Oaktree Capital Management recently disclosed its 13F portfolio updates for the second quarter of 2022, which ended on June 30.

Founded by Howard Marks (Trades, Portfolio) and several fellow investors in 1995, Oaktree Capital Management is a global investing firm that specializes in alternative and credit strategies. The Los Angeles-based firm now has over 39 portfolio managers and 950 employees in offices around the globe. Marks is the co-chairman and chief financial officer. The core investment philosophy of the firm has six tenets: risk control, consistency, market inefficiency, specialization, bottom-up analysis and disavowal of market timing.

In the second quarter, the firm’s top buys (as per its 13F filing) were in biosimilars and residential construction, reaffirming its commitment to a contrarian stance and going against the herd.

Investors should be aware that 13F reports do not provide a complete picture of a guru’s holdings. They include only a snapshot of long equity positions in U.S.-listed stocks and American depository receipts as of the quarter’s end. They do not include short positions, non-ADR international holdings or other types of securities. However, even this limited filing can provide valuable information.

Alvotech

Oaktree established a 6,338,660-share stake in biosimilar developer Alvotech (ALVO, Financial), giving the stock a 0.68% weight in the equity portfolio at the quarter’s average share price of $9.31.

Alvotech is new to the stock market, having gone public via a special purpose acquisition company deal in mid-June. Based in Iceland, the company’s goal is to expand global access to life-changing biologic medicines. Its pipeline includes biosimilars for Humira, Stelara, Xolair, Eylea and more.

Many new drug manufacturers like Alvotech are considered risky investments at the moment due to their rapid cash-burning in a time of high interest rates and economic troubles, which could easily lead to cost reductions and staff layoffs at the crucial development stage.

While biosimilars are easier to develop compared to pioneer drugs, they do not have the same patent protections, leading to a tradeoff between higher market accessibility and lower profit margins. Over the past decade, Alvotech has built a vertically integrated platform for developing and manufacturing biosimilars at scale.

“Oaktree is proud to be associated with Alvotech, a world-class biosimilar platform with a mission-critical focus on providing important drugs at a reduced cost. We look forward to the continuation of our relationship as the company enters its next phase of growth,” Marks said when the company went public.

Toll Brothers

The firm also picked up 597,000 shares of luxury homebuilder Toll Brothers Inc. (TOL, Financial). At the quarter’s average share price of $46.79, the position takes up 0.35% of the equity portfolio.

Toll Brothers designs, builds, markets, sells and helps finance both residential and commercial properties in the United States, with a focus on the luxury market. It primarily builds on the east and west coasts of the U.S. and also offers luxury rental properties.

This company has recently begun to feel the pain of the housing boom slowing down due to the combination of higher interest rates and persistently high prices. It offered sales incentives of approximately $30,000 in August compared to just $12,000 in May as it tried to keep property sales moving along without decreasing sticker prices. In the three months through the end of July, Toll Brothers reported a 60% decrease in purchase contracts compared to a year ago.

While Toll Brothers acknowledges that the housing market has become more of a buyer’s market, it remains confident that its luxury focus will protect it somewhat from the pain of lower-cost homebuilders, since most of its customers are move-up buyers that are typically looking above the $1 million mark.

PulteGroup

Marks’ firm also added a 619,000-share investment in PulteGroup Inc. (PHM, Financial) to its portfolio. The stock now takes up 0.32% of the equity portfolio. During the quarter, shares averaged $42.11 apiece.

Another residential construction company, PulteGroup is the third-largest U.S. homebuilder by volume, with operations in 23 states. The company builds under the brand names Pulte Homes, Centex, Del Webb, DiVosta and John Wieland. It also owns a subsidiary mortgage business.

Unlike Toll Brothers, PulteGroup does not have a laser-focus on the luxury homebuilding market, but it does tend to run at a higher operating margin and sports a stronger balance sheet. The fact that Oaktree is investing in both PulteGroup and Toll Brothers suggests a positive long-term outlook on the entire homebuilding sector, not just higher-end homes.

Homebuilding is a highly cyclical industry, so it might come as a surprise to some that an investor who claims to disavow market timing would invest in this sector. On the other hand, Marks did say in a recent interview with Ameritrade Network that now is the time for caution in the markets with a focus on value, quality and the ability to survive a more difficult financing environment.

After more than a decade of intentional underbuilding, the residential homebuilding sector could end up falling into the value basket rather than the cyclical crash of years past. There is also the possibility that interest rates will be lowered again sooner than expected, which would boost home sales again provided we have not entered a full-blown recession by then.

See also

Oaktree’s other notable trades in the second quarter included reductions to Vistra Corp. (VST, Financial) and Hertz Global Holdings Inc. (HTZ, Financial) and additions to Petroleo Brasileiro SA Petrobras (PBR) and ICICI Bank Ltd. (IBN, Financial). The firm also sold out of Sociedad Quimica Y Minera De Chile SA (SQM, Financial) and got rid of its preferred shares of Bank of America Corp. (BACpL.PFD) and Wells Fargo & Co. (WFCpL.PFD).

As of the quarter’s end, Oaktree held 267 common stock positions valued at a total of $7.69 billion. The turnover for the quarter was 6%.

The top holding was Chesapeake Energy Corp. (CHK, Financial) with 11.07% of the equity portfolio, followed by TORM PLC (TORM, Financial) with 9.45% and Star Bulk Carriers Corp. (SBLK, Financial) with 8.46%.

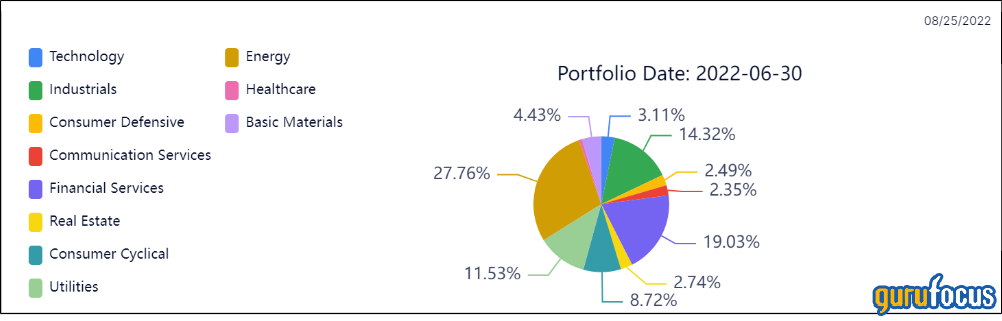

By sector weighting, the firm had the biggest portions of its portfolio allocated to energy, financial services and industrials.