Consolidated Edison (ED, Financial) has a long history of dividend increases, a solid dividend yield and a reliable cash-generating business.

-Seven-Year Annualized Revenue Growth Rate: 4.1%

-Seven-Year Annualized EPS Growth Rate: 6.7%

-Seven-Year Annualized Dividend Growth Rate:<1%

-Current Dividend Yield: 4.08%

-Balance Sheet: Fairly Strong for a Utility

I calculate that Consolidated Edison is somewhat overvalued currently. Utilities in aggregate aren't particularly value investments at the current time, though there are a few fair ones. MLPs and telecoms are currently more attractive areas for high yields in my opinion, with blue-chip tech, health care and industrial/engineering firms being attractive areas for dividend growth.

Overview

Consolidated Edison Inc. (ED) traces its founding back to 1823. This large utility company serves New York, including New York City, and some parts of northern New Jersey and Pennsylvania with electricity, gas and steam. It also provides energy infrastructure development services.

The regulated businesses are Consolidated Edison Company of New York (CECONY), and Orange and Rockland utilities (O&R). CECONY serves 3.3 million customers electricity, 1.1 million customers gas, and 1,700 customers with steam, mostly in New York City. O&R serves an additional 300,000 customers with electricity in areas surrounding New York, and over 100,000 customers with gas.

In addition to the regulated businesses, ConEd’s less regulated businesses include Con Edison Solutions, Con Edison Development, and Con Edison Energy. These groups participate in the development of energy infrastructure and the wholesale and trading of energy.

Ratios

Price to Earnings: 16.6

Price to Free Cash Flow: Highly Erratic

Price to Book: 1.5

Return on Equity: 9%

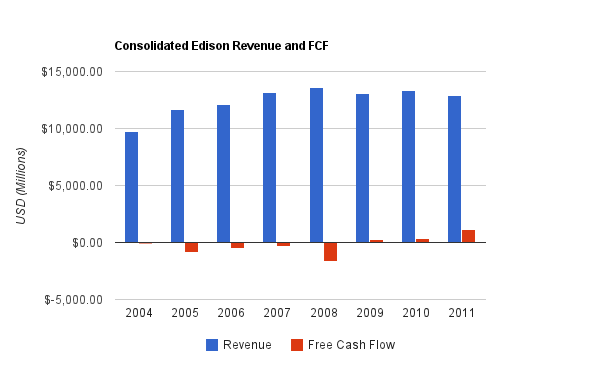

Revenue and Free Cash Flow

(Chart Source: DividendMonk.com)

Revenue growth averaged 6.7% per year over this period, while FCF was erratic and often negative.

Utilities have large capital expenditures that are required to maintain and expand equipment, which can keep free cash flow on the lower side.

The revenue number is solid, except that the trend has been downward since the middle of the reporting period. This is due primarily to a broad mild reduction in annual energy transmission.

-Total kWh’s of electricity delivered by CECONY were approximately 1% lower in 2011 than they were back in 2007.

-Total sales and transportation of gas by CECONY in terms of mdth were approximately 1% lower in 2011 than they were back in 2007.

-Total steam delivered by CECONY was down over 13% in 2011 from 2007.

-Total kWh’s of electricity delivered by O&R were approximately 2% lower in 2011 than they were back in 2007.

-Total sales and transportation of gas by O&R in terms of mdth were approximately 23% lower in 2011 than they were back in 2007.

-Sales of electric volume (kWh) by Con Edison solutions were up over 28% in 2011 compared to 2007.

-Wholesale of electric energy was way down in 2011 to only about a fourth of what it was in 2007.

-Construction expenditures by Con Edison Development has been mildly down.

These reductions in energy volume, mostly across the board, have had a mildly negative affect on ConEd’s revenue, partially offset by rate increases. Modest revenue increases are currently expected by analysts for 2012 and 2013.

