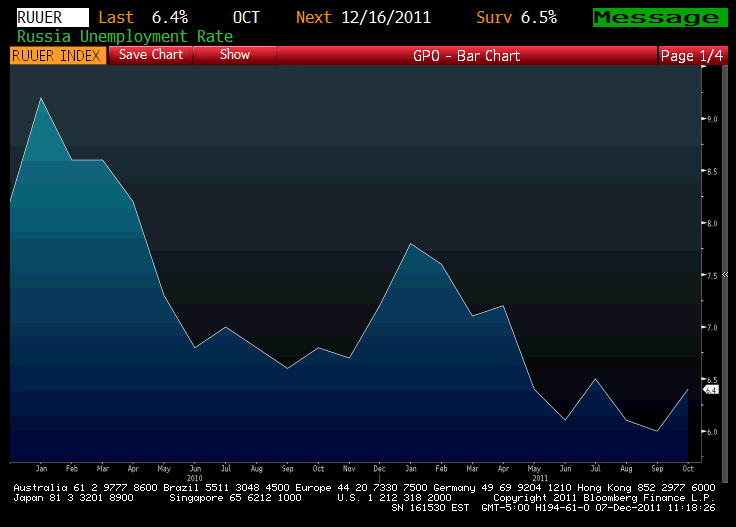

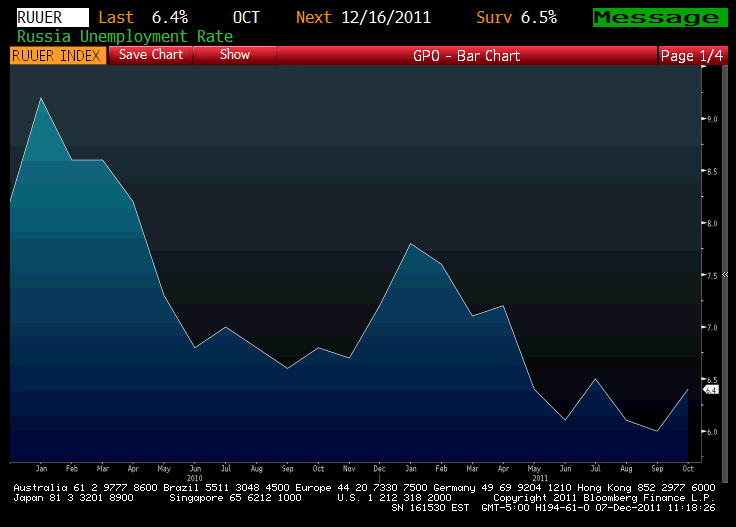

Consumer demand and domestic investment will be the two pillars of Russian economic growth next year. Unemployment remains relatively low in Russia at about 6.4 percent, down from about 9 percent in 2010.

