In light of increasing geopolitical turmoil across the globe, five tech stocks with high profitability, high guru ownership and are trading at fair GF Values are Microsoft Corp. (MSFT, Financial), Adobe Inc. (ADBE, Financial), Salesforce.com Inc. (CRM, Financial), Intuit Inc. (INTU, Financial) and Accenture PLC (ACN, Financial) according to the All-in-One Screener, a Premium feature of GuruFocus.

U.S. markets gyrate as Russia invades Ukraine, stoking geopolitical uncertainty

On Thursday, the Dow Jones Industrial Average closed at 33,223.83, up 92.07 points from Wednesday’s close of 33,131.76 despite shedding more than 850 points at the intraday low of 32,272.64. Likewise, the Standard & Poor’s 500 Index and the Nasdaq Composite Index gained 1.5% and 3.34% despite opening in the red.

Stocks initially sold off on the back of Russia launching its invasion of Ukraine, stoking geopolitical uncertainty and sending European stock markets down more than 3%. Despite this, the average day’s change for the S&P 500 stocks is 1.12% with a mean of 0.88%: According to Aggregated Portfolio statistics, a Premium feature, 323 stocks finished in the green while 183 stocks closed in the red.

Wedbush Securities analyst Dan Ives said in an analyst note that while such geopolitical shocks may each be unique, the wealth management firm has continued seeking “tech winners” that it views as “oversold in a panic-like selloff” since 2000.

As such, investors may find opportunities in tech stocks that have high profitability, high guru ownership and are trading at fair GF Values. Patterned after Peter Lynch’s earnings line, GuruFocus’ exclusive valuation method considers a company’s historical valuations and adjusts for past performance and future growth estimates.

GuruFocus’ Screener listed five technology stocks that have high profitability, at least 10 gurus owning shares as of the fourth quarter of 2021 and are trading at a price-to-GF Value ratio between 0.6 and 1.2, suggesting moderate undervaluation to fair valuation.

Microsoft

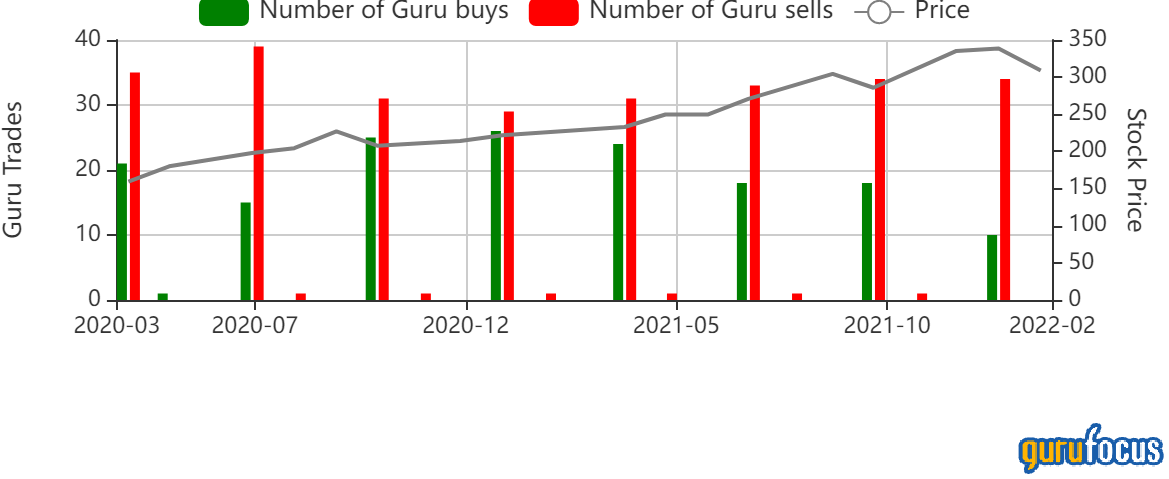

Sixty-one gurus own shares of Microsoft (MSFT, Financial) with a combined weight of 201.99%.

Shares of Microsoft traded around $287.21, showing the stock is fairly valued based on Thursday’s price-to-GF Value ratio of 1.03.

GuruFocus ranks the Redmond, Washington-based software giant’s profitability 9 out of 10 on several positive investing signs, which include a high Piotroski F-score of 8 and profit margins and returns that are outperforming more than 96% of global competitors.

Gurus with holdings in Microsoft include Ken Fisher (Trades, Portfolio)’s Fisher Investments, PRIMECAP Management (Trades, Portfolio) and Dodge & Cox.

Adobe

Twenty-two gurus own shares of Adobe (ADBE, Financial) with a combined weight of 20.30%.

Shares of Adobe traded around $456.78, showing the stock is modestly undervalued based on Thursday’s price-to-GF Value ratio of 0.79.

GuruFocus ranks the San Jose, California-based software company’s profitability 10 out of 10 on several positive investing signs, which include a high Piotroski F-score of 7 and profit margins and returns that are outperforming more than 93% of global competitors.

Salesforce.com

Twenty gurus own shares of Salesforce.com (CRM, Financial) with a combined weight of 16.60%.

Shares of Salesforce.com traded around $201.95, showing the stock is modestly undervalued based on Thursday’s price-to-GF Value ratio of 0.79.

GuruFocus ranks the San Francisco-based customer relationship management software company’s profitability 7 out of 10 on several positive investing signs, which include a 4.5-star business predictability rank and three-year revenue and earnings growth rates outperforming more than 76% of global competitors.

Intuit

Nineteen gurus own shares of Intuit (INTU, Financial) with a combined weight of 11.62%.

Shares of Intuit traded around $490.61, showing the stock is fairly valued based on Thursday’s price-to-GF Value ratio of 1.08.

GuruFocus ranks the Mountain View, California-based accounting and tax software company’s profitability 9 out of 10 on several positive investing signs, which include profit margins and returns outperforming more than 89% of global competitors.

Accenture

Eighteen gurus own shares of Accenture (ACN, Financial) with a combined weight of 16.05%.

Shares of Accenture traded around $314.75, showing the stock is modestly overvalued based on Thursday’s price-to-GF Value ratio of 1.14.

GuruFocus ranks the Irish consulting company’s profitability 10 out of 10 on several positive investing signs, which include a five-star business predictability rank, a high Piotroski F-score of 8 and profit margins and returns that outperform more than 90% of global competitors.