Moore Capital Management, founded by Louis Moore Bacon (Trades, Portfolio) in 1989, has revealed its portfolio for the third quarter of 2021. The firm’s major trades include reductions to its Amazon.com Inc. (AMZN, Financial) and Affirm Holdings Inc. (AFRM, Financial) positions, selling out of holdings in The Energy Select Sector SPDR Fund (XLE, Financial) and Meta Platforms Inc. (FB, Financial) alongside a new buy into Canadian National Railway Co. (CNI, Financial).

The firm uses a bold and global macro-based approach to investing. After 30 years of operation, the hedge fund closed itself to outside investors in late 2019 and consolidated its three flagship funds into one proprietary fund. Regarding the new arrangement, Bacon wrote, "now I am once again concentrating on my personal investment account while overseeing a large multi-asset alternatives platform."

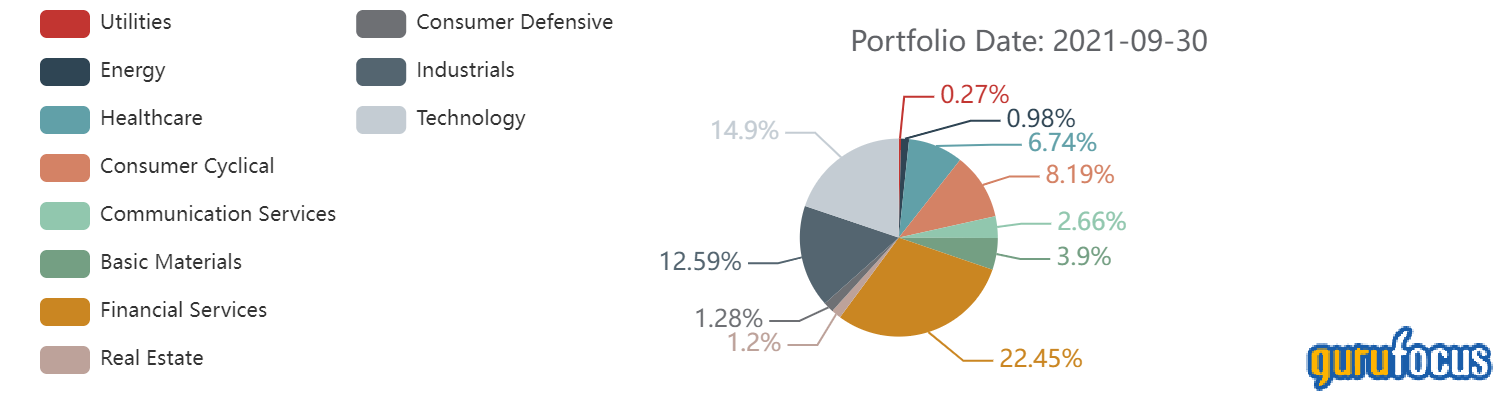

Portfolio overview

At the end of the quarter, the firm’s equity portfolio contained 786 stocks with 175 new holdings. It was valued at $6.53 billion and has seen a turnover rate of 30%. The firm’s top holdings include Microsoft Corp. (MSFT, Financial), Fisker Inc. (FSR, Financial), Services Now Inc. (NOW, Financial), Canadian National Railway and Moderna Inc. (MRNA, Financial).

The top sectors represented in the firm’s portfolio are financial services (22.45%), technology (14.9%) and industrials (12.59%).

Amazon

The firm slashed its Amazon (AMZN, Financial) holding by 97.04% with the sale of 40,984 shares. The shares traded at an average price of $3,451.22 throughout the quarter, landing the firm at a total estimated gain of 43.11% on the holding. Overall, the sale had a -2% impact on the firm’s equity portfolio.

Amazon is a leading online retailer and one of the highest-grossing e-commerce aggregators, with $386 billion in net sales and approximately $482 billion in estimated physical-digital online gross merchandise volume, or GMV, in 2020. Retail-related revenue represented approximately 83% of total sales, followed by Amazon Web Services' cloud computing, storage, database and other offerings (12%), and advertising services and co-branded credit cards (6%). International segments constituted 27% of Amazon's non-AWS sales in 20202, led by Germany, the U.K. and Japan.