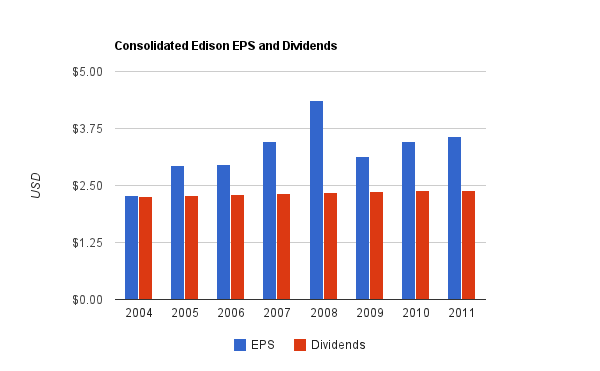

Earnings and Dividends

(Chart Source: DividendMonk.com)

EPS had been mildly erratic, and has averaged 6.7% annualized growth over this period. The chart shows a sharp recovery in EPS from the recession, compared to the previously described revenue figures which were in a sustained downward trend.

Although the consecutive years of dividend increases approaches four decades, the dividend has grown at a tiny pace of less than 1% per year over this seven-year period. Each year here, the company has increased the quarterly dividend by half a cent per share. Fortunately, I believe the numbers show that this pace can modestly quicken over time. Back in 2004, the dividend payout was only one penny less than EPS, resulting in a nearly 100% dividend payout ratio from earnings. As EPS has grown, the dividend has grown more slowly, which has now resulted in a dividend payout ratio from earnings of under 70%. This gap doesn’t have to increase forever, and eventually the dividend can sustainably grow at the same rate as EPS, on average.

Balance Sheet

ConEd’s balance sheet is fairly robust for a utility. Utilities, which are asset-heavy and require substantial investment, need to utilize debt to get a decent return on equity. But this debt is generally reasonably conservative because the cash flows generated by a utility are pretty reliable.

The company’s total debt/equity ratio is a bit over 0.9. For a utility to be under 1 with this ratio is fairly conservative. The interest coverage ratio is over 3, and closer to 4, which is comfortable for a utility. Goodwill is rather negligible. Debt maturities from 2012 to 2016 are reasonably smooth.

Overall, the company is in very good shape here.

Investment Thesis

Consolidated Edison has a rather diversified assortment of products and services in a strong economic area, geographically speaking. The dividend growth has a very long and consistent record but recently, the dividend growth has not even kept up with inflation. Revenue declines have occurred due to decreases in energy volume, which were partially offset by increases in rates.

Utilities in aggregate aren’t particularly attractively valued at the current time. As they historically have been solid places for dividends, and bond rates have been very low, it’s natural to shift towards dividend paying stocks. But with too many interested investors, comes unappealing valuations.

Risks

As a utility, ConEd has rather reliable operating cash flows and stability, but they do have a number of risks. They are highly regulated, and rely on reasonable regulations to maintain profitability. When their costs rise year to year, they need rate increases to avoid massive decreases in margins. Their operations are at risk to damage from weather, although their areas of operation tend to have fairly mild weather, overall. In addition, economic health affects energy usage. And of course, increases in interest rates affect a company’s ability to roll debt into new debt with similar interest payments, and so for a company that uses substantial leverage, potential interest rate increases can have an impact.

Conclusion and Valuation

I previously analyzed ED back in 2010, and reported that it was a fair investment for a decent income stream but not too great on growth. But since then, the stock has increased somewhat substantially in terms of valuation, and the yield has decreased to only a bit over 4%. The sum of dividend yield and and dividend growth, at only around 5%, isn’t particularly appealing.

Several telecoms and MLPs provide both a higher yield and a higher growth of the income stream. ConEd’s dividend growth may mildly accelerate, but still, I wouldn’t expect much in the way of total returns compared to some of the alternatives out there. Using the dividend discount model, and assuming 2% future dividend growth, the stock is only fairly valued at a discount rate of below 6%, which is rather low. Even various other estimates for dividend growth rates (such as 3% or 4%) don’t provide very robust outcomes for a decent target rate of return, generally resting in the mid-single digits. At the current time, I’d look elsewhere for dividend income, unless the stock dips back to the mid-$40s, where it would more readily provide a mid-high single-digit rate of return.

