After posting three straight days of gains, U.S. market indexes were down on Thursday morning in anticipation of the consumer price index for November being released by the Labor Department on Friday.

The Dow Jones Industrial Average slid 148 points, or 0.4%, while the S&P 500 Index and the tech-heavy Nasdaq Composite each retreated 0.3%.

As a result, investors may be looking to buy financially strong companies that qualify for Benjamin Graham’s Lost Formula screen, a Premium GuruFocus feature.

Prior to his death in 1976, the author of "Security Analysis" and "The Intelligent Investor" developed a refined formula that screened for companies with a price-earnings ratio of less than 10 and an equity-to-asset ratio of at least 0.5. The formula got its name from that fact that he was unable to publish it before his passing; therefore, it was lost from public knowledge for a time. Since Graham also prioritized a minimum interest coverage of 5 with the companies he invested in, that element was included in the criteria as well.

A backtest of the strategy from 1926 to 1976 showed it would have outperformed the Dow benchmark by approximately twice as much.

As supply shortages for a variety of goods are impacting the market, investors may be especially interested in finding value opportunities in the basic materials sector.

The screener found that as of Dec. 9, companies that met the criteria were Reliance Steel & Aluminum Co. (RS, Financial), Commercial Metals Co. (CMC, Financial), Boise Cascade Co. (BCC, Financial), Schnitzer Steel Industries Inc. (SCHN, Financial) and Nucor Corp. (NUE, Financial).

GuruFocus’ Industry Overview shows that four of these companies are among the largest players in the steel industry, while Boise Cascade, a lumber company, is the fourth-largest player in the forest products space.

Reliance Steel & Aluminum

Reliance Steel & Aluminum (RS, Financial) has a $9.75 billion market cap; its shares were trading around $155.33 on Thursday with a price-earnings ratio of 8.96, a price-book ratio of 1.67 and a price-sales ratio of 0.82.

The Los Angeles-based company operates a metals service center, providing metal processing and inventory management services. It provides over 100,000 product types to the nonresidential construction, automotive, aerospace, energy, transportation and heavy equipment end markets.

The GF Value Line suggests the stock is fairly valued currently based on its historical ratios, past performance and future earnings projections.

GuruFocus rated Reliance’s financial strength 7 out of 10. In addition to a comfortable level of interest coverage and an equity-to-asset ratio of 0.63, the high Altman Z-Score of 4.98 indicates the company is in good standing. The return on invested capital also overshadows the weighted average cost of capital, indicating value is being created as the company grows.

The company’s profitability scored an 8 out of 10 rating, driven by an expanding operating margin as well as strong returns on equity, assets and capital that outperform a majority of competitors. Reliance also has a high Piotroski F-Score of 7 out of 9, indicating business conditions are healthy. Consistent earnings and revenue growth also contributed to a predictability rank of four out of five stars. According to GuruFocus, companies with this rank return an average of 9.8% annually over a 10-year period.

Of the gurus invested in Reliance, Pioneer Investments has the largest position with 1.1% of its outstanding shares. Chuck Royce (Trades, Portfolio), Jim Simons (Trades, Portfolio)’ Renaissance Technologies, Jeremy Grantham (Trades, Portfolio), Lee Ainslie (Trades, Portfolio) and Joel Greenblatt (Trades, Portfolio) also own the stock.

Commercial Metals

Commercial Metals (CMC, Financial) has a market cap of $3.94 billion; its shares were trading around $32.22 on Thursday with a price-earnings ratio of 9.56, a price-book ratio of 1.71 and a price-sales ratio of 0.59.

The metal manufacturer, which is headquartered in Irving, Texas, primarily makes rebar and structural steel for the nonresidential construction sector. It also operates a number of scrap metal recycling facilities.

According to the GF Value Line, the stock is modestly overvalued currently.

Commercial Metals’ financial strength was rated 6 out of 10 by GuruFocus, driven by an equity-to-asset ratio of 0.5, adequate interest coverage and a high Altman Z-Score of 4. The ROIC also eclipses the WACC, so value creation is occurring.

The company’s profitability fared better, scoring a 7 out of 10 rating. While the operating margin is expanding, its returns outperform over half of its industry peers. Commercial Metals also has a moderate Piotroski F-Score of 5, suggesting conditions are typical for a stable company, as well as a one-star predictability rank. GuruFocus says companies with this rank return an average of 1.1% annually.

With a 0.94% stake, Fairholme leader Bruce Berkowitz (Trades, Portfolio) is the company’s largest guru shareholder. Richard Snow (Trades, Portfolio), Royce, Hotchkis & Wiley, Ray Dalio (Trades, Portfolio)’s Bridgewater Associates, Steven Cohen (Trades, Portfolio) and First Eagle Investment (Trades, Portfolio)s also have positions in Commerical Metals.