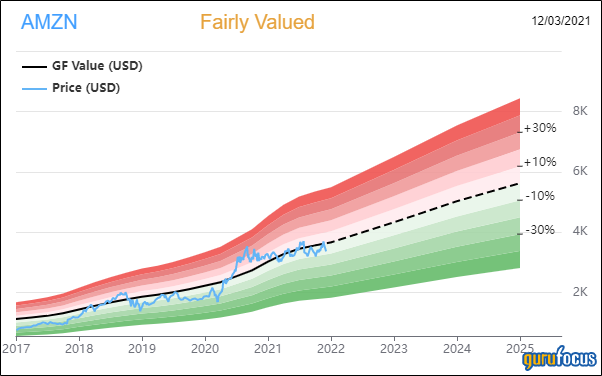

On Dec. 3, the stock was trading at $3,364 per share with a market cap of $1.70 trillion. According to the GF Value Line, the stock is trading at a fair value rating.

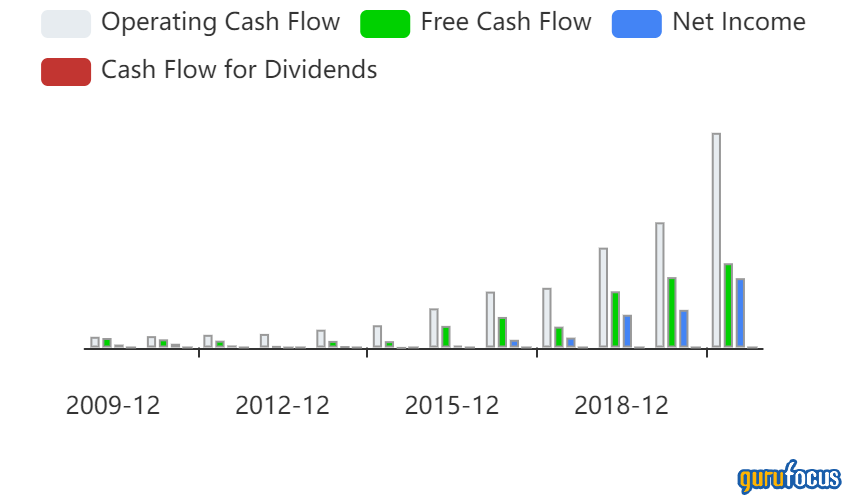

GuruFocus gives the company a financial strength rating of 6 out of 10, a profitability rank of 8 out 10 and a valuation rank of 3 out of 10. There is one severe warning sign issued for assets growing faster than revenue. The company has drastically increased cash flows over the last decade, opening up plenty of opportunities to reinvest and develop new technology.

Baillie Gifford (Trades, Portfolio), Ken Fisher (Trades, Portfolio), Pioneer Investments, Spiros Segalas (Trades, Portfolio) and Frank Sands (Trades, Portfolio) maintain the largest guru positions in Amazon (AMZN, Financial).

Affirm

The guru’s firm also pulled back its Affirm (AFRM, Financial) holding during the quarter. It sold 1.60 million shares to cut the holding back by 99.07% as the shares traded at an average price of $79.94. GuruFocus estimates the firm has lost 4.07% on the holding and the sale had a -1.53% impact on the equity portfolio overall.

Affirm offers a platform for digital and mobile-first commerce. It comprises a point-of-sale payment solution for consumers, merchant commerce solutions and a consumer-focused app. The company generates its revenue from merchant networks and through virtual card networks, among others. Geographically, it generates a major share of its revenue from the United States.

As of Dec. 3, the stock was trading at $108.23 per share with a market cap of $30.33 billion. The stock rallied through the beginning of November to hit a peak of almost $170 per share.

GuruFocus gives the company a financial strength rating of 5 out of 10 and a profitability rank of 1 out of 10. There are no severe warning signs issued for the company, but a medium warning sign was issued for insiders selling shares. The company has generated increased revenue over the last several years, but has failed to pull net income out of the red.

Affirm (AFRM, Financial) shares are also owned by Baillie Gifford (Trades, Portfolio), Philippe Laffont (Trades, Portfolio), Pioneer Investments, Chase Coleman (Trades, Portfolio) and Paul Tudor Jones (Trades, Portfolio).