Source: Bloomberg

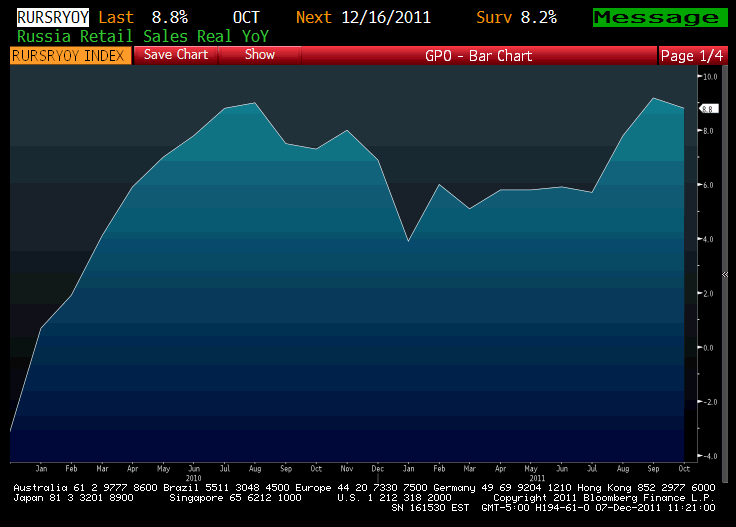

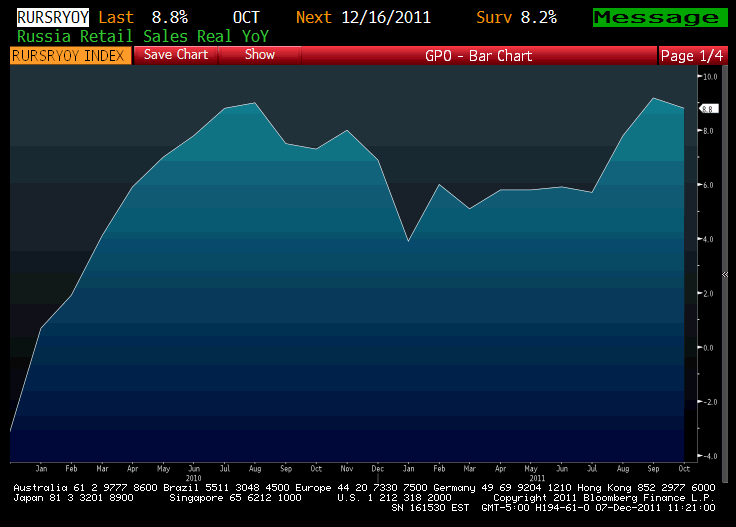

Furthermore, wages have grown at about 5 percent per year, which will support consumer spending. As the chart below indicates, retail sales in Russia have been growing by close to 9 percent per year, and I expect consumer spending to continue along this trajectory.

Source: Bloomberg

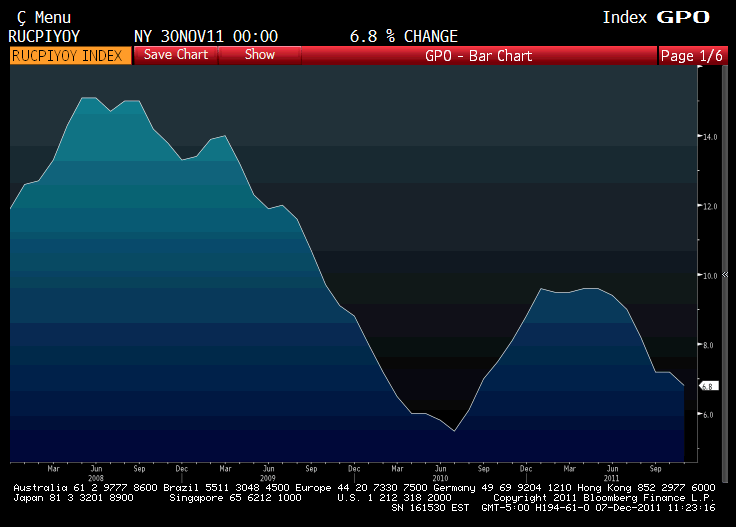

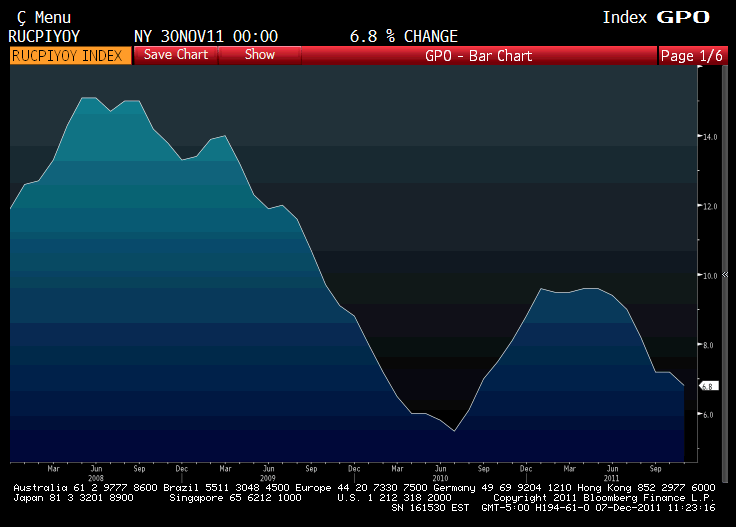

Like many emerging markets, Russia has grappled with high levels of inflation for some time. However, prices are on a downtrend. Although the current inflation rate of 6.8 percent remains above the central bank’s target of 6 percent, it’s fallen significantly from 2008, when inflation clocked in at 15 percent. I believe that inflation will continue to moderate along with a weaker economic outlook, and will fall below 6 percent in the first half of 2012.

