AT&T Inc. (T, Financial) is a telecommunications provider of wired and wireless services and is one of the largest companies in the U.S. and the world.

-Four Year Annual Revenue Growth Rate: 1.6%

-Four Year Annual EPS Growth Rate: negative

-Four Year Annual Dividend Growth Rate: 4.9%

-Current Dividend Yield: 4.93%

-Balance Sheet Strength: Leveraged, but Stable

I believe that although AT&T is a quality company in an industry with significant long-term growth, at the current price of over $35, AT&T is on the expensive side, and investors should look for a dip to the low $30s before considering it a solid investment.

In 2011, approximately 50% of revenue came from wireless and 26% came from wired data/managed services. The company considers these two areas to be their growth engines. The rest of revenue came 19% from wireline voice and 5% from advertising/other, which are considered the company’s legacy businesses.

Forward P/E: Approximately 14

Price to Free Cash Flow: 15

Price to Book: 2

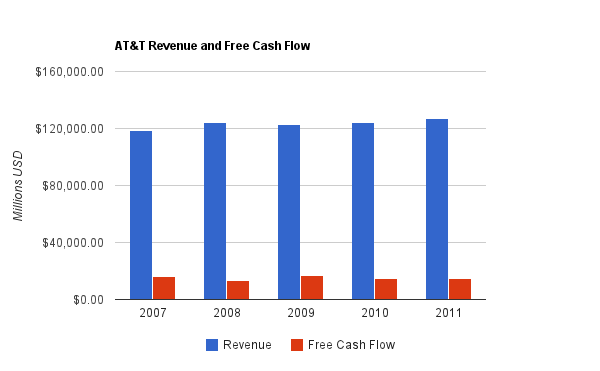

(Chart Source: DividendMonk.com)

AT&T has experienced good system growth over the last several years, which is discussed below, but it has not particularly shown through in the numbers. Revenue grew at 1.6% per year over this period, while free cash flow had a weaker report in 2011 than in 2007. AT&T requires significant continued capital expenditures to keep its communications system fast and widespread, and much of their growth is offset by declines in their legacy businesses.

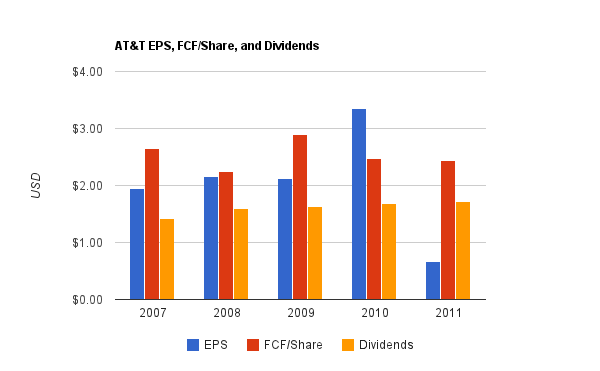

(Chart Source: DividendMonk.com)

Earnings growth was lacking over this period. The low 2011 EPS figure is due to one-time events that affected EPS; primarily the costs of the failed merger attempt with T-Mobile. In reality, free cash flow and the normal earnings remain solid, albeit without much per-share growth.

Dividend growth has slowed lately, because the company has been increasing the quarterly dividend by a penny each year, which means a slightly lower raise in terms of percentage each year. The dividend grew at less than 5% annually over this period, and the more recent increases were under 3%. Raising the quarterly dividend from $0.43 in 2011 to $0.44 in 2012 represents 2.32% dividend growth for the year.

In 2012, the company is paying approximately three-quarters of its EPS out as dividends. The dividend is therefore rather safe for this type of business, but EPS will have to continue to grow if dividend growth is going to continue. The company has not utilized share repurchases recently, but has authorization to do so.

The total debt/equity ratio is around 66%, but if the substantial amount of goodwill is removed from equity, total debt/equity in the tangible sense is quite high, at over 200%. The company also has substantial pension obligations.