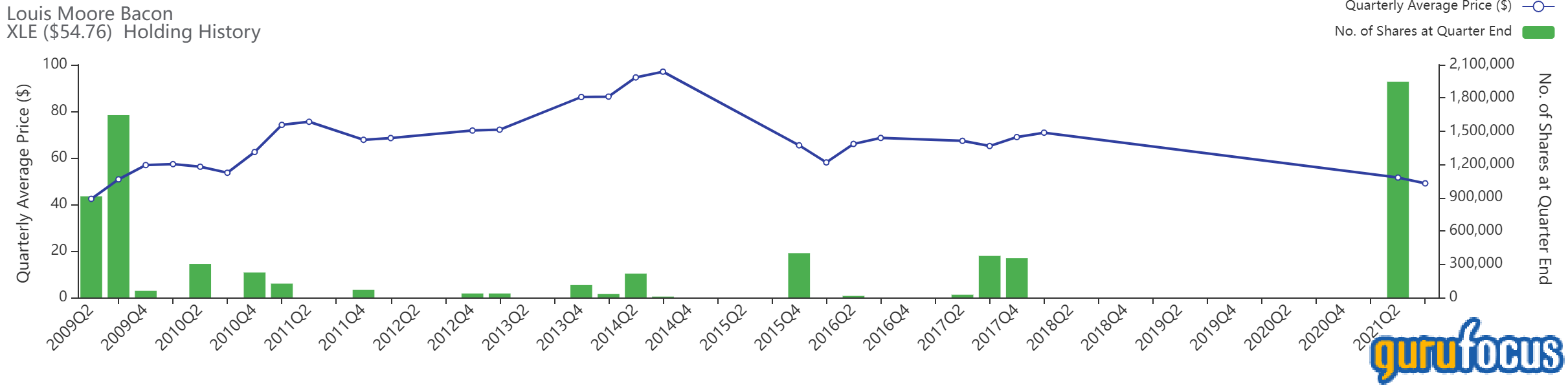

Energy Select Sector ETF

A holding in The Energy Select Sector (XLE, Financial) ETF was cut from the portfolio during the quarter. The firm sold all 1.94 million shares at an average price of $49.03 during the three-month span. The sale had a -1.49% impact on the equity portfolio and GuruFocus estimates the holding maintained a 5.27% gain throughout its lifetime.

The exchange-traded fund traded at $54.76 per share on Dec. 3. It has performed well with a year-to-date gain of 51.53% that far outshines the S&P 500 Trust ETF (SPY, Financial)’s gain of 23.52% over the same period.

Shares of the ETF are also maintained by David Tepper (Trades, Portfolio), Steven Cohen (Trades, Portfolio), George Soros (Trades, Portfolio), Ken Fisher (Trades, Portfolio) and Mario Gabelli (Trades, Portfolio).

Meta Platforms

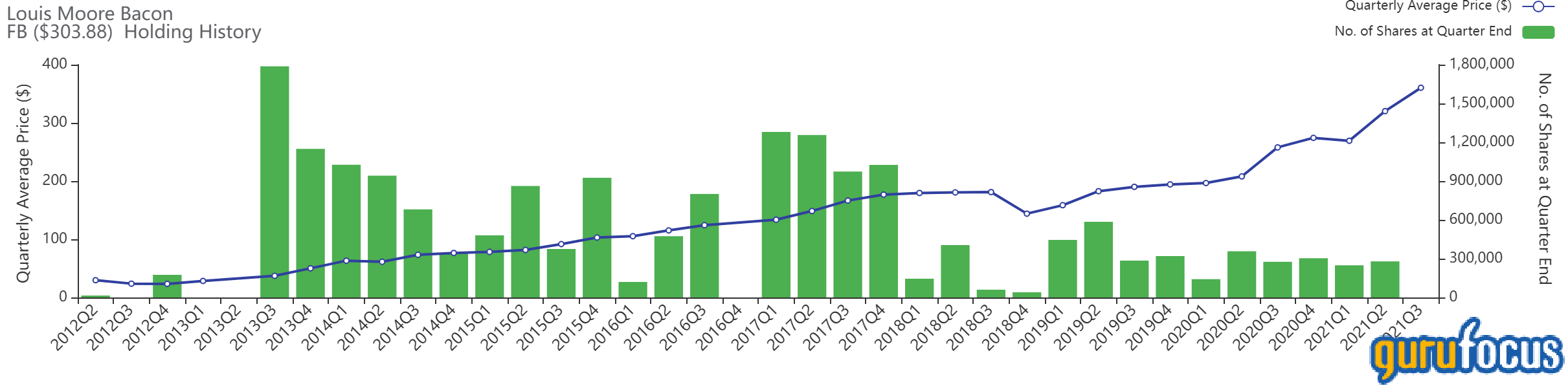

The firm cut ties with its Meta Platforms (FB, Financial) position after a small addition in the second quarter. The 278,919 shares traded at an average price of $360.33 during the quarter, which landed the firm at a total estimated gain of 37.21% on the position. The sale pulled the portfolio down by 1.38%.