Source: Bloomberg

The second piece of the puzzle is domestic investment and public spending. Russia is in the midst of an infrastructure boom. Infrastructure investment last year came in at USD111 billion, representing more than 7 percent of GDP. More important, infrastructure-related investment remained above USD100 billion per year throughout the global economic crisis. By contrast, in 1999 only about USD7 billion — representing about 3.5 percent of GDP — was allocated to infrastructure-related investments.

Russia’s strong fiscal position and a debt-to-GDP ratio of about 8 percent allowed it to make the most out of strong oil prices. The country has sought to modernize its infrastructure by focusing on projects related to power, telecommunications, ports and airports. In the future, I expect funds to flow to projects that concentrate on power, railways and roads.

Of course, energy remains the linchpin of the Russian economy; the country is second only to Saudi Arabia in terms of total oil production.

The US Energy Information Administration (EIA) estimates that every USD1 rise in the price of oil boosts the Russian government’s receipts by 0.35 percent of GDP. Additionally, most estimates suggest that the oil and gas industries account for about 20 percent of Russia’s GDP. These industries generate nearly two-thirds of export revenues and comprise close to a third of foreign direct investment (FDI) inflows into Russia.

With domestic consumption of crude oil running at just 2.7 million barrels per day, Russia is also a huge net exporter of crude oil; the country had about 7 million barrels per day available for export in 2006.

Russian oil production over the past 20 years has exhibited an unusual U-shape. During the Soviet era, the government mandated that producers pump oil as quickly as possible. These surges in production meant that, in the early to mid-1980s, Russian production was as high as 12.5 million barrels per day.

But those surges came with a cost, as aggressive production damaged many reservoirs. Furthermore, during the waning days of the Soviet Union, Russian producers simply didn’t invest what was needed in oil-related infrastructure. Pipelines fell into disrepair and producers didn’t perform necessary maintenance on wells.

But since the late 1990s, Russia’s production growth has been impressive. Two factors have conspired to bring about that shift. First, oil prices have risen sharply, increasing incentives to produce and generating capital to be reinvested in growing production. Second, Russia has modernized its infrastructure, adopting more modern technologies imported from the West to squeeze more production out of maturing fields.

Russian gas monopoly Gazprom (OTC: OGZPY) is my favorite Russian energy stock. Gazprom is Russia’s largest company by a wide margin and controls almost 85 percent of the country’s total natural gas production. The company alone accounts for nearly 20 percent of global gas production.

Europe remains the company’s main market; Gazprom supplies about 25 percent of Europe’s natural gas. The recently completed Nord Stream pipeline that connects Russia to Germany is the clearest sign of Russia’s importance to meeting Europe’s energy needs. The USD10 billion 760-mile pipeline runs under the Baltic Sea and is expected to carry about 970 billion cubic feet of natural gas per year. A second leg of the pipeline through the Baltic Sea is expected to be completed next year.

Gazprom’s stock trades at a little more than 3 times estimated 2011 earnings, which makes it one of the cheapest energy companies in the world. It’s true that Gazprom is not a high-beta stock and the company’s deep ties with the Russian government makes Gazprom a complicated investment. Nevertheless, the current valuation represents a good opportunity for long-term investors

Heading into 2012, the Russian economy seems well-positioned for growth and its stock market is cheap enough to attract more attention from investors. Most important, the majority of foreign investors are either underweight the market or have no presence at all in Russia.

Historically, these conditions have allowed the Russian market to outperform global indexes, and the same should be true next year, especially if oil prices do not collapse in 2012. Given that the Russian market currently trades at a little over 6 times earnings, I believe that the risk-reward tradeoff is quite appealing.

Given my less-than-sanguine outlook for Europe in 2012, Russian exports should be weak next year. Europe remains Russia’s key trading partner, and I expect a European recession to slow Russian economic growth in 2012. Nevertheless, Russia should be able to match the global economy’s growth of about 3.5 percent. Indeed, Russia’s status as a high-beta market could allow it to grow even faster than the global economy.