Interest coverage is under 3, which is not a comfortable margin, but not the lowest in its peer group.

The interest coverage ratio has not been static, but rather, has decreased in recent years from more comfortable pre-recession levels. The company borrows significant sums to fund capital investment, which in this low interest-rate environment, is rational.

The primary force that has driven cloud computing to this point is that the data networks around the world have become fast enough to deliver good software over long distances. Something as simple as making the charts in this article in a web-browser quickly and effectively only works because networks have become so fast and there’s barely a noticeable difference between a client-based office tool and a server-based office tool.

The need for data results in enormous capital expenditures, but also increases in revenue. Wireless services in particular have grown exponentially. As AT&T’s 2011 annual report shows, between 2006 and 2011, the number of wireless subscribers increased from 61 million to 103 million, smart phone users increased from 7 million to 40 million, wireless data usage has surged from near-zero to upwards of 30 petabytes a month, and wireless revenue has grown fivefold. The company has reported that it expects its wireless data usage to grow another eight times in the next five years. AT&T’s “U-Verse” revenue grew almost 10-fold over three years, up to nearly $7 billion.

-Larger quantities of television and movies are watched online, and often on mobile. On a traditional television set, data can come from the internet protocol rather than from cable.

-Tablets and e-readers represent a growing area for wireless data usage.

-The increased number of wireless devices allows for the potential of data-bundling, a customer paying one fee for data usage across multiple devices, or using devices as hotspots for other devices.

-Software as a Service, in wired or wireless variants, generally requires more data than client-based software.

-Emerging areas like data usage from automobiles or in health care can open new revenue streams and continued data growth.

-The need for cloud computing resources for small and large businesses is an area of growth.

-Investing significant sums of money into infrastructure boosts competitiveness and quality, but this money cannot be paid as dividends as owner’s profit.

-Paying significant dividends is helpful for the owners, but detracts from the money to grow and enhance the network.

Company management must balance growth with profitability.

AT&T also faces regulatory risk, which have been true for the long life of the whole business. Owning infrastructure can result in a monopoly, and so regulations exist with the intention of preserving competition. AT&T lost billions over a failed T-Mobile acquisition due to regulations.

A key regulation concern, as voiced by the CEO of AT&T and others, is that companies are running of allocated radio spectrum for growth. This was a key reason for the attempted T-Mobile merger- to acquire complimentary spectrum. Spectrum is being for other purposes, legally, and since the U.S. allocated spectrum long ago compared to some newer economies, the U.S. has spectrum allocated in a less optimized way.

The company faces strong competition in wireless services, wired internet services, cloud services, and essentially every area where they operate. Leverage has been used to compete, which makes the company more vulnerable when interest rates eventually rise.

With the spike of the stock price over the last two months, I do believe the stock may have gotten modestly ahead of itself. A 4.93% dividend yield and less than 3% dividend growth is reasonable, but not necessarily attractive. At the current yield and growth rate, approximately 8% total returns can be expected based on the dividend discount model. This potentially can be somewhat enhanced by a strategy of writing covered calls. Instead, I’d propose looking at Vodafone as a preferable telecommunications investment, and checking back with AT&T should the stock dip a bit.

Full Disclosure: As of this writing, I have no position in any stocks mentioned.

-Four Year Annual Revenue Growth Rate: 1.6%

-Four Year Annual EPS Growth Rate: negative

-Four Year Annual Dividend Growth Rate: 4.9%

-Current Dividend Yield: 4.93%

-Balance Sheet Strength: Leveraged, but Stable

I believe that although AT&T is a quality company in an industry with significant long-term growth, at the current price of over $35, AT&T is on the expensive side, and investors should look for a dip to the low $30s before considering it a solid investment.

Overview

AT&T Inc. (T) traces its history back to the 1800s as part of the original company named after Alexander Graham Bell, who is credited with the invention of the first practical telephone. In its current form, AT&T’s history as a public company goes back to the 1980s, after the original company was broken apart and the pieces began merging back together.In 2011, approximately 50% of revenue came from wireless and 26% came from wired data/managed services. The company considers these two areas to be their growth engines. The rest of revenue came 19% from wireline voice and 5% from advertising/other, which are considered the company’s legacy businesses.

