Jana Partners (Trades, Portfolio), a New York-based firm, disclosed in a regulatory filing that its top trades during the first quarter included a boost to its position in Zendesk Inc. (ZEN, Financial), the closure of its holdings of Macy’s Inc. (M, Financial) and LivePerson Inc. (LPSN, Financial), and reductions to its holdings of Mercury Systems Inc. (MRCY, Financial) and the S&P 500 Trust ETF (SPY, Financial).

Founded in 2001 by Barry Rosenstein, the firm applies a value-oriented, event-driven investing approach. Jana seeks undervalued companies in which a catalyst event can unlock shareholder value.

As of March, the firm’s $1.48 billion 13F equity portfolio contains eight stocks with a quarterly turnover ratio of 6%. The top four sectors in terms of weight are consumer defensive, technology, health care and industrials, representing 29.38%, 25.49%, 21.60% and 14.06% of the equity portfolio.

Investors should be aware that the 13F filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

Zendesk

Jana purchased 711,839 shares of Zendesk (ZEN, Financial), boosting the position by 29.82% and its equity portfolio by $108.63.

Shares of Zendesk averaged $108.63 during the first quarter; the stock is significantly undervalued based on Tuesday’s price-to-GF Value ratio of 0.62.

The San Francisco-based customer engagement software company has a GF Score of 78 out of 100, driven by a momentum rank of 9 out of 10 and a rank of 8 out of 10 for growth and GF Value despite profitability ranking just 3 out of 10 and financial strength ranking 4 out of 10.

Other gurus with holdings in Zendesk include Daniel Loeb (Trades, Portfolio)’s Third Point Offshore and Chase Coleman (Trades, Portfolio)’s Tiger Global Management.

Macy’s

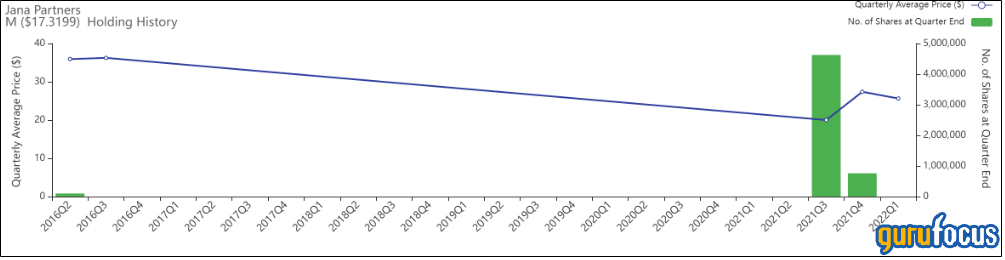

The firm sold all 760,780 shares of Macy’s (M, Financial), reducing its equity portfolio by 1.29%.

Shares of Macy’s averaged $25.63 during the first quarter; the stock is fairly valued based on Tuesday’s price-to-GF Value ratio of 0.90.

The New York City-based department store company has a GF Score of 75 out of 100 based on a momentum rank of 10 out of 10 and a profitability rank of 7 out of 10 despite growth ranking just 2 out of 10 and financial strength and GF Value ranking 6 out of 10.

LivePerson

The firm sold all 455,423 shares of LivePerson (LPSN, Financial), trimming 1.05% of its equity portfolio. Shares of LivePerson averaged $27 during the first quarter.

The New York-based cloud solutions company has a GF Score of 60 out of 100: Although the company has a growth rank of 6 and a momentum rank of 4, LivePerson’s financial strength, profitability and GF Value ranked just between 2 and 3 out of 10.

The GF Value Line labeled LivePerson a possible value trap based on the stock’s Tuesday price-to-GF Value ratio of just 0.23 and low financial strength and profitability.

Mercury Systems

The firm sold 322,782 shares of Mercury Systems (MRCY, Financial), paring 9.07% of the position and 1.15% of its equity portfolio.

Shares of Mercury Systems averaged $59.28 during the first quarter; the stock is significantly undervalued based on Tuesday’s price-to-GF Value ratio of 0.64.

The Andover, Massachusetts-based commercial technology company has a GF Score of 90 out of 100, driven by a rank of 9 out of 10 for growth and momentum, a GF Value rank of 8 out of 10, a profitability rank of 7 out of 10 and a financial strength rank of 6 out of 10.

S&P 500 Trust ETF

The firm sold 20,333 shares of S&P 500 Trust ETF (SPY, Financial), trimming 6.14% of the position and 0.62% of its equity portfolio. Shares averaged $444.05 during the first quarter.

According to the State Street Global Advisors website, the exchange-traded fund seeks to track the performance of the Standard & Poor’s 500 index.