Bridgewater Associates, the investing firm founded by Ray Dalio (Trades, Portfolio) in 1975, recently disclosed its 13F report for the second quarter of 2022, which ended on June 30.

Bridgewater takes a principled approach to investing, applying standardized methods to deal with recognizable market patterns. Dalio’s investment innovations such as risk parity, alpha overlay and “All Weather” are recognized as having changed the way global institutions approach investing. As a global macro-investment manager, the firm diversifies itself with investments in 150 different markets. Its management strategy is based on creating an “idea meritocracy” where fund managers employ radical truth and radical transparency, encouraging open and honest dialogue and allowing the best thinking to prevail.

According to Bridgewater’s latest 13F report, it dumped its stakes in Alibaba Group Holding Ltd (BABA, Financial) and JD.com Inc. (JD, Financial) in the second quarter. It also abruptly reversed course on emerging market ETFs, reducing its positions in the iShares MSCI Emerging Markets ETF (EEM, Financial) and the Vanguard FTSE Emerging Markets ETF (VWO, Financial) after adding to three emerging market ETFs in the first quarter.

Investors should be aware that 13F reports do not provide a complete picture of a guru’s holdings. They include only a snapshot of long equity positions in U.S.-listed stocks and American depository receipts as of the quarter’s end. They do not include short positions, non-ADR international holdings or other types of securities. However, even this limited filing can provide valuable information.

Delisting risks mount for Alibaba and JD.com

In late 2020, when the U.S. government first began threatening to delist Chinese stocks from the country’s exchanges if they didn’t submit their books to be audited by U.S. regulators for three consecutive years, the general public opinion seemed to be that delisting wasn’t a real risk that investors might face. Surely the two countries could come to a mutually agreeable compromise. After all, it’s not like all countries require foreign companies to submit to local audits in order to list on their exchanges.

As 2022 wears on, it is becoming clearer that the Holding Foreign Companies Accountable Act is not a negotiation tactic. The U.S. wants access to even the classified materials of China’s top companies that have been deemed matters of China’s national security, and if it doesn’t get them, then these stocks will most likely be delisted from U.S. exchanges. SEC Chair Gary Gensler said in July that he was “not particularly confident” about the prospects for a compromise.

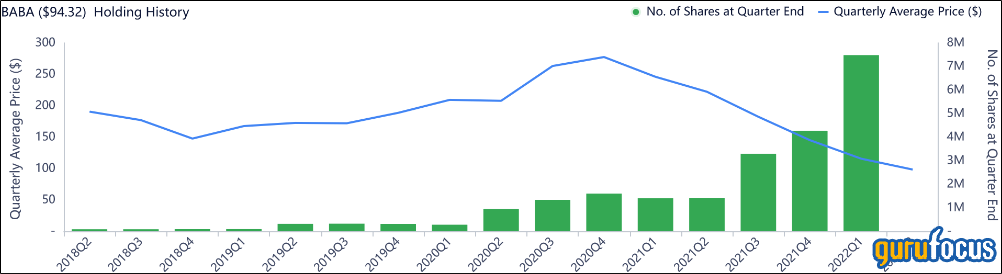

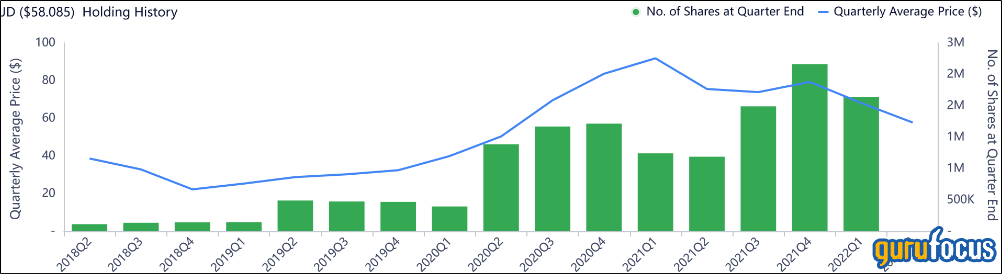

Alibaba (BABA, Financial) and JD.com (JD, Financial) have both been shortlisted by the SEC as companies to be delisted once the three-year mark is up. Previously, Dalio was building positions in both of these stocks, but perhaps the delisting risk and other headwinds such as China’s tech regulatory crackdown have become too much for him, because his firm has recently sold out of both stocks.

