Paul Tudor Jones (Trades, Portfolio), founder of Tudor Investment Corp., has revealed his portfolio for the third quarter of 2021. The guru’s top trades included the closure of a position in Alexion Pharmaceuticals Inc. (ALXN), new buys into the S&P 500 ETF Trust (SPY, Financial) and VEREIT Inc. (VER), a reduction in his PPD Inc. (PPD, Financial) position and selling out of his Proofpoint Inc. (PFPT) holding.

While Tudor Investment is best known for its rich history in discretionary macro trading, the firm also has significant experience in model-driven and systematic investment approaches. Management believes that firms must continually innovate in order to compete in rapidly evolving markets and thus commits significant resources to research and development across a variety of strategies in order to expand the firm's edge. Ultimately, Tudor seeks to generate consistent returns for both client and proprietary capital through the use of best-in-class research, trading and investment techniques.

Portfolio overview

At the end of the quarter, the guru’s portfolio contained 2,402 stocks with 599 new holdings. It was valued at $6.15 billion and has seen a turnover rate of 40%. Top holdings at the end of the quarter include Nuance Communications Inc. (NUAN, Financial), the S&P 500 ETF Trust, Kansas City Southern (KSU, Financial), Liberty Broadband Corp. (LBRDK, Financial) and Flagstar Bancorp Inc. (FBC, Financial).

The top sectors represented in the portfolio are technology (17.78%), financial services (11.2%) and industrials (9.02%).

Alexion Pharmaceuticals

The guru’s Alexion Pharmaceuticals (ALXN) position was dissolved during the quarter with the finalization of its acquisition by AstraZeneca (AZN, Financial). The acquisition, completed on July 21 of this year and valued at $39 billion, was expected to give $60 and 2.1243 shares of AstraZeneca for each share of Alexion. GuruFocus estimates Jones gained 16.07% throughout the lifetime of the holding.

Alexion Pharmaceuticals specializes in developing and marketing drugs for rare, life-threatening medical conditions. Its blockbuster product, Soliris, is approved for paroxysmal nocturnal hemoglobinuria (PNH), atypical hemolytic uremic syndrome (aHUS), generalized myasthenia gravis (gMG) and neuromyelitis optica spectrum disorder (NMOSD). Next-generation Ultomiris is approved in PNH and aHUS. Strensiq and Kanuma target ultra rare metabolic diseases. Alexion's pipeline targets rare diseases with high unmet need in hematology, nephrology, metabolic diseases, neurology, cardiology, and other areas.

“I am delighted to be working alongside my new colleagues at Alexion where we will continue to discover, develop and deliver medicines that change the lives of people suffering from rare diseases. We look forward to also applying Alexion’s complement-biology platform across areas of AstraZeneca’s broader early stage pipeline and, significantly, to the extraordinary opportunity to extend existing and future rare disease medicines to patients in many countries where AstraZeneca already has a strong presence,” incoming AstraZeneca CEO Marc Dunoyer said.

S&P 500 ETF Trust

A new buy into the S&P 500 ETF Trust (SPY, Financial) was established after it was sold in the second quarter. The guru purchased 305,273 shares that traded at an average price of $439.92 during the quarter. The new holding is now the second-largest in the portfolio at a 2.13% weighting, and GuruFocus estimates the total gain of the holding at 5.26%.

The ETF has performed exceptionally well with a year-to-date gain of 26.45%. On Nov. 24, shares were trading at $467.23, but showed a loss of 0.23% over the last week.

Shares of the ETF are also owned by Ray Dalio (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio), Jana Partners (Trades, Portfolio), Warren Buffett (Trades, Portfolio) and Al Gore (Trades, Portfolio).

