Last week, PriceSmart Inc. (PSMT, Financial) announced record operating results for the fiscal second quarter of 2022, which ended on Feb. 28, notching net merchandise sales of more than $1 billion for the first time in its history. Yet some question its amount of debt.

The San Diego-based operator of 49 warehouse clubs in 12 countries and one U.S. territory on Thursday reported total revenue for the quarter increased 10.8% to $1.04 billion, compared to $937.6 million in the comparable period of the prior year. Net merchandise sales increased 12.6% to $1.01 billion from $898.4 million.

The company recorded operating income of $48.3 million, which was up from operating income of $45 million in the prior-year period. Net income attributable to PriceSmart was $31.5 million, or $1.03 per diluted share, in the second quarter as compared to $28.2 million, or 92 cents per diluted share, in the year-ago quarter.

CEO Sherry S. Bahrambeygui said, "Our team achieved a record second quarter, with net merchandise sales of more than $1 billion for the first time in our company's history. The favorable results for the quarter were driven by net merchandise sales growth of 12.6% and comparable net merchandise sales growth of 10.3% as compared to the same period last year. Our 12-month trailing membership renewal rate was a record 89.8%, and our membership base has grown to its all-time high.”

The company also noted this quarter marked record performance in net merchandise sales, earnings per share, membership base and renewal rates. Management continued its pursuit of its three drivers of growth, which include expanding the company’s real estate footprint, enhancing member benefits and increasing incremental sales through PriceSmart.com.

“Through our digital presence, we are increasing our engagement with Members which also helps drive in-club sales,” Bahrambeygui explained. “We believe that our investments in these drivers of growth are providing positive momentum and results for the company.” Executives plan to open their second club in Jamaica this week, located in the city of Portmore, marking the company's 50th warehouse club.

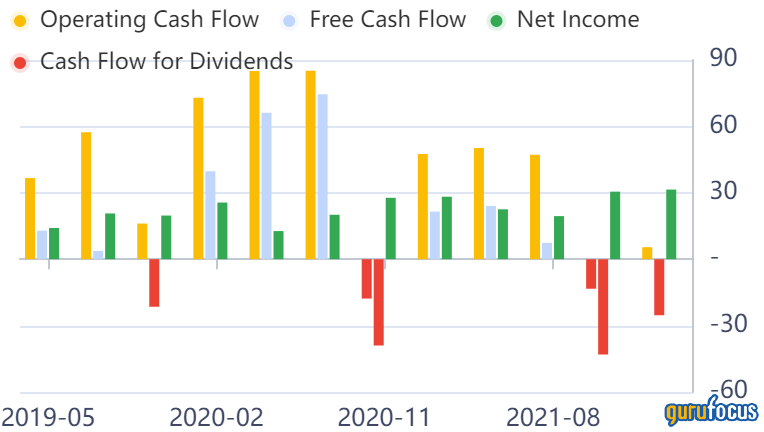

It is the debt load carried by PriceSmart - which owns and operates U.S.-style membership shopping warehouse clubs in Latin America and the Caribbean, selling high-quality merchandise and services at low prices to members – that has drawn some investors’ attention. PriceSmart “may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt,” SimplyWall.St recently reported. “Looking at the most recent three years, PriceSmart recorded free cash flow of 41% of its Ebit, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.”

Bahrambeygui said during an earnings call that her company’s cash flow was “robust,” enabling it to accelerate plans and investments to continue to drive growth. She pointed out that management is still grappling with the impact of the pandemic, “significant” supply chain disruptions and the “challenges of an inflationary environment that we haven't seen in decades.”

As a result of many of these factors and the performance of the company in the second quarter, the board of directors increased the annual dividend by 22.9% to 86 cents per share, up from 70 cents per share last year.