After drawing down by more than 20% since the turn of the year, many investors might wonder whether Morgan Stanley (MS, Financial) is at an investable level. There's certainly a fair argument that Morgan Stanley could be a lucrative investment, given that it's a high-quality company that pays an abundance of dividends. However, from a capital gains vantage point, I believe Morgan Stanley is significantly overvalued and could be set for further declines; here's why.

Economic concerns and earnings

Morgan Stanley's economics team recently opined that, "At this point, a recession is no longer just a tail risk given the Fed's predicament with inflation."

Banking stocks usually underperform whenever there's a fear of recession as they're inextricably linked with the average consumer's personal balance sheet. Moreover, the market's currently pricing a recession as the yield curve has shown signs of inversion lately. As such, banking stocks are in a high-risk zone.

Furthermore, while Morgan Stanley's latest earnings report revealed a target beat of 34 cents per share, there's a definite slowdown in business activity as the bank's revenue receded by 5.9% year-over-year amid softening equity market activities.

Stress test

On a lighter note, Morgan Stanley's stress test implies that it's still operating with stability. However, forecasted results convey a clear decrease in the bank's key metrics into the future as economic circumstances seem gloomy. For instance, Morgan Stanley expects its CET1 ratio to settle between 11.9% to 14.8%, significantly lower than the 16% it displayed in 2021's fourth quarter.

Although Morgan Stanley's projected stress tests are beyond the regulatory minimum, it's clear that the bank's risk-adjusted performance is projected to fade in the coming year.

Source: Morgan Stanley

Valuation

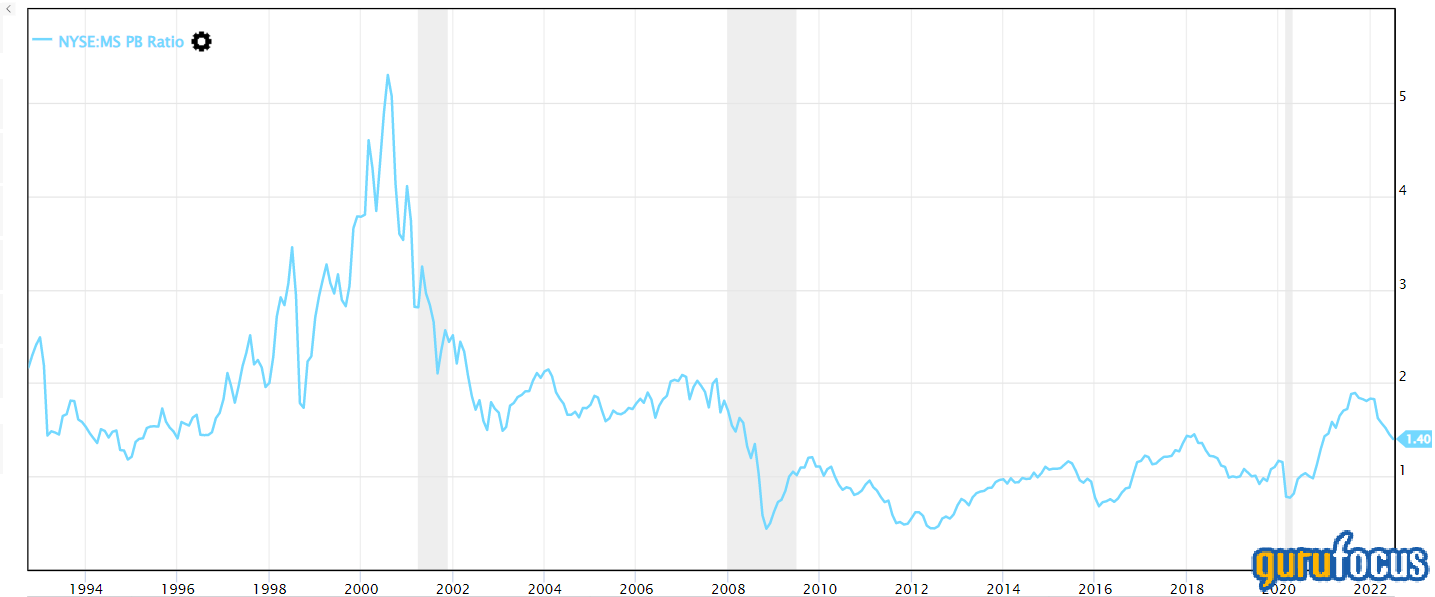

The price-book ratio is important to valuing bank stocks due to the nature of the banking business, which involves trading liquid assets at given values. As such, bank stocks that trade above their book value are usually considered overvalued, and Morgan Stanley's price-book ratio of 1.48 implies that it is trading substantially above its intrinsic value.

Additionally, the PEG ratio of Morgan Stanley is 3.47, which suggests that the market overprices the company's growth. Thus, if Morgan Stanley's earnings per share growth doesn't accelerate soon, we could see its stock price capitulate.

Concluding thoughts

Although Morgan Stanley passed its stress test and delivered positive results in its latest earnings report, the signs are clear that its business activities are slowing down amid an economic crunch. Additionally, the stock is significantly overvalued, especially on a price-book basis.