Who says there are no second chances? We may be close to seeing one such second chance appear with Teladoc Health Inc. (TDOC, Financial), a pandemic darling that has fallen from grace.

On the heels of the war in Ukraine, resurgent Covid in China and extremely high levels of money printing in the U.S., we now have the fastest Fed rate hike cycle in 40 years getting started. It may be peanuts compared to historical rate hikes before the 1980s, but thanks to unprecedented high debt in the U.S., the cost of money has nevertheless exploded. Wall Street quants and algorithms plugging in the rising interest rates in their DCF models have en masse decided to dump speculative equites.

This has created a "risk off" mood in the market, and speculative tech growth stocks with no earnings are being ghosted by Mr. Market. The bulls have been booted off and the bears are in charge of the bandwagon.

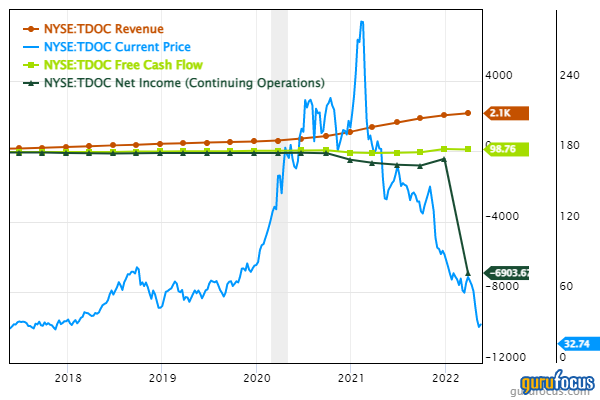

Teladoc was a pandemic rocket that has tumbled over 88% off the lofty valuation it reached last year when we were in the eye of the Covid market storm. The bubble has now fully burst, and Teladoc has fallen back to 2017 levels.

Analysts are rushing to close the barn door after the horse has bolted. Morningstar, for example, cut its fair value estimate of the stock from $210 to $62. CFRA slashed its 12-month target to $35 from $71, which is just above where the stock price is right now. CFRA had earlier in February cut its target from $173 and had started coverage of the company in April 2021 with a target of $218.

I don't think the stock is done yet, though. In fact, I believe that for value investors with a high risk appetite, this could prove to be a great opportunity to pick up shares of Teladoc at a discount.

About Teladoc

Teladoc provides virtual health care services in the United States and internationally. The company offers a portfolio of services and solutions covering non-urgent, episodic, chronic and complicated medical conditions, including diabetes, hypertension, chronic kidney disease, cancer, congestive heart failure and mental health conditions. It offers a range of programs and services, including primary and specialty care telehealth solutions, chronic condition management, expert medical services, mental health solutions and platform and program services.

The company serves employers, health plans, hospitals and health systems, insurance and financial services companies as well as individual members. It offers its products and services under the Teladoc, Livongo and BetterHelp brands. The company was formerly known as Teladoc Inc. and changed its name to Teladoc Health Inc. in August 2018. The company was incorporated in 2002 and is headquartered in Purchase, New York.

Teladoc is the largest telehealth provider in the U.S. and has recently begun to expand internationally. Teledoc's platform enables an expanding list of patient-medical doctor interactions (including those for primary health care, mental health issues and chronic condition management) to transition from an on-site visit to one that can be done remotely with full video-based interaction.

Teladoc provides its platform of services on both a business-to-business and direct-to-consumer basis, through monthly subscription-based relationships. For its core business-to-business clients, the company contracts with a wide range of entities, including large scale employers (the company currently contracts with over 50% of the Fortune 500), health plans, health systems and medical insurance companies, which currently cover more than 50 million members.

For these customers, the company provides a win-win-win, as patients spend no time traveling and less time waiting, doctors are more efficient seeing more patients in less time and payers (employers and plan sponsors) save money while being able to offer a highly popular additional benefit for their employees. This B2B market is projected to be worth more than $100 billion eventually, and Teladoc is the clear global market leader in the space.

For its direct-to-consumer clients, the company provides a growing suite of services for individuals to have affordable access to on-demand and scheduled medical services, even for which their current insurance does not provide reimbursement (such as extended mental health counseling).

Covid kicks off growth

Although the company has been growing steadily for well over a decade, the business has transformed over the past couple of years as the Covid pandemic caused a significant increase in the demand for virtual health care. In addition, the company's 2020 acquisitions of Livongo, the leader in virtual chronic condition management, and InTouch, a competitive telehealth platform, materially broadened the company's product offerings.

Teladoc Health completed its acquisition of InTouch Health on July 1, 2020. Pursuant to the terms of the agreement as announced on January 12, 2020, the purchase price consisted of approximately $150 million in cash and 4.6 million shares of Teladoc Health common stock.