Consumer demand and domestic investment will be the two pillars of Russian economic growth next year. Unemployment remains relatively low in Russia at about 6.4 percent, down from about 9 percent in 2010.

Source: Bloomberg

Furthermore, wages have grown at about 5 percent per year, which will support consumer spending. As the chart below indicates, retail sales in Russia have been growing by close to 9 percent per year, and I expect consumer spending to continue along this trajectory.

Source: Bloomberg

Like many emerging markets, Russia has grappled with high levels of inflation for some time. However, prices are on a downtrend. Although the current inflation rate of 6.8 percent remains above the central bank’s target of 6 percent, it’s fallen significantly from 2008, when inflation clocked in at 15 percent. I believe that inflation will continue to moderate along with a weaker economic outlook, and will fall below 6 percent in the first half of 2012.

Source: Bloomberg

The second piece of the puzzle is domestic investment and public spending. Russia is in the midst of an infrastructure boom. Infrastructure investment last year came in at USD111 billion, representing more than 7 percent of GDP. More important, infrastructure-related investment remained above USD100 billion per year throughout the global economic crisis. By contrast, in 1999 only about USD7 billion — representing about 3.5 percent of GDP — was allocated to infrastructure-related investments.

Russia’s strong fiscal position and a debt-to-GDP ratio of about 8 percent allowed it to make the most out of strong oil prices. The country has sought to modernize its infrastructure by focusing on projects related to power, telecommunications, ports and airports. In the future, I expect funds to flow to projects that concentrate on power, railways and roads.

Of course, energy remains the linchpin of the Russian economy; the country is second only to Saudi Arabia in terms of total oil production.

The US Energy Information Administration (EIA) estimates that every USD1 rise in the price of oil boosts the Russian government’s receipts by 0.35 percent of GDP. Additionally, most estimates suggest that the oil and gas industries account for about 20 percent of Russia’s GDP. These industries generate nearly two-thirds of export revenues and comprise close to a third of foreign direct investment (FDI) inflows into Russia.

With domestic consumption of crude oil running at just 2.7 million barrels per day, Russia is also a huge net exporter of crude oil; the country had about 7 million barrels per day available for export in 2006.

Russian oil production over the past 20 years has exhibited an unusual U-shape. During the Soviet era, the government mandated that producers pump oil as quickly as possible. These surges in production meant that, in the early to mid-1980s, Russian production was as high as 12.5 million barrels per day.

But those surges came with a cost, as aggressive production damaged many reservoirs. Furthermore, during the waning days of the Soviet Union, Russian producers simply didn’t invest what was needed in oil-related infrastructure. Pipelines fell into disrepair and producers didn’t perform necessary maintenance on wells.

But since the late 1990s, Russia’s production growth has been impressive. Two factors have conspired to bring about that shift. First, oil prices have risen sharply, increasing incentives to produce and generating capital to be reinvested in growing production. Second, Russia has modernized its infrastructure, adopting more modern technologies imported from the West to squeeze more production out of maturing fields.

Russian gas monopoly Gazprom (OTC: OGZPY) is my favorite Russian energy stock. Gazprom is Russia’s largest company by a wide margin and controls almost 85 percent of the country’s total natural gas production. The company alone accounts for nearly 20 percent of global gas production.

Europe remains the company’s main market; Gazprom supplies about 25 percent of Europe’s natural gas. The recently completed Nord Stream pipeline that connects Russia to Germany is the clearest sign of Russia’s importance to meeting Europe’s energy needs. The USD10 billion 760-mile pipeline runs under the Baltic Sea and is expected to carry about 970 billion cubic feet of natural gas per year. A second leg of the pipeline through the Baltic Sea is expected to be completed next year.

Gazprom’s stock trades at a little more than 3 times estimated 2011 earnings, which makes it one of the cheapest energy companies in the world. It’s true that Gazprom is not a high-beta stock and the company’s deep ties with the Russian government makes Gazprom a complicated investment. Nevertheless, the current valuation represents a good opportunity for long-term investors