Nothing is guaranteed in investing or in real estate, but there are some stocks in the real estate investment trust sector that rate high on predictability that investors can look for.

With the S&P 500 Index showing steep declines in 2022, investors might be interested in those names that can be considered predictable and offer the combined benefit of value and high yields.

I will examine two REITs that meet the following criteria:

- A predictability score from GuruFocus of at least 3 out of 5.

- A GF Score of at least 80 out of 100.

- A dividend yield of at least 4%.

- A double-digit discount to the GF Value Line.

As a note, there are just nine REITs in total that met these criteria.

Boston Properties

First up is Boston Properties Inc. (BXP, Financial), a self-managed REIT that specializes in owning and operating diverse class-A office space. The company also has retail, residential and hotel properties.

According to Value Line, Boston Properties’ funds from operation per share have a compound annual growth rate of 3.3% over the last decade. The trust has a predictability score of 3 out of 5, has generated revenue of just under $3 billion over the last year and has a market capitalization of $12.9 billion.

Boston Properties has a GF Score of 82 out of 100, meaning it is expected to have good performance in the years ahead.

The trust’s GF Score is due in large part to strong showings on value and profitability, scoring 10 out of 10 and 8 out of 10, respectively. The price-funds from operations, price-sales and price-to-free cash flow ratios are well ahead of Boston Properties’ peer group and close to the higher end of its 10-year historical performance.

On profitability, Boston Properties’ return on equity and return on invested capital are both above the industry. Importantly, the trust has turned in 10 consecutive years of profitability, besting 99.8% of the REIT industry.

Shares of Boston Properties yield 4.8%. This compares to stock’s average yield of 2.7% since 2012 and the average yield of 1.7% for the S&P 500. The company has increased its dividend for the past five years. With an expected payout ratio of just 52% for 2022, a very low ratio for a REIT, it is likely that Boston Properties will continue to pay and raise its dividend.

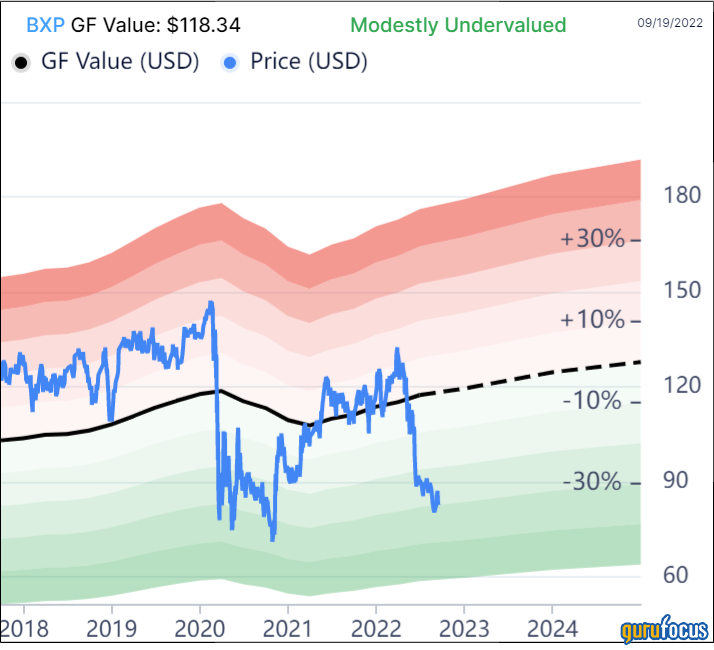

The GF Value chart suggests the stock is undervalued based on historical ratios, past financial performance and analysts' future earnings projections.

With a recent price of $82.25 and a GF Value of $118.34, Boston Properties is trading with a price-to-GF Value ratio of 0.70. Reaching the GF Value would result in a 44% gain before even accounting for the stock’s high yield. Shares are rated as modestly undervalued.