The merger of Teladoc Health and Livongo was in October 2020. Under the terms of the merger, Livongo shareholders received 0.5920 shares of Teladoc Health plus cash of $11.33 for each Livongo share (including the special dividend declared by Livongo). This amounted to a 58% to 42% split in terms of control. The purchase price totalled $18.5 billion.

Falling to earth

The company's stock price decline was furthreed by the huge first-quarter earnings loss, which was mostly due to a $6.6 billion non-cash goodwill impairment. This writedown highlights that Teladoc overpaid for its acquisition of Livongo mostly with its own overvalued stock in 2020. but excluding the impairment, Teladoc actually beat Wall Street's expectations. Its bottom line also continued to trend overall in the right direction.

Teladoc reduced its 2022 revenue outlook by less than 6% at the midpoint of the guidance range. The company still expects revenue growth of about 20%. Teladoc cut its adjusted Ebitda estimate by 26% at the midpoint of its range. However, the main cause for this is a lower expected yield on advertising for its BetterHelp mental health business

Catherine Wood (Trades, Portfolio), a big Teledoc investor, recently discussed her bullish stance on Teladoc on CNBC. Wood's Ark Invest funds are collectively the biggest Teladoc shareholders. When shares crashed further last week, Wood scooped up 20 million shares.

Valuation

The GF Value line is flagging Teladoc as a possible value trap owing to the recent steep drop in stock price combined with the declining bottom line and increasing debt.

The risk of Teladoc stock has been considerably reduced to new investors because of the stock price drop. However, some risks still remain. For example, most doctor visits are paid for by third parties (like insurance companies or governments) in the U.S., so their buy-in is essential. During the beginning of the pandemic, the third-party payors temporarily lifted any restrictions (or reductions) in reimbursement on telehealth vs. conventional office appointments. Some of these policy restrictions are now coming back. Also, physicians are now getting back to the office.

In the longer term, I think telehealth has a bright future as for many visits telehealth is sufficient, so patients, employers and providers will increasingly demand it given the increase in productivity with lowered costs and better health outcomes.

But competition will also ramp up as other tech and business process companies jump in and consolidate this space. Services like Teladoc's Livongo are going to be increasingly important in managing chronic diseases such as asthma, allergies, diabetes, heart disease, kidney disease, addiction, depression and anxiety, which require consistent care over extended periods of time. Teladoc does have first mover advantage, and the pandemic bought it to the attention of lots of third-party payors and employers and doctors, which would have otherwise not have been possible in such an abbreviated time. It also has the widest range of specialists on its roster.

In the longer term, the model will evolve as well with hybrid models springing up, like a visit to a less costly medical professional like a pharmacist or a nurse coupled with a brief telehealth consult with a higher-priced physician or a specialist. The company is harnessing big data and AI to nudge patients into better health outcomes (like in diabetes with dietary advice and medication reminders), which is a big selling point for payors if it reduces overall health care costs. It's also possible that regulations may evolve which would force providers to provide telehealth as well.

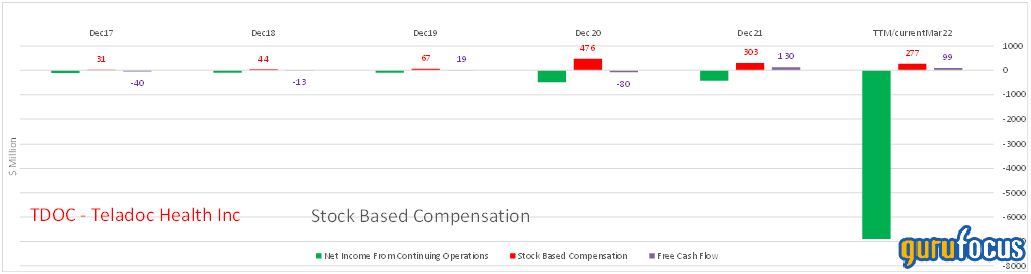

The company is still unprofitable on a GAAP basis, though it is producing a small amount of free cash flow before stock-based compensation (stock-based compensation for executives is exceedingly high, which is a potential warning sign).

The company has grown revenue rapidly since going public in 2012 at a CAGR of 44%, though this has slowed down to the mid 20% range in the last three years. The industry is very much still in a "land grab" mode with consistent profitability still way off. Teladoc has mostly been funded by equity, so debt is not terribly high.

It's hard to say how this business model will evolve, but I believe it's fair to say that telemedicine is here to stay. So right now, Teladoc remains a story stock. Whether you believe in the story or not is they key question. The stock does not appear to be grossly overvalued like last year, and thus may be suitable for risk-tolerant value investors who believe in this evolving business model.