Meta Platforms, formerly Facebook, is the world's largest online social network with 2.5 billion monthly active users. Users engage with each other by exchanging messages and sharing news events, photos and videos. On the video side, the company is in the process of building a library of premium content and monetizing it via ads or subscription revenue. Facebook refers to this as Facebook Watch. Its ecosystem consists mainly of the Facebook app, Instagram, Messenger, WhatsApp and many features surrounding these products.

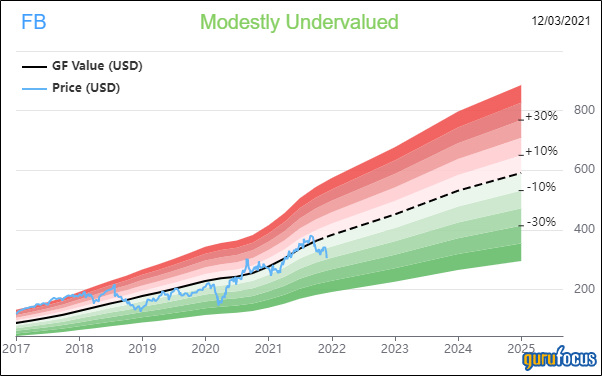

On Dec. 3, the stock was trading at $305.07 per share with a market cap of $848.63 billion. According to the GF Value Line, the stock is trading at a modestly undervalued rating.

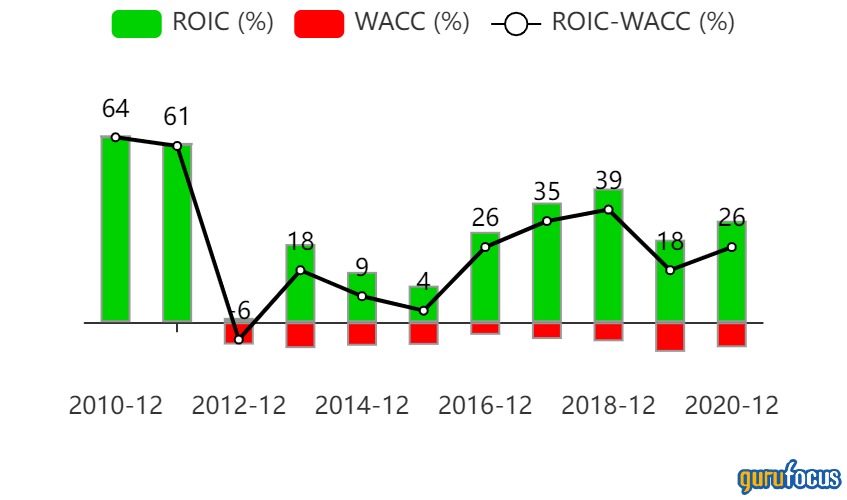

GuruFocus gives the company a financial strength rating of 7 out of 10 and a profitability rank of 9 out of 10. There are currently two severe warning signs issued for a declining gross margin and a declining operating margin. The company has settled back into strong returns on invested capital after a short struggle in the early 2010s.

Meta (FB, Financial) shares are also owned by Baillie Gifford (Trades, Portfolio), Ken Fisher (Trades, Portfolio), Frank Sands (Trades, Portfolio), Pioneer Investments and Chase Coleman (Trades, Portfolio).

