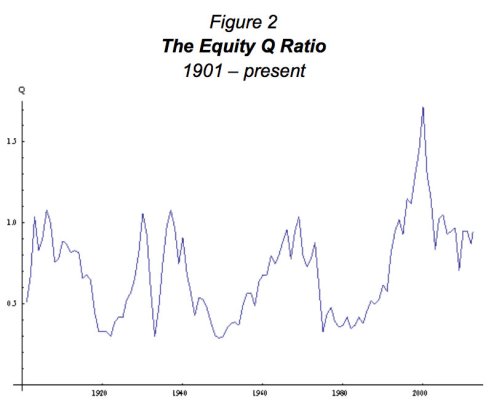

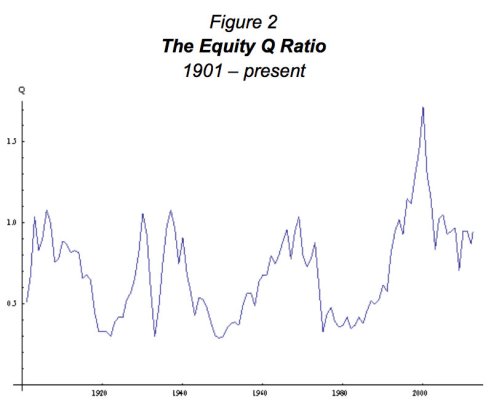

Mark Spitznagel, CIO of Universa, released in May a prescient white paper called “The Austrians and the Swan: Birds of a Different Feather” in which he discussed the theory behind the “Equity Q Ratio,” a variation of Tobin’s Q ratio, and the expected returns to the market from various levels of Equity Q Ratio.

Tobin’s Q ratio is the ratio between the market value of the stock market and against the aggregate net worth of the constituent stocks measured at replacement cost.

It can be defined to include or exclude debt. We exclude debt for ease of calculation and refer to it in this form as “Equity Q.”

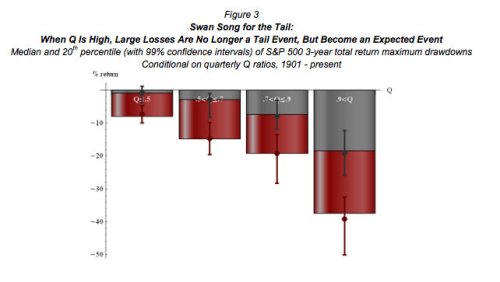

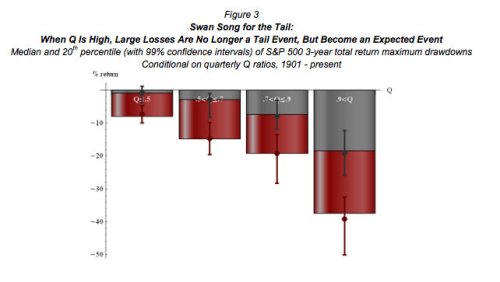

Spitznagel observes that the aggregate U.S. stock market has suffered very few sizable annual losses (which he defines as “20% or more”). By definition, we can categorize such extreme stock market losses as “tail events.”

However, when the Equity Q ratio is high, large losses are “no longer a tail event, but become an expected event.”

Equity Q ratios over 0.9 lead to some very ugly results. So where are we now?

Ugly.

Tobin’s Q ratio is the ratio between the market value of the stock market and against the aggregate net worth of the constituent stocks measured at replacement cost.

It can be defined to include or exclude debt. We exclude debt for ease of calculation and refer to it in this form as “Equity Q.”

Spitznagel observes that the aggregate U.S. stock market has suffered very few sizable annual losses (which he defines as “20% or more”). By definition, we can categorize such extreme stock market losses as “tail events.”

However, when the Equity Q ratio is high, large losses are “no longer a tail event, but become an expected event.”

Equity Q ratios over 0.9 lead to some very ugly results. So where are we now?

Ugly.