Full Disclosure: As of this writing, I have no position in ED.

-Seven-Year Annualized Revenue Growth Rate: 4.1%

-Seven-Year Annualized EPS Growth Rate: 6.7%

-Seven-Year Annualized Dividend Growth Rate:<1%

-Current Dividend Yield: 4.08%

-Balance Sheet: Fairly Strong for a Utility

I calculate that Consolidated Edison is somewhat overvalued currently. Utilities in aggregate aren't particularly value investments at the current time, though there are a few fair ones. MLPs and telecoms are currently more attractive areas for high yields in my opinion, with blue-chip tech, health care and industrial/engineering firms being attractive areas for dividend growth.

Overview

Consolidated Edison Inc. (ED) traces its founding back to 1823. This large utility company serves New York, including New York City, and some parts of northern New Jersey and Pennsylvania with electricity, gas and steam. It also provides energy infrastructure development services.

The regulated businesses are Consolidated Edison Company of New York (CECONY), and Orange and Rockland utilities (O&R). CECONY serves 3.3 million customers electricity, 1.1 million customers gas, and 1,700 customers with steam, mostly in New York City. O&R serves an additional 300,000 customers with electricity in areas surrounding New York, and over 100,000 customers with gas.

In addition to the regulated businesses, ConEd’s less regulated businesses include Con Edison Solutions, Con Edison Development, and Con Edison Energy. These groups participate in the development of energy infrastructure and the wholesale and trading of energy.

Ratios

Price to Earnings: 16.6

Price to Free Cash Flow: Highly Erratic

Price to Book: 1.5

Return on Equity: 9%

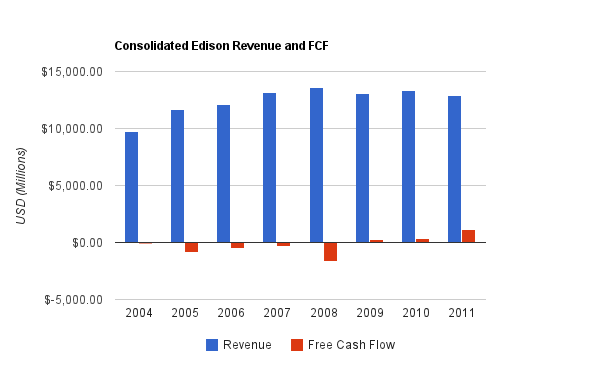

Revenue and Free Cash Flow

(Chart Source: DividendMonk.com)

Revenue growth averaged 6.7% per year over this period, while FCF was erratic and often negative.

Utilities have large capital expenditures that are required to maintain and expand equipment, which can keep free cash flow on the lower side.

The revenue number is solid, except that the trend has been downward since the middle of the reporting period. This is due primarily to a broad mild reduction in annual energy transmission.

-Total kWh’s of electricity delivered by CECONY were approximately 1% lower in 2011 than they were back in 2007.

-Total sales and transportation of gas by CECONY in terms of mdth were approximately 1% lower in 2011 than they were back in 2007.

-Total steam delivered by CECONY was down over 13% in 2011 from 2007.

-Total kWh’s of electricity delivered by O&R were approximately 2% lower in 2011 than they were back in 2007.

-Total sales and transportation of gas by O&R in terms of mdth were approximately 23% lower in 2011 than they were back in 2007.

-Sales of electric volume (kWh) by Con Edison solutions were up over 28% in 2011 compared to 2007.

-Wholesale of electric energy was way down in 2011 to only about a fourth of what it was in 2007.

-Construction expenditures by Con Edison Development has been mildly down.

These reductions in energy volume, mostly across the board, have had a mildly negative affect on ConEd’s revenue, partially offset by rate increases. Modest revenue increases are currently expected by analysts for 2012 and 2013.