Canadian National Railway

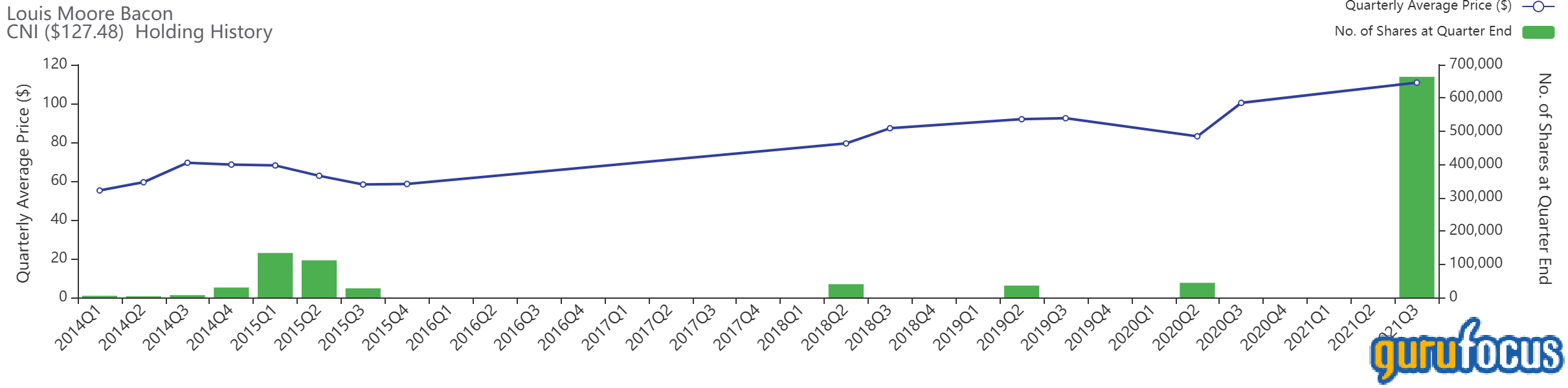

Rounding out the firm’s top trades was a new buy into Canadian National Railway (CNI, Financial) that landed as the firm’s fourth-largest holding. It was established with 663,440 shares that were purchased at an average price of $110.76 throughout the quarter. Overall, the purchase had a 1.17% impact on the equity portfolio and GuruFocus estimates the total gain on the holding at 11.87%.

Canadian National's railway spans Canada from coast to coast and extends through Chicago to the Gulf of Mexico. In 2019, the company delivered almost 6 million carloads over its 19,600 miles of track. It generated roughly 14 billion Canadian dollars ($10.9 billion) in total revenue by hauling intermodal containers (25% of consolidated revenue), petroleum and chemicals (21%), grain and fertilizers (16%), forest products (12%), metals and mining (11%), automotive shipments (6%) and coal (4%).

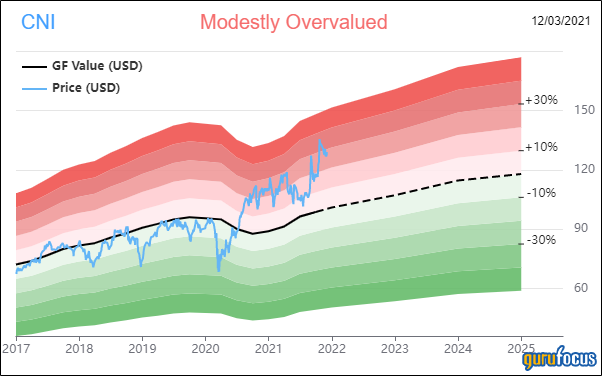

As of Dec. 3, the stock was trading at $127.48 per share with a market cap of $90 billion. The GF Value Line shows the stock trading at a modestly overvalued rating.

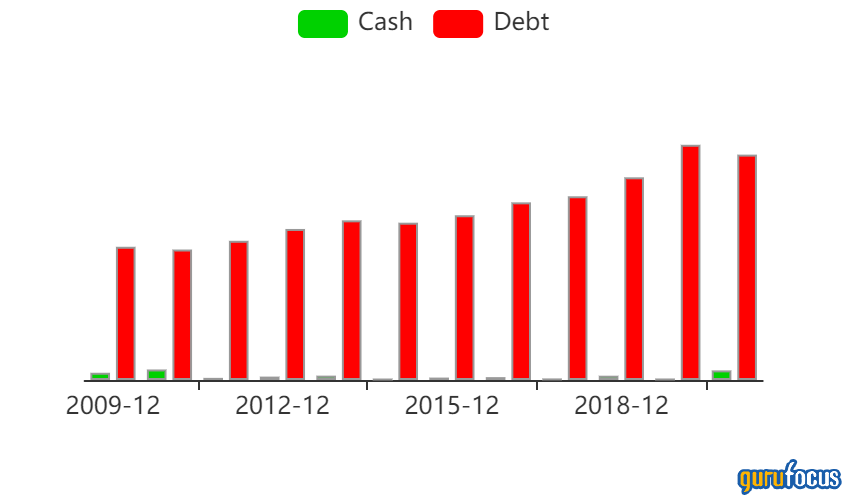

GuruFocus gives the company a financial strength rating of 5 out of 10, a profitability rank of 9 out of 10 and a valuation rank of 1 out of 10. There are two severe warning signs issued for a declining gross margin and a declining operating margin. The company’s cash-to-debt ratio of 0.16 ranks worse than 71.62% of industry competitors, but is well above the company’s 10-year median of 0.03.

Other top guru shareholders in Canadian National Railway (CNI, Financial) include Bill Gates (Trades, Portfolio)' foundation trust, Pioneer Investments, Steven Cohen (Trades, Portfolio), Ray Dalio (Trades, Portfolio) and Jim Simons (Trades, Portfolio)' Renaissance Technologies.