Ratios

Price to Earnings: 51 (due to one-time earnings hit from failed T-Mobile acquisition)Forward P/E: Approximately 14

Price to Free Cash Flow: 15

Price to Book: 2

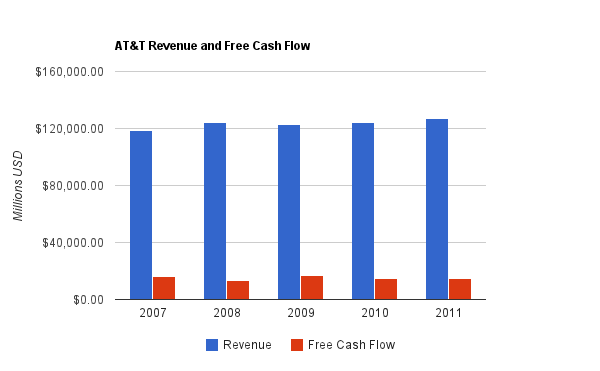

Revenue and Free Cash Flow

(Chart Source: DividendMonk.com)

AT&T has experienced good system growth over the last several years, which is discussed below, but it has not particularly shown through in the numbers. Revenue grew at 1.6% per year over this period, while free cash flow had a weaker report in 2011 than in 2007. AT&T requires significant continued capital expenditures to keep its communications system fast and widespread, and much of their growth is offset by declines in their legacy businesses.

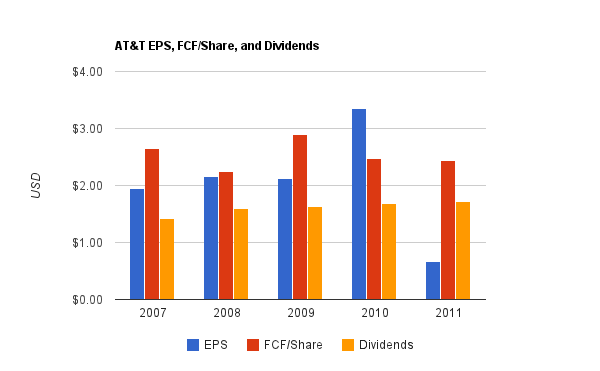

Earnings and Dividends

(Chart Source: DividendMonk.com)

Earnings growth was lacking over this period. The low 2011 EPS figure is due to one-time events that affected EPS; primarily the costs of the failed merger attempt with T-Mobile. In reality, free cash flow and the normal earnings remain solid, albeit without much per-share growth.

Dividend growth has slowed lately, because the company has been increasing the quarterly dividend by a penny each year, which means a slightly lower raise in terms of percentage each year. The dividend grew at less than 5% annually over this period, and the more recent increases were under 3%. Raising the quarterly dividend from $0.43 in 2011 to $0.44 in 2012 represents 2.32% dividend growth for the year.

In 2012, the company is paying approximately three-quarters of its EPS out as dividends. The dividend is therefore rather safe for this type of business, but EPS will have to continue to grow if dividend growth is going to continue. The company has not utilized share repurchases recently, but has authorization to do so.

Balance Sheet

AT&T doesn’t have a very comfortable balance sheet, but for a stable infrastructure-intensive business, they’re solid enough.The total debt/equity ratio is around 66%, but if the substantial amount of goodwill is removed from equity, total debt/equity in the tangible sense is quite high, at over 200%. The company also has substantial pension obligations.

Interest coverage is under 3, which is not a comfortable margin, but not the lowest in its peer group.

The interest coverage ratio has not been static, but rather, has decreased in recent years from more comfortable pre-recession levels. The company borrows significant sums to fund capital investment, which in this low interest-rate environment, is rational.