Boise Cascade

Boise Cascade (BCC, Financial) has a $2.59 billion market cap; its shares were trading around $65.88 on Thursday with a price-earnings ratio of 4.58, a price-book ratio of 1.97 and a price-sales ratio of 0.35.

The Boise, Idaho-based forest products company provides engineered wood products, building materials and plywood.

Based on the GF Value Line, the stock appears to be fairly valued currently.

Boise Cascade’s financial strength and profitability were both rated 7 out of 10 by GuruFocus. In addition to a comfortable level of interest coverage and a equity-to-asset ratio of 0.5, the high Altman Z-Score of 6.3 indicates the company is in good standing. Value creation also appears to be occurring since the ROIC exceeds the WACC.

The company is supported by an expanding operating margin, returns that outperform a majority of competitors and a high Piotroski F-Score of 7. Steady earnings and revenue growth have also contributed to a three-star predictability rank. GuruFocus data shows companies with this rank return, on average, 8.2% annually.

Simons’ firm has the largest position in Boise Cascade with 0.41% of its outstanding shares. Other top guru shareholders are Hotchkis & Wiley, Pioneer Investments, Greenblatt, Royce, Ainslie, John Hussman (Trades, Portfolio) and Grantham.

Schnitzer Steel Industries

Schnitzer Seel Industries (SCHN, Financial) has a market cap of $1.33 billion; its shares were trading around $48.42 on Thursday with a price-earnings ratio of 8.58, a price-book ratio of 1.59 and a price-sales ratio of 0.52.

Headquartered in Portland, Oregon, the company manufactures steel as well as operates scrap metal recycling centers, which collect auto bodies, rail cars, appliances, machinery and construction demolition products.

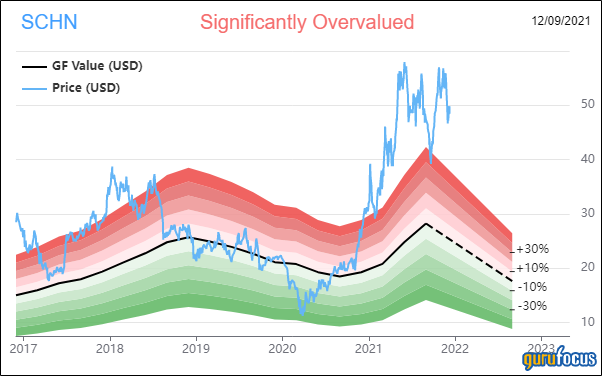

The GF Value Line suggests the stock is significantly overvalued currently.

Schnitzer’s financial strength and profitability were both rated 6 out of 10 by GuruFocus. In addition to a comfortable level of interest coverage and an equity-to-asset ratio of 0.56, the Altman Z-Score of 4.47 indicates the company is in good standing. The ROIC also surpasses the WACC, so value is being created.

The company is further supported by operating margin expansion, strong returns that outperform a majority of industry peers and a high Piotroski F-Score of 7. Schnitzer also has a one-star predictability rank.

Of the gurus invested in Schnitzer, Grantham has the largest holding with 0.33% of its outstanding shares. Simons’ firm and Paul Tudor Jones (Trades, Portfolio) also see value in the stock.

Nucor

Nucor (NUE, Financial) has a $32.06 billion market cap; its shares were trading around $112.05 on Thursday with a price-earnings ratio of 6.7, a price-book ratio of 2.38 and a price-sales ratio of 1.06.

The Charlotte, North Carolina-based company produces steel and related products. It is also the largest recycler of scrap metal in North America.

According to the GF Value Line, the stock is modestly overvalued currently.

GuruFocus rated Nucor’s financial strength 6 out of 10. Although the company has issued new long-term debt in recent years, it is manageable due to sufficient interest coverage. The company also has a equity-to-asset ratio of 0.54 and a robust Altman Z-Score of 5.11, indicating it is in good standing. The ROIC is significantly higher than the WACC, so value is being created as the company grows.

The company’s profitability scored a 7 out of 10 rating on the back of an expanding operating margin, strong returns that top a majority of competitors as well as a high Piotroski F-Score of 7. Nucor also has a one-star predictability rank.

Holding 0.32% of its outstanding shares, Pioneer Investments is Nucor’s largest guru shareholder. Other top guru investors are Ken Fisher (Trades, Portfolio), Jones, Greenblatt, Snow, Simons’ firm, Grantham, Dodge & Cox, Scott Black (Trades, Portfolio) and Jeff Auxier (Trades, Portfolio).