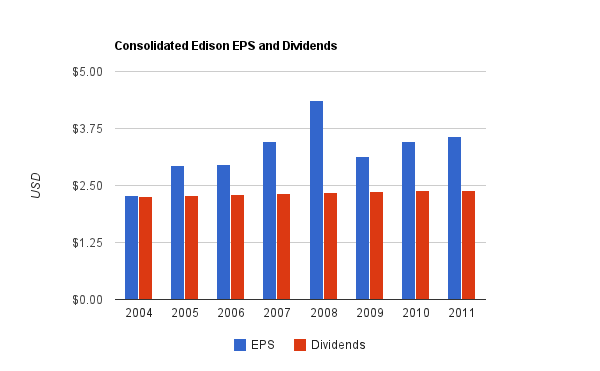

Earnings and Dividends

(Chart Source: DividendMonk.com)

EPS had been mildly erratic, and has averaged 6.7% annualized growth over this period. The chart shows a sharp recovery in EPS from the recession, compared to the previously described revenue figures which were in a sustained downward trend.

Although the consecutive years of dividend increases approaches four decades, the dividend has grown at a tiny pace of less than 1% per year over this seven-year period. Each year here, the company has increased the quarterly dividend by half a cent per share. Fortunately, I believe the numbers show that this pace can modestly quicken over time. Back in 2004, the dividend payout was only one penny less than EPS, resulting in a nearly 100% dividend payout ratio from earnings. As EPS has grown, the dividend has grown more slowly, which has now resulted in a dividend payout ratio from earnings of under 70%. This gap doesn’t have to increase forever, and eventually the dividend can sustainably grow at the same rate as EPS, on average.

Balance Sheet

ConEd’s balance sheet is fairly robust for a utility. Utilities, which are asset-heavy and require substantial investment, need to utilize debt to get a decent return on equity. But this debt is generally reasonably conservative because the cash flows generated by a utility are pretty reliable.

The company’s total debt/equity ratio is a bit over 0.9. For a utility to be under 1 with this ratio is fairly conservative. The interest coverage ratio is over 3, and closer to 4, which is comfortable for a utility. Goodwill is rather negligible. Debt maturities from 2012 to 2016 are reasonably smooth.

Overall, the company is in very good shape here.

Investment Thesis

Consolidated Edison has a rather diversified assortment of products and services in a strong economic area, geographically speaking. The dividend growth has a very long and consistent record but recently, the dividend growth has not even kept up with inflation. Revenue declines have occurred due to decreases in energy volume, which were partially offset by increases in rates.

Utilities in aggregate aren’t particularly attractively valued at the current time. As they historically have been solid places for dividends, and bond rates have been very low, it’s natural to shift towards dividend paying stocks. But with too many interested investors, comes unappealing valuations.

Risks

As a utility, ConEd has rather reliable operating cash flows and stability, but they do have a number of risks. They are highly regulated, and rely on reasonable regulations to maintain profitability. When their costs rise year to year, they need rate increases to avoid massive decreases in margins. Their operations are at risk to damage from weather, although their areas of operation tend to have fairly mild weather, overall. In addition, economic health affects energy usage. And of course, increases in interest rates affect a company’s ability to roll debt into new debt with similar interest payments, and so for a company that uses substantial leverage, potential interest rate increases can have an impact.

Conclusion and Valuation

I previously analyzed ED back in 2010, and reported that it was a fair investment for a decent income stream but not too great on growth. But since then, the stock has increased somewhat substantially in terms of valuation, and the yield has decreased to only a bit over 4%. The sum of dividend yield and and dividend growth, at only around 5%, isn’t particularly appealing.

Several telecoms and MLPs provide both a higher yield and a higher growth of the income stream. ConEd’s dividend growth may mildly accelerate, but still, I wouldn’t expect much in the way of total returns compared to some of the alternatives out there. Using the dividend discount model, and assuming 2% future dividend growth, the stock is only fairly valued at a discount rate of below 6%, which is rather low. Even various other estimates for dividend growth rates (such as 3% or 4%) don’t provide very robust outcomes for a decent target rate of return, generally resting in the mid-single digits. At the current time, I’d look elsewhere for dividend income, unless the stock dips back to the mid-$40s, where it would more readily provide a mid-high single-digit rate of return.

Full Disclosure: As of this writing, I have no position in ED.