Domino's Pizza Inc. (DPZ, Financial), the largest pizza company in the world, got roughed up in the first quarter of 2022, falling short of estimates for both earnings per share and revenue and seeing net income plummet.

Diluted earings for the three months ended March 27 were $2.50 per share, a decrease of 16.7% from the prior-year quarter, management reported on Thursday. Global retail sales increased 3.6%, excluding the negative impact of foreign currency. Without adjusting for the impact of foreign currency, global retail sales increased 0.3%.

U.S. same-store sales, however, were not so rosy as they declined 3.6%. This is the second time the chain has had a decline in this metric in the last three quarters. As nutrition site EatThis.com noted dryly, “Turns out the demand for Domino's pizza is finite after all.”

The Ann Arbor, Michigan-based company said international same-store sales (excluding the impact of foreign currency) increased 1.2% during the quarter, marking the 113th consecutive quarter of growth. Domino's recorded global net store growth of 213 stores, which was comprised of 37 U.S. store openings and 176 international store openings.

Net income decreased 22.8% from a year ago to $91 million. Domino's noted the decrease was primarily driven by lower income from operations of $22 million resulting from lower U.S. company-owned store and supply chain operating margins as well as higher general and administrative expenses.

Following the disappointing results, Domino’s shares were trading at $346.80, down $7.08 or 2%, at noon on Friday.

At these levels, the GF Value Line, which takes historical ratios, past financial performance and future earnings projections into account, suggests the stock is modestly undervalued.

In a statement, outgoing CEO Ritch Allison emphasized the company "faced a number of headwinds" during the quarter, including the Omicron surge, staffing shortages and unprecedented inflation.

"We are actively implementing strategies designed to address them; however, we expect some of these headwinds are likely to persist further into 2022," he said. "The strength of the Domino's brand is not defined in the short term, but instead by our outstanding long-term track record and the ongoing commitment of our team members and franchisees, as evidenced by continued strong store growth, including the opening of our 19,000th global store during the quarter. As I hand the leadership of the company over to Russell Weiner on May 1, I do so with great confidence that he and our talented team will take this great global brand to the next level in the years to come."

In response to labor shortages, the pizza chain has been offering a $3 discount to customers for pick-up orders, but the promotion has had little effect.

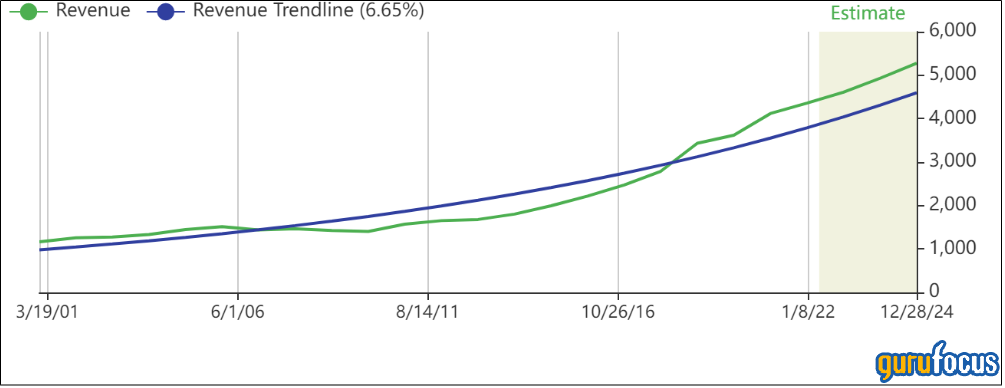

Revenue increased 2.8% from the pror-year quarter to $1.01 billion, primarily due to higher supply chain revenues attributable to increases in market basket pricing to stores.

On April 26, Domino's board of directors declared a quarterly dividend of $1.10 per share on its outstanding common stock for shareholders of record as of June 15. The payment will be made on June 30.