Investment Thesis

A newsletter issue I published a couple months back focused on cloud computing and the effects it can have on lower-tech industries that aren’t on the cutting edge of cloud software. In short, the world is hungry for data. Mobile Internet requires vast amounts of data for apps, movies, browsing and rich media, and wired or wireless Software-as-a-Service requires robust data usage and reliability. While high valuations are focused towards cloud software, someone’s got to provide the data.The primary force that has driven cloud computing to this point is that the data networks around the world have become fast enough to deliver good software over long distances. Something as simple as making the charts in this article in a web-browser quickly and effectively only works because networks have become so fast and there’s barely a noticeable difference between a client-based office tool and a server-based office tool.

The need for data results in enormous capital expenditures, but also increases in revenue. Wireless services in particular have grown exponentially. As AT&T’s 2011 annual report shows, between 2006 and 2011, the number of wireless subscribers increased from 61 million to 103 million, smart phone users increased from 7 million to 40 million, wireless data usage has surged from near-zero to upwards of 30 petabytes a month, and wireless revenue has grown fivefold. The company has reported that it expects its wireless data usage to grow another eight times in the next five years. AT&T’s “U-Verse” revenue grew almost 10-fold over three years, up to nearly $7 billion.

-Larger quantities of television and movies are watched online, and often on mobile. On a traditional television set, data can come from the internet protocol rather than from cable.

-Tablets and e-readers represent a growing area for wireless data usage.

-The increased number of wireless devices allows for the potential of data-bundling, a customer paying one fee for data usage across multiple devices, or using devices as hotspots for other devices.

-Software as a Service, in wired or wireless variants, generally requires more data than client-based software.

-Emerging areas like data usage from automobiles or in health care can open new revenue streams and continued data growth.

-The need for cloud computing resources for small and large businesses is an area of growth.

Risks

AT&T must continually invest capital to keep its communication system up to par with competitors. Many aspects of the business are a commodity; people want affordable and fast data packages, since it’s just the middle-man between customers and the data they want to consume. Differentiation comes from having solid and growing infrastructure, from offering the right mix of data packages and phone contracts, and from meeting business data/voice needs. There is indeed at least a limited economic moat, as spectrum is limited, and capital expenditures are enormous.-Investing significant sums of money into infrastructure boosts competitiveness and quality, but this money cannot be paid as dividends as owner’s profit.

-Paying significant dividends is helpful for the owners, but detracts from the money to grow and enhance the network.

Company management must balance growth with profitability.

AT&T also faces regulatory risk, which have been true for the long life of the whole business. Owning infrastructure can result in a monopoly, and so regulations exist with the intention of preserving competition. AT&T lost billions over a failed T-Mobile acquisition due to regulations.

A key regulation concern, as voiced by the CEO of AT&T and others, is that companies are running of allocated radio spectrum for growth. This was a key reason for the attempted T-Mobile merger- to acquire complimentary spectrum. Spectrum is being for other purposes, legally, and since the U.S. allocated spectrum long ago compared to some newer economies, the U.S. has spectrum allocated in a less optimized way.

The company faces strong competition in wireless services, wired internet services, cloud services, and essentially every area where they operate. Leverage has been used to compete, which makes the company more vulnerable when interest rates eventually rise.

Conclusion and Valuation

Telecommunications companies typically pay larger than average dividends with their reliable infrastructure businesses. AT&T has tailwinds from increasing mobile data usage and increasing total data usage from internet, video and cloud services.With the spike of the stock price over the last two months, I do believe the stock may have gotten modestly ahead of itself. A 4.93% dividend yield and less than 3% dividend growth is reasonable, but not necessarily attractive. At the current yield and growth rate, approximately 8% total returns can be expected based on the dividend discount model. This potentially can be somewhat enhanced by a strategy of writing covered calls. Instead, I’d propose looking at Vodafone as a preferable telecommunications investment, and checking back with AT&T should the stock dip a bit.

Full Disclosure: As of this writing, I have no position in any stocks mentioned.