Twin Disc makes transmissions, shift controllers, propellers, water jets and other industrial power transmission products for marine and industrial vehicles. You can get an idea of what products they sell from the links below.

The stock dropped 18% on earnings announcement in January and is now down 27% YTD.

But, does it offer any value?

Verdict

This is quite a big jump in the 6 month backlog. Shows that there is potential and demand for their products provided the economy helps.

However, TWIN is better than most small industrial companies because they design specially engineered products to meet and serve market demand. If they continue to research and develop products, they can grow but it is difficult to differentiate from competitors.

Add in the fact that the majority of company growth has to come from an improving economy. These types of companies are under heavy economic influences. Unless there is a total product in a truck or boat, customers are not inclined to purchase their products. Or if money is tight, it is easy to get a part serviced or fixed versus replaced.

Even the goodwill section in the annual report does not show anything significant in terms of hidden assets or relationships which could be interpreted as a moat.

Financial Numbers and Quick Valuation

Even if I use 9% discount rate, the expected growth rate is 14%. Much too high for a cyclical company.

Performing a reverse Graham with EPS of $1.60, the implied growth rate is 9%. Achievable but difficult in my opinion given the risk and the environment in which it does business.

The reproduction value of the business comes out to around mid to high $20’s so there is potential in terms of maximizing value out of its assets.

But overall, valuation wise, it looks fairly to slightly overvalued purely based on these numbers.

If the company announces a share buyback, it will be a clear indicator that management believes their stock price to be cheap. I would prefer to see other insiders other than the CEO to purchase shares.

Fundamentally, the company is average, but management has done a good job of maximizing the potential during the good years.

With that said, the upside does not outweigh the downside. Far too many things could go wrong before upside could materialize.

Think of it as probabilities. Even with the big drop YTD, the upside is maybe 30-40% max whereas the downside percentage is easily 40% and could be greater if the economy continues to slide.

- http://www.twindisc.com/MarineProducts/MarineProducts.html

- http://www.twindisc.com/IndustrialProducts/IndustrialProducts.html

- Pleasure craft (boats)

- Commercial and military marine market

- Energy and natural resources

- Government and industrial markets

The stock dropped 18% on earnings announcement in January and is now down 27% YTD.

But, does it offer any value?

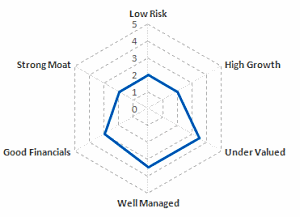

Twin Disc Spider Graph

Verdict

- Management: B

- Growth: B

- Moat: C

- Risk: C

- Valuation: B

- Overall: B-

Findings on Management

- Michael E. Batten owns 22.7% of the company. Batten is chairman and CEO.

- Remaining 10 executives and directors own 3%

- From the Def-14A: “The Corporation believes that its executive officers should hold a meaningful stake in Twin Disc in order to align their economic interests with those of the shareholders.” - Ironic that 10 insiders hold 0.3% of shares each given this statement.

- From 2008 – 2009, company hired an independent consultant to review salaries. In 2010, due to recession and to reduce cost, salaries were cut by 5-15% without independent review. In 2011, salaries were restored to previous levels without independent review. In 2012, independent consultant was rehired.

- Funny thing is that the list of comparable companies in the compensation survey includes hundreds of non related companies like Coach, Heinz, Time Warner, 7-Eleven and health insurance companies.

- Comparing 2009 to 2011 (since 2010 was a paycut), Batten increased his total compensation by 32%. Batten’s son, the President and COO increased total compensation by 31%. CFO increased compensation 40%. The pay reduction in 2010 seems to have been more strategic than anything else.

- Executive pay comes out to 2% of sales.

- Barely any insider buys.

Company Growth

TWIN sells to the oil industry and at the moment with oil prices increasing, their 6 month backlog as of June 2011 was $146.9m vs $84.4m.This is quite a big jump in the 6 month backlog. Shows that there is potential and demand for their products provided the economy helps.

However, TWIN is better than most small industrial companies because they design specially engineered products to meet and serve market demand. If they continue to research and develop products, they can grow but it is difficult to differentiate from competitors.

Add in the fact that the majority of company growth has to come from an improving economy. These types of companies are under heavy economic influences. Unless there is a total product in a truck or boat, customers are not inclined to purchase their products. Or if money is tight, it is easy to get a part serviced or fixed versus replaced.

Strategic Advantage/Moat

I cannot think of or find any strategic advantages.Even the goodwill section in the annual report does not show anything significant in terms of hidden assets or relationships which could be interpreted as a moat.

Competitors

There are lots of competitors both domestically and internationally selling power transmission products. Up to this point, I don’t find TWIN attractive enough to go through their competitors.Risks

- TWIN does 59% of sales outside USA. A majority of that comes from Canada and Europe. The Europe crisis wil damper sales. Currency exchange rates is also important with international sales. They have international manufacturing operations in Belgium, Italy and Switzerland.

- Some products are sold to the oil industry. Dependent on oil prices.

- Company sells to the government, which means that any budget cuts will hurt them.

- Cyclical business.

- Most of their products are made of steel. If steel prices go up, margins will compress.

Financial Numbers and Quick Valuation

- Healthy balance sheet

- Inventory is valued using the LIFO method

- Inventory of raw materials and works in progress has increased, which is expected based on the increase in backlog.

- Capital intensive. TWIN needs to upgrade or maintain their equipment. They have to constantly invest in R&D for new and better products.

- The 2011 sales and margin is misleading. 2011 gross margin is around 39%, but that should come down to 34%.

- Capex has also returned to normal levels.

- During recessions, CROIC is avg 3.7% and ROE is 3.8%. Will most likely lose money in a recession. Makes investing during a down cycle very tough.

Even if I use 9% discount rate, the expected growth rate is 14%. Much too high for a cyclical company.

Performing a reverse Graham with EPS of $1.60, the implied growth rate is 9%. Achievable but difficult in my opinion given the risk and the environment in which it does business.

The reproduction value of the business comes out to around mid to high $20’s so there is potential in terms of maximizing value out of its assets.

But overall, valuation wise, it looks fairly to slightly overvalued purely based on these numbers.

Catalysts

- Increase in demand from emerging markets.

- Improvement in economy

- Continued expansion of product line through research and development

- Increasing sales in the US

Other Pieces of Info

- From the Proxy: “Cost of Capital is defined as the weighted average expectation of Twin Disc’s sources of capital, debt and equity. For FY2011, the cost of capital has been calculated at 9%”

- From the 10-K: “business is not considered to be seasonal” but they are very cyclical

- top ten customers accounted for approximately 43% of sales

- Involved in several product liability litigation. Not material.

Conclusion

There are hints here and there that management isn’t the most shareholder friendly, but my opinion is arguable because they pay a very small dividend and bought back shares during the lows of 2008 for an average price of $7.25.If the company announces a share buyback, it will be a clear indicator that management believes their stock price to be cheap. I would prefer to see other insiders other than the CEO to purchase shares.

Fundamentally, the company is average, but management has done a good job of maximizing the potential during the good years.

With that said, the upside does not outweigh the downside. Far too many things could go wrong before upside could materialize.

Think of it as probabilities. Even with the big drop YTD, the upside is maybe 30-40% max whereas the downside percentage is easily 40% and could be greater if the economy continues to slide.