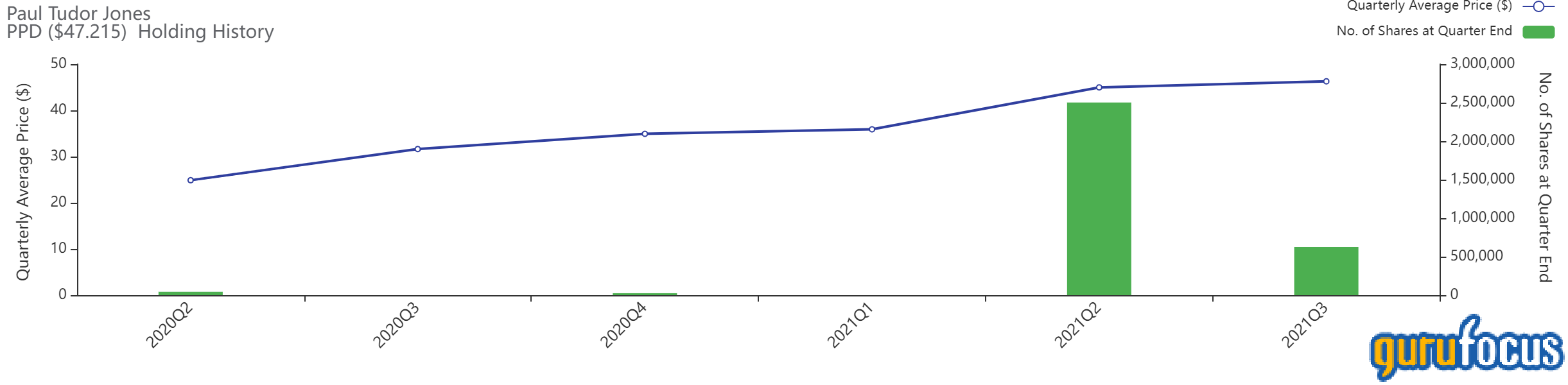

PPD

The quarter saw the guru slash his PPD (PPD, Financial) holding by 75.02% with the sale of 1.87 million shares. The shares traded at an average price of $46.29 throughout the quarter, landing the holding at a total estimated gain of 3.67%. The sale had a -1.64% impact on the portfolio overall.

PPD is a global contract research organization that provides clinical trial and laboratory services to pharmaceutical and diagnostic firms. Thermo Fisher Scientific announced it will acquire PPD for $17.4 billion, which is scheduled to close by the end of 2021.

As of Nov. 24, the stock was trading at $47.22 per share with a market cap of $16.59 billion. The Peter Lynch Chart shows the stock trading above its intrinsic value.

GuruFocus gives the company a financial strength rating of 4 out of 10 and a profitability rank of 5 out of 10. There are currently no severe warning signs issued for the company, but a medium warning sign is issued for the price approaching a 2-year high. The company’s cash-to-debt ratio of 0.27 ranks it worse than 77.06% of industry competitors.

Other top guru shareholders in PPD (PPD, Financial) include George Soros (Trades, Portfolio), Jeremy Grantham (Trades, Portfolio), Jim Simons (Trades, Portfolio), the Signature Select Canadian Fund (Trades, Portfolio) and Mario Gabelli (Trades, Portfolio).

Proofpoint

A holding in Proofpoint (PFPT) was also dissolved during the quarter after the company was acquired by Thoma Bravo (TBA, Financial). The acquisition, completed on Aug. 31 and valued at $12.3 billion, granted shareholders of Proofpoint $176 for each share owned. GuruFocus estimates the holding had a total estimated gain of 7.94%.

Proofpoint is a provider of cloud-based security solutions to large- and mid-sized organizations in a wide range of industries. The firm's solutions are delivered through its security-as-a-service platform, which hosts an integrated set of on-demand data protection applications. These solutions include threat protection, incident response, regulatory compliance, archiving, governance and secure communication capabilities. The company derives revenue from subscription fees and hardware, training and professional services fees. The majority of the firm's revenue is generated in the United States.

Gary Steele, Chairman and CEO of Proofpoint, said, “We are excited about this next chapter in our company’s journey. Proofpoint is well positioned to benefit from Thoma Bravo’s significant experience investing in software companies and overall approach to value creation. We look forward to building on our offerings to continue preventing, defending and responding to both today’s and tomorrow’s cybersecurity threats. I’m extremely grateful to our team members whose dedication and hard work have contributed to Proofpoint’s success and made this possible and, together, I know we’ll deliver even more innovative solutions for our customers.”

VEREIT

Rounding out the guru’s top trades was a new buy into VEREIT (VER). The holding was established with the purchase of 1.23 million shares that traded at an average price of $48.57 during the quarter. The purchase had a 0.91% impact on the portfolio and GuruFocus estimates the total gain of the holding at 4.72%.

VEREIT is a real estate investment trust primarily involved in the ownership of property located in the U.S. and Canada. VEREIT organizes its operations through the Real Estate Investment segment and the investment management segment. The company derives the vast majority of its income from its Real Estate Investment division in the form of rental income from long-term leases. This business unit owns and manages a real estate portfolio that is fairly evenly diversified between retail, restaurant, office and industrial properties. A sizable amount of the company's total rental income is derived from customers in the casual dining restaurant and manufacturing industries.

On Nov. 1, VEREIT completed its merger with Realty Income Corp. (O, Financial). Under the terms of the merger agreement, VEREIT stockholders were entitled to receive, for each share of VEREIT common stock held, 0.705 shares of Realty Income common stock.

"We are pleased to announce the completion of our merger with VEREIT, strengthening our position as the leading net lease REIT and global consolidator of the net lease space," said Sumit Roy, Realty Income's president and CEO. "With the closing of the VEREIT merger, we believe our size, scale and diversification will further enhance many of our competitive advantages, accelerate our investment activities, and enhance shareholder value for years to come. I thank all of our employees for their tireless efforts to achieve this milestone and welcome our new colleagues to our 'One Team'."