In the second quarter, Dalio’s firm dumped all 7,480,545 of its Alibaba shares, which previously took up 3.28% of the equity portfolio. Shares averaged $98.24 apiece in the three months ended June 30.

The firm also axed its 2,141,206-share holding in JD.com, which used to take up 0.50% of the equity portfolio. During the quarter, shares changed hands for an average price of $57.70.

While delisting from U.S. exchanges certainly won’t be the end for either of these companies, there are worries that that delisting could have long-lasting effects on the stock prices as well as implications for worsening U.S.-China relations.

Alibaba and JD were the highest-profile sales of Chinese stocks, but Bridgewater also exited its positions in Bilibili (BILI, Financial), NetEase (NTES, Financial) and DiDi Global (DIDIY, Financial). Given that the firm's selloff of Chinese stocks was broad, it seems likely to be driven by the above-mentioned geopolitical factors, though of course we can't know for sure unless Dalio makes public statements on the topic.

Emerging market ETFs

Bridgewater reduced its stake in the iShares MSCI Emerging Markets ETF (EEM, Financial) by 92.62% for a remaining holding of 1,435,298 shares. At the quarter’s average price of $41.73, this reduced the equity portfolio by 3.31%.

The firm also slimmed its investment in the Vanguard FTSE Emerging Markets ETF (VWO, Financial) by 32.07%, bringing the total number of shares owned to 15,432,241. The trade reduced the equity portfolio by 1.36% at the quarter’s average share price of $42.94.

These ETFs are both meant to provide exposure to emerging markets for those who don’t have any expertise on the markets in question, as well as easy diversification for portfolio stability.

Despite the different names, these ETFs are very similar in terms of their largest holdings; it’s mainly in the smaller holdings where they differentiate themselves from each other. The number one holding for both of them is Taiwan Semiconductor Manufacturing Co. Ltd (TPE:2330, Financial). Other stocks that make it into the top 10 lists for both ETFs include Samsung Electronics Ltd. (XKRX:005930), Tencent Holdings Ltd (HKSE:00700, Financial), Meituan (HKSE:03690, Financial) and Infosys Ltd. (INFY, Financial).

For the most part, these ETFs make sure to purchase shares of companies in their respective home markets, which reduces risks from delisting and geopolitical turmoil. However, with global inflation hitting emerging markets hard, foreign investors are getting spooked.

Portfolio overview

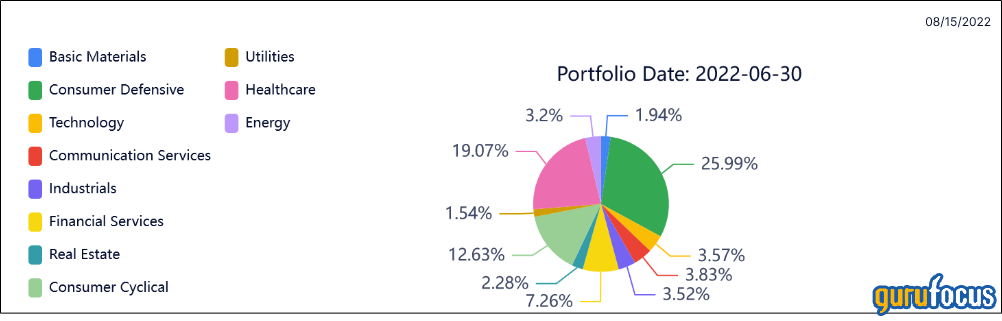

As of the quarter’s end, the firm held shares in 987 stocks valued at a total of $23.59 billion. The turnover for the period was 32%.

The top holding was Procter & Gamble (PG, Financial) with 4.11% of the equity portfolio, followed by Johnson & Johnson (JNJ, Financial) with 3.26% and the iShares Core MSCI Emerging Markets ETF (IEMG, Financial) with 3.18%.

By sector, the firm was most invested in consumer defensive, health care and consumer cyclical stocks.