On Tuesday, Berkshire Hathaway Inc. (BRK.A, Financial)(BRK.B, Financial) CEO Warren Buffett (Trades, Portfolio)’s favorite market indicator stood at 153.5%, showing the stock market remains significantly overvalued.

Markets hover near record highs following Halloween weekend

The Dow Jones Industrial Average hit an intraday high of 36,033.90, up 120.06 points from Monday’s close of 35,913.84.

According to the Aggregated Statistics chart, the mean one-month total return among the Dow 30 stocks as of November is 3.27% with a median of 2.62%.

Likewise, the Standard & Poor’s 500 index hit an intraday high of 4,635.15, up 21.48 points from the previous close of 4,613.67.

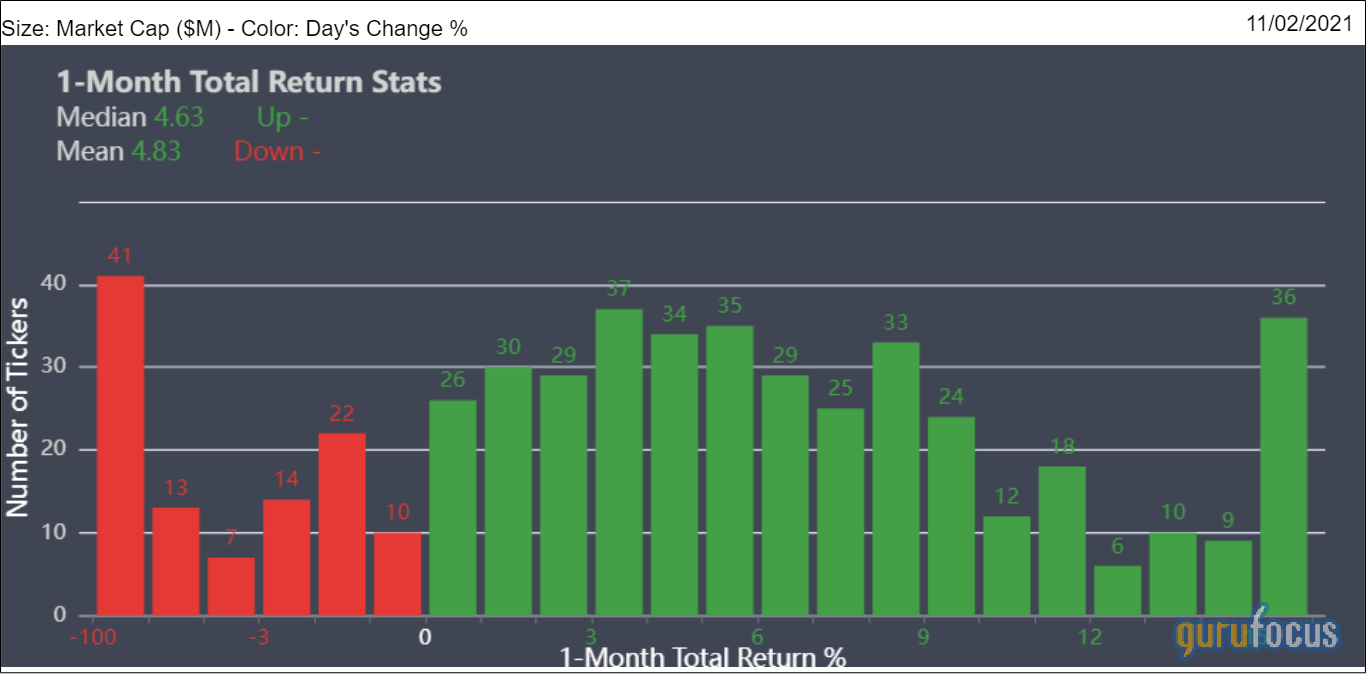

The mean one-month total return among the S&P 500 stocks as of November is 4.83%, with a median of 4.63%.

Stock market remains significantly overvalued

The ratio of total market cap to the sum of gross domestic product and Federal Bank total assets stood at 153.5%, compared to the 20-year-median level of 91.89%. According to the predicted and actual returns chart, the implied market return per year ranges from -5.70% per year assuming a pessimistic case of reversion to 70% of the 20-year-median level to -0.50% per year assuming an optimistic case of reversion to 130% of the 20-year-median level.