The Bill & Melinda Gates Foundation Trust, founded in 2000 by Bill Gates (Trades, Portfolio) and his ex-wife Melinda, disclosed in a regulatory filing that its top trades during the second quarter included boosts to its holdings in Berkshire Hathaway Inc. (BRK.B, Financial) and Madison Square Garden Sports Corp. (MSGS, Financial), new positions in Carvana Co. (CVNA, Financial) and Vroom Inc. (VRM, Financial) and a reduction to its stake in Canadian National Railway Co. (CNI, Financial).

While the foundation trust is managed by outside investors, Gates guides the managers in voting proxies consistent with the principles of good governance and good management. The trust also considers other issues beyond corporate profits, including defining areas in which the trust will not invest in.

As of June, the trust’s $17.68 billion 13F equity portfolio contains 20 stocks with a quarterly turnover ratio of 10%. The top three sectors in terms of weight are financial services, industrials and consumer defensive, representing 53.56%, 33.06% and 4.66% of the equity portfolio.

Investors should be aware that 13F filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

Berkshire Hathaway

The fund invested in 6,003,166 Class B shares of Berkshire Hathaway (BRK.B, Financial), expanding the stake by 20.93% and its equity portfolio by 9.27%.

Class B shares of Berkshire averaged $314.34 during the second quarter; the stock is modestly overvalued based on Wednesday’s price-to-GF Value ratio of 1.26.

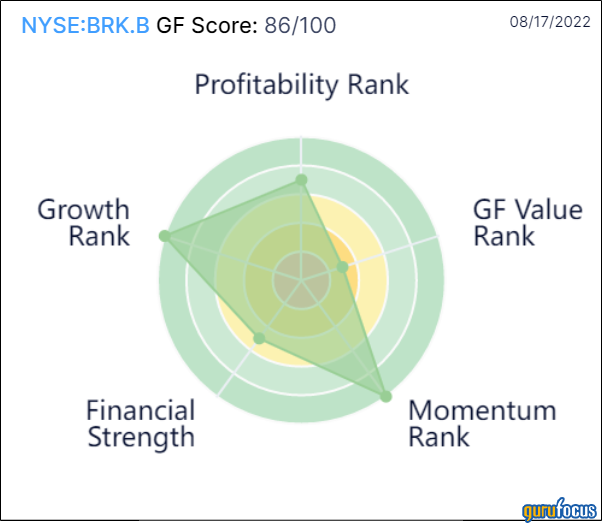

Warren Buffett (Trades, Portfolio)’s insurance conglomerate has a GF Score of 86 out of 100 based on a rank of 10 out of 10 for growth and momentum, a profitability rank of 7 out of 10, a financial strength rank of 5 out of 10 and a GF Value rank of 3 out of 10.

Other gurus with holdings in Berkshire include Jim Simons (Trades, Portfolio)’ Renaissance Technologies and Tom Gayner (Trades, Portfolio)’s Markel Gayner Asset Management.

Madison Square Garden Sports

The trust added 314,259 shares of Madison Square Garden Sports (MSGS, Financial), boosting the holding by 112.98% and its equity portfolio by 0.27%.

Shares of Madison Square Garden Sports averaged $162.56 during the second quarter.

GuruFocus’ Value Line labeled Madison Square Garden Sports a possible value trap: Although the stock has a price-to-GF Value ratio of 0.61, suggesting undervaluation, the New York-based live sports company has a growth rank of 1 out of 10 and a rank of 3 out of 10 for financial strength and profitability.

Based on the above ranks, GuruFocus assigned Madison Square Garden Sports a GF Score of 58 out of 100.

Carvana

The trust invested in 520,000 shares of Carvana (CVNA, Financial), giving the position 0.07% equity portfolio weight. Shares averaged $53.66 during the second quarter.

GuruFocus’ GF Value Line labeled the Tempe, Arizona-based car retailer a possible value trap based on its low price-to-GF Value ratio of 0.20 and a rank of 3 out of 10 for financial strength and profitability.

Carvana has a GF Score of 68 out of 100, driven by a growth rank of 10 out of 10 despite momentum ranking just 4 out of 10 and GF Value ranking just 2 out of 10.

Vroom

The trust invested in 2.5 million shares of Vroom (VRM, Financial), giving the stake 0.02% equity portfolio weight. Shares averaged $1.59 during the second quarter.

The New York-based e-commerce car company has a GF Score of 16 out of 100 based on a financial strength rank of 3 out of 10 and a profitability rank of 1 out of 10. However, the company does not have enough data to compute a growth rank, momentum rank and a GF Value rank and thus, the GF Score may give an incomplete picture of the stock’s potential.

Canadian National Railway

The trust sold 2,787,539 shares of Canadian National Railway (CNI, Financial), trimming 21.33% of the position and 1.89% of its equity portfolio.

Shares of Canadian National Railway averaged $117.14 during the second quarter; the stock is fairly valued based on Wednesday’s price-to-GF Value ratio of 1.05.

The Montreal, Quebec-based railroad company has a GF Score of 91 out of 100 based on a momentum rank of 10 out of 10, a rank of 9 out of 10 for profitability and growth and a rank of 5 out of 10 for financial strength and GF Value.