Shareholders of Best Inc. (BEST, Financial) and AMC Entertainment Holdings Inc. (AMC, Financial) have seen their stocks fall dramatically over the past year, significantly underperforming the S&P 500 Index. It also seems the profitability of these companies is not improving while financial conditions could be much better. Additionally, most sell-side analysts on Wall Street have given these companies lackluster recommendation ratings (for reference, most of the market has an overweight median rating). This suggests these stocks are likely to underperform the market in the coming months.

Best Inc.

Best Inc. (BEST, Financial) is a Hangzhou, People's Republic of China-based provider of intelligent supply chain solutions and logistics services in China and Southeast Asia. Through its proprietary technology, the company offers cargo delivery, supply chain management and global logistics services.

Shares have fallen by nearly 85% over the past year, underperforming the S&P 500 by approximately 96%.

Best Inc. does not pay dividends.

The financial position does not look solid. The Altman Z-Score is -1.92, indicating financial distress and the possibility of bankruptcy. In addition, the return on invested capital is -9.33% versus a weighted average cost of capital of 2.72%, meaning value is being destroyed rather than created as the company continues to operate. This is because each investment has a negative return, apart from the cost of raising the necessary capital to fund the investment.

In terms of profitability, things are not going as shareholders would hope. In the first quarter of 2022, the company had an adjusted net loss of 68 cents per share and a significant decline in revenue, down 35.2% year over year to $284.4 million. The company attributed the declines to disruptions caused by the Covid-19 pandemic.

But since sales and earnings were already declining before the pandemic (over the past five years, sales per share fell 18% annually while earnings per share fell 4.60% annually), measures to contain the Covid-19 virus cannot be the only cause of poor business operations. A structural issue might also be affecting the business, as Best is still struggling to ramp up operations despite ongoing efforts to make the business much leaner and lower the cost of doing business. This is evident from the latest data on freight volume and supply chain management statistics, which, after falling 13.5% and 13.3% respectively in 2022, are still well short of the company's desired growth targets.

Competition in the industry includes giants such as the logistics arm of the e-commerce giant JD.com (JD, Financial), as well as Deppon Logistics Co Ltd (SHSE:603056, Financial) and Shanghai Foreign Service Holding Group CO., Ltd. (SHSE:600662, Financial), to name a few. This makes the task even more difficult for Best Inc. Greater access to financial resources allows these giants' service offerings to be widespread enough to siphon off demand from Best and other smaller operators.

For the foreseeable future, sell-side analysts on Wall Street forecast a 63.5% decline in Best’s total revenue to $1.7 billion in 2022 (from approximately $1.8 billion in 2021) and a 74% decline to $442.4 million in 2023 (from 2022).

The deterioration in Best's operations has resulted in a write-down of its book value per share since 2019, which has fallen 19.2% annually. This has led to such a share price drop that the stock was in danger of being delisted on the stock exchange. It has recently been in line with the trading standard of the stock exchange again, but due to the circumstances mentioned above, it cannot be ruled out that Best’s stock will end up in a similar issue.

Shares traded around $1.28 each at close on Wednesday for a market capitalization of $100.48 million and a 52-week range of $0.99 to $12.35.

On Wall Street, the stock has a recommendation rating of underweight.

AMC Entertainment Holdings Inc.

AMC Entertainment Holdings Inc. (AMC, Financial) is a Leawood, Kansas-based movie theater company operating 950 theaters and 10,500 screens across the globe. The company claims to be the largest movie theater chain globally, operating primarily in the United States and Europe.

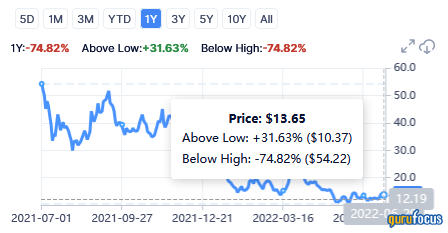

Shares have dropped nearly 75% over the past year, underperforming the S&P 500 by about 86%.

To strengthen its balance sheet, which is still not in good shape, AMC Entertainment Holdings suspended the payment of its quarterly dividend in 2020. The latest payment of 3 cents per share was made on March 23, 2020, reflecting an 85% decline from the previous payment. A dividend cut is a already a sign of a deterioration in the financial position of a company, but things have taken a turn for the worse since then at AMC Entertainment Holdings.

This seems evident from analyzing some metrics that measure the financial strength of the balance sheet. The Altman Z-Score of -0.54 indicates that the company is currently at significant risk of bankruptcy and could go bankrupt within a few years if the situation does not improve quickly.

The company is heavily leveraged with $10.8 billion in total debt, which is nine times higher than the cash on hand of $1.2 billion as of March 31. The company is more indebted than most of its industry peers.

Additionally, the company is struggling to pay the interest expenses on its debt ($388 million for the trailing 12 months ended March 30), as its operations are currently at a loss.

When it comes to profitability, all other financial metrics are negative except for the gross margin, which is 70.1% versus the industry median of 39%. Also, sales and free cash flow have decreased by 49.8% and 54.2%, respectively, since 2019.

There is no doubt that the pandemic impacted AMC's business, not just in the short-term but in the long-term as well. Three was a long-term shift towards streaming at home instead of going to the cinema, and some studios have even started releasing movies on streaming services at the same time as theatrical releases.

While people are less cautious about the pandemic, AMC is now worried about another issue in the form of high inflation. High inflation will continue to affect various personal expenses, especially the most optional expenses such as entertainment, which, like going to the cinema, has a high hourly rate.

Shares traded around $13.65 at close on Wednesday for a market capitalization of $6.99 billion and a 52-week range of $9.70 to $58.18.

On Wall Street, the stock has a median recommendation rating of underweight.