Digital Realty Trust

The second name for consideration is Digital Realty Trust Inc. (DLR, Financial), which focuses on owning and developing properties used for technology-related properties. Among the companies that Digital Realty Trust leases properties to include tech giants Microsoft Corp. (MSFT, Financial) and Meta Platforms Inc. (META, Financial).

Digital Realty Trust’s funds from operation per share have a CAGR of 4.4% since 2012. Share issuances used to acquire new properties hides the true growth of the trust as the share count has more than doubled over this period. Accounting for this, funds from operation have actually increased almost 10% annually over the last decade. Digital Realty Trust has annual revenue of $4.5 billion and is valued at close to $32 billion today. The trust has a predictability score of 3.5 out of 5.

Digital Realty Trust also has a GF Score of 82 out of 100.

The GF Score is driven by high marks on value, growth and profitability.

The trust scores a 9 out of 10 for both value and growth. For value, the majority of ratios, including price-book, price-to-projected free cash flow and PEG are all near the company's best marks for the last decade.

For growth, Digital Realty Trust’s three-year Ebitda ratio tops more than two-thirds of peers. Where the trust really stands out, though, is on the expected top- and bottom-line growth over the next three to five years, which is above 85% and 93% of peers.

The profitability rank is 8 out of 10, mostly due to the trust turning in 10 years of profitability in a row.

Digital Realty offers a yield of 4.4%, which compares favorably to its long-term average yield of 4.1%. For additional context, the stock has not averaged a yield above 4% for an entire year since 2013. With a projected payout ratio of 72% for the year, the stock’s 18-year dividend growth streak will likely remain intact.

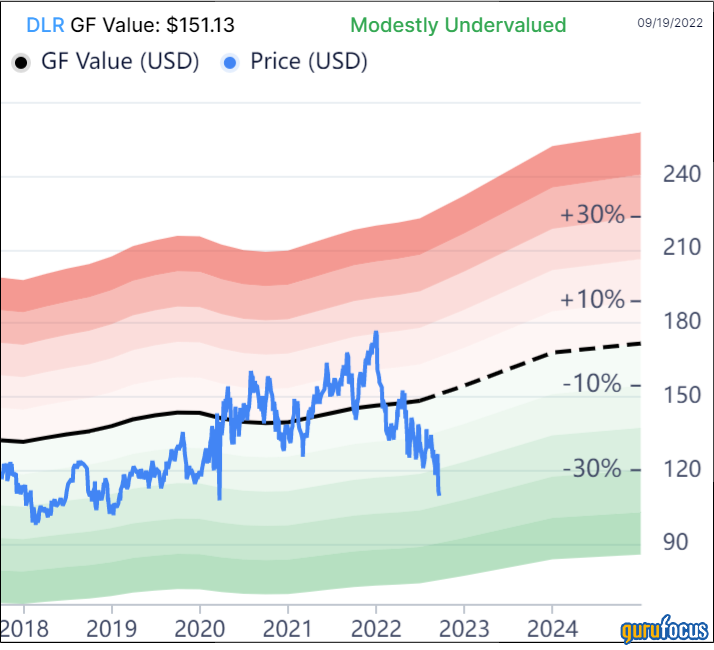

The GF Value chart shows the stock to be inexpensive.

Shares trade at close to $110 at the moment. The stock has a GF Value of $151.13, giving Digital Realty a price-to-GF Value ratio of 0.73. This means shares could return 37.4% from current levels even before the addition of the dividend. Digital Realty Trust is rated as modestly undervalued.

Final thoughts

In unpredictable times, those names that are considered to be more predictable can be very attractive to the investor. When those names come with the potential for high share price returns and high yields, then the attraction level is likely to be even more so.

Boston Prosperities and Digital Realty Trust have shown growth over a long period of time and each provides a high yield that is above its long-term average. Both stocks are also both deeply undervalued relative to their GF Values.

These factors suggest investors looking for predictability, value and income should consider adding both